Important information

- Eastspring Investments - Asian Bond Fund is referred to the ‘Fund’.

- The Fund invests in fixed income/debt securities and is subject to interest rate fluctuation and exposed to credit default, valuation and credit rating risks as well as credit risk of the counterparties with which it trades. Pertaining to investments in high yield/unrated/non-investment grade fixed income/debt securities, these securities may be subject to higher credit risks and liquidity risks, compared with investment grade fixed income/debt securities, with an increased risk of loss of investments. Investment grade fixed income/debt securities are subject to the risks of credit rating downgrades.

- The Fund may use financial derivatives instruments (FDIs) for hedging and efficient portfolio management purposes. Using FDIs may expose the Fund to market risk, management risk, credit risk, counterparty risk, liquidity risk, volatility risk, operational risk, leverage risk, valuation risk and over-the-counter transaction risk. The use of such instruments may be ineffective and the Fund may incur significant losses.

- The Fund invests primarily in Asia and may be more volatile than a diversified fund.

- The Fund’s investment in emerging markets subject it to greater political, tax, economic, foreign exchange, liquidity and regulatory risks.

- The Fund may incur substantial losses if it is unable to sell those investments with liquidity risks at opportune times or prices.

- The Fund may invest in securities denominated in currencies other than the Fund’s base currency and may be exposed to currency and exchange rates risk.

- The Fund may offer currency hedged share classes which involve currency hedging transactions that may, in extreme cases, adversely affect the Fund's net asset value.

- The Fund's Board of Directors may, at its discretion, pay dividends out of capital or gross income while charging all or part of the fees and expenses to the Fund’s capital, resulting in higher distributable income. Thus, the Fund may effectively pay dividends out of capital. Payment of dividends out of capital (effectively or not) amounts to a return or withdrawal of part of an investor’s original investment or from any capital gains attributable to that original investment, which will result in an immediate reduction of the net asset value per share.

- Investment involves risk. Investors should not rely solely on this document in making investment decision. Past performance information presented is not indicative of future performance.

Asian bonds offer attractive yields compared with similarly rated bonds in developed markets, which allows investors to diversify their bond portfolios while enhancing overall portfolio yield and participating in Asia’s growth story.

Fund objective

-

USD 20.145

NAV as of 12 Feb 2026

-

$0.03

Daily $ Change

-

0.16 %

Daily % Change

-

Morningstar rating*

31 Jan 2026

Past performance data

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|---|---|---|---|

| Returns (%) | 4.4 | -2.8 | 11.0 | 5.9 | -6.4 | -19.5 | 7.0 | 5.6 | 7.6 |

Source: Eastspring Investments (Singapore) Limited. Returns are based in USD and computed on NAV-NAV basis with net income reinvested, if any. Calendar year returns are based on the share class performance for the year, and if the share class was incepted during a particular year, the returns shown relate to the performance of the share class since its inception to the end of that calendar year. Past performance information presented is not indicative of future performance.

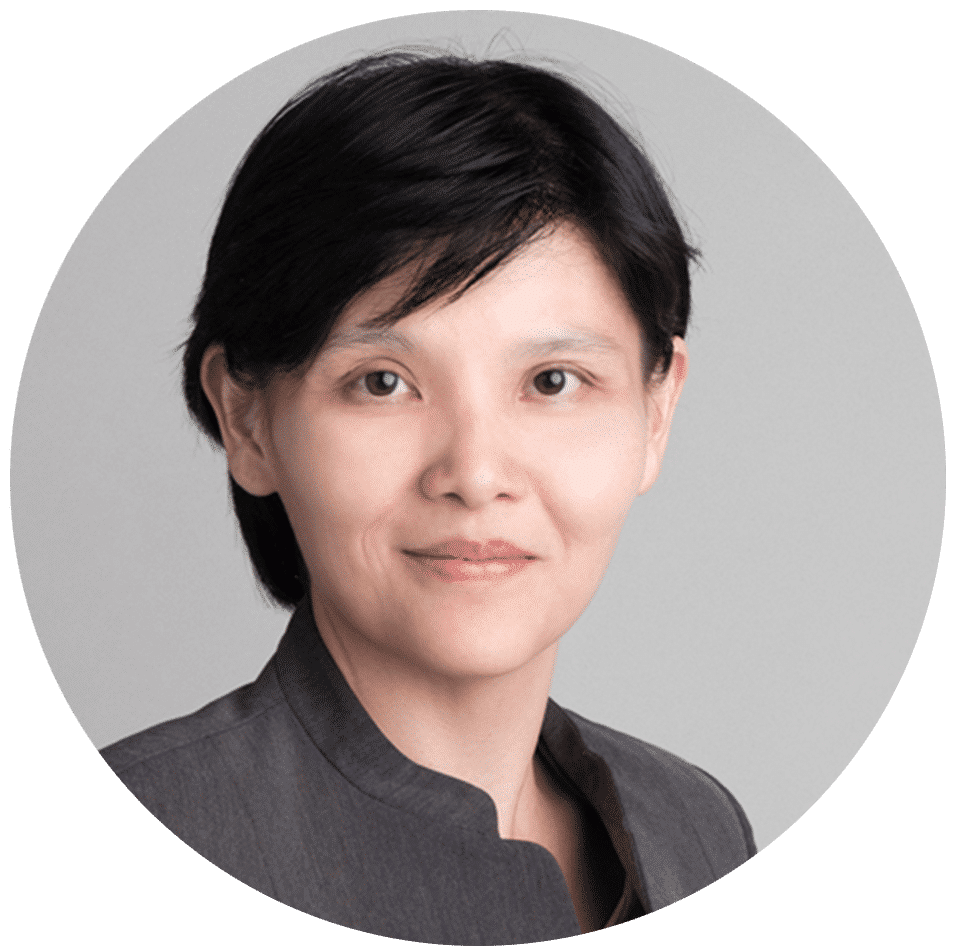

Portfolio Manager

-

Wai Mei Leong

Portfolio Manager

Wai Mei Leong is a Portfolio Manager in the Fixed Income team and Lead Portfolio Manager for Asian hard currency fixed income portfolios, including the Asian Bond, Asian Investment Grade Bond and High Yield Bond strategies. Wai Mei has over 23 years of investment experience and holds a Postgraduate Diploma (Finance) from Melbourne University and Bachelor of Business (Accounting) from RMIT, Australia. She is a Certified Public Accountant.

Fund facts

- Asset classBond

- ClassA

- Subscription methodCash

- ISIN codeLU0154355936

- Bloomberg tickerPRUASBA LX

- Minimum initial investmentUSD 500

- Minimum subsequent investmentUSD 50

- Inception date 01 Mar 2005

- Share class currencyUSD

- Initial sales chargeMax 3%

- Annual management feesMAX 1.0%

-

Morningstar rating *

31 Jan 2026

Footnote:

*Rating should not be taken as a recommendation. © Morningstar. All rights reserved.