Executive Summary

- Stay invested even in uncertain times with low volatility strategies that mitigate potential losses and reduce concentration risk.

- Over the full market cycles, stocks with lower volatility and correlation tend to deliver returns comparable to the broader equity market.

- Losing less during downturns while participating in market upswings gives low volatility investing its edge.

The story of the hare and the tortoise is a children’s favourite around the world. In the story, the persistent and determined tortoise unexpectedly wins a race against a fast but overconfident hare. While seemingly unrelated, the fable offers a valuable lesson to investors, particularly in today's volatile markets.

Many investors are drawn to the excitement and buzz around the latest "hare-like" stocks that dominate news and social media. However, such stocks can be unpredictable and risky. Research shows that investing in less exciting "tortoise-like" stocks, which exhibit steady (and often more predictable) growth over time, can be more effective in the long run. Focusing your portfolio on these stable and established companies is known as "low volatility investing" because it results in a portfolio with less variability in value over time.

Tortoise investing: Winning by losing less in turbulent markets

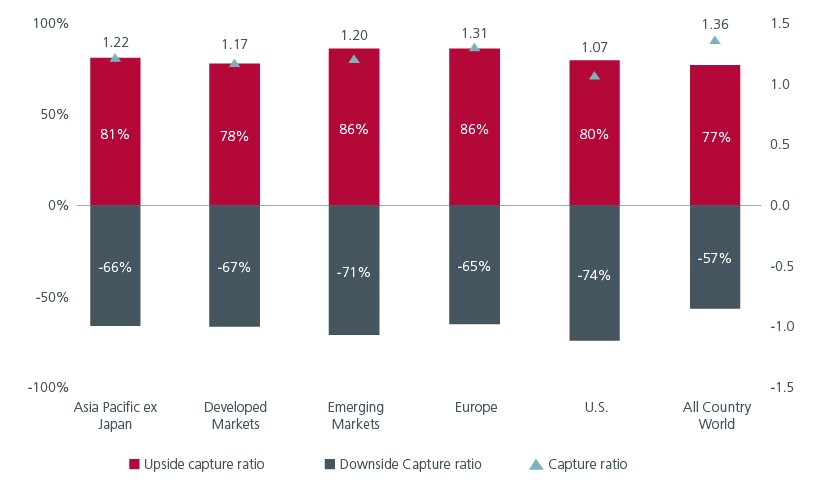

A low volatility portfolio helps to balance performance over time by losing less in negative market periods while still participating in positive market periods, albeit to a lesser extent than the broad market. This approach of losing less during downturns while participating in upswings gives low volatility investing its edge. Like the tortoise, a low volatility portfolio may not be the fastest, but it can ultimately win the race.

Fig. 1 shows the effect works across most major markets. Low volatility strategies have historically delivered a higher degree of upside capture—achieving gains during positive market phases— and a lower degree of downside capture, giving rise to superior risk-adjusted returns.

Fig 1: Asymmetry: Upside/Downside capture ratios across markets

Source: Upside and Downside Capture Ratio (LHS), Asymmetry Capture Ratio (RHS). Source: Eastspring Investments, MSCI, Bloomberg, December 2023. The upside/downside capture and asymmetry-capture ratio are calculated using MSCI AC Asia Pacific ex Japan Minimum Volatility Index, MSCI AC Asia Pacific ex Japan Index, MSCI World Minimum Volatility Index, MSCI World Index, MSCI EM Minimum Volatility Index, MSCI EM Index, MSCI Europe Minimum Volatility Index, MSCI Europe Index, MSCI USA Minimum Volatility Index, MSCI USA Index, MSCI ACWI Minimum Volatility Index, MSCI ACWI Index. All in USD. From 31st Jan 2002 to 29th Dec 2023.

Tortoise math: Compounding the benefits of low volatility

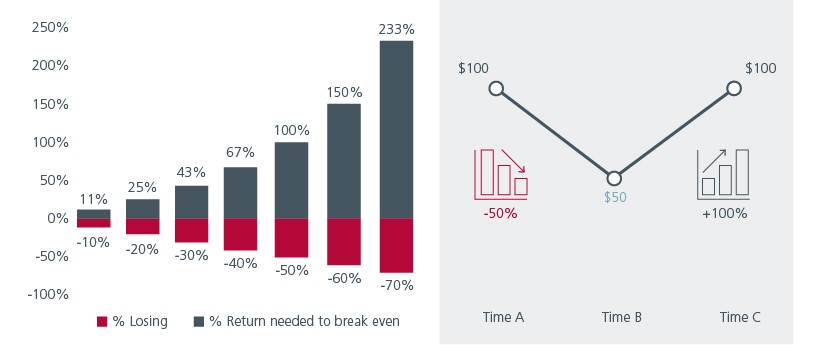

We have discussed the asymmetry in upside and downside capture in a low volatility portfolio but there is another dimension to this downside protection where the power of compounding truly shines. We illustrate this in Fig. 2.

Fig. 2: Illustration of return needed to break even after a downturn

Source: Eastspring Investments, Jan 2024

Consider a single share valued at USD100 at time A. If the market crashes and the share loses 50% of its value, it will drop to USD50 at time B. To return to its initial value of USD100, the share needs to gain not just 50%, but 100%, as it is starting from a lower base. This simple maths highlights the importance of minimising losses during downturns.

Although a high-growth stock may recover from a 50% drop, the 100% gain to break even puts immense pressure on its performance and exposes it to further risk if the recovery stumbles. In contrast, a low volatility “tortoise” stock, having suffered a smaller loss (e.g., 30% loss shown in the left illustration), only needs to climb 43% to reach its original USD100 value. This makes it less vulnerable to further tumbles and makes it easier to keep pace with the overall market over the long haul.

Lighten the load: Why weighting by volatility beats valuation

Recent years have seen an influx of investors into portfolios weighted by the market value of constituent companies (i.e., passive strategies). The idea is that other investors can do the hard work of valuing companies, and you can benefit by simply copying them with an implicit assumption that the market is efficiently capturing all available information in an unbiased manner.

However, as with any homework copying strategy, the key question is how good the student you are copying is! There is reason to believe that as more investors adopt these strategies, they can distort the market, causing prices to become detached from any rational valuation of the underlying company. It is like walking into a shop and declaring that you will pay whatever the shop owner asks—you are unlikely to get a good deal!

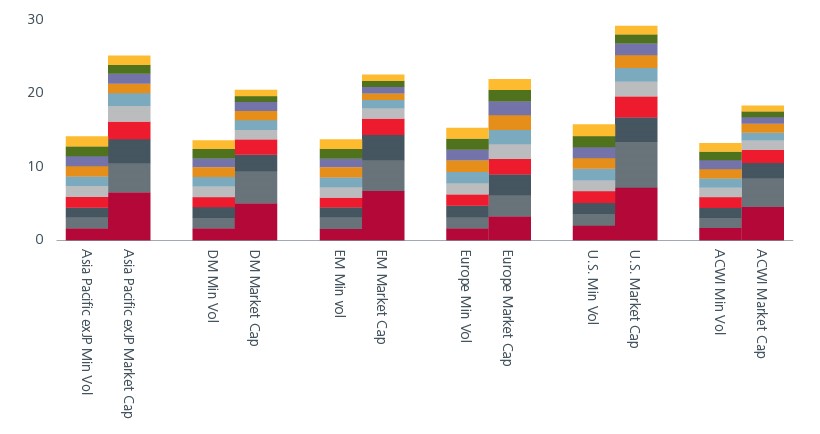

Low volatility portfolios do not suffer from this problem because they weight stocks based on volatility, not valuation; these portfolios do not mindlessly buy more of a company during a market mania.

Fig 3: Illustration of top 10 holdings weight (%) in min vol indices versus market cap

Source: DM: Developed Markets, EM: Emerging Markets, ACWI: All Country. Eastspring Investments, Top 10 holdings from MSCI AC Asia Pacific ex Japan Minimum Volatility Index, MSCI AC Asia Pacific ex Japan Index, MSCI World Minimum Volatility Index, MSCI World Index, MSCI EM Minimum Volatility Index, MSCI EM Index for Emerging Markets, MSCI Europe Minimum Volatility Index, MSCI Europe Index, MSCI USA Minimum Volatility Index, MSCI USA Index, MSCI ACWI Minimum Volatility Index, MSCI ACWI Index All in USD. As of 29th Dec 2023

This approach is complemented by diversification across sectors, countries, and stock levels, contributing to a well-rounded risk management strategy. Low volatility equity portfolios generally offer investors a smoother ride through the business cycle which makes it easier to maintain exposure to stocks and resist the siren voices of market timing.

Tortoise wisdom: The case for long-term, low-risk strategies

Global financial markets have weathered a series of significant shocks over the past few years, including the COVID-19 pandemic, geopolitical tensions like the Ukraine-Russia conflict, and high-profile banking collapses such as those of SVB and Credit Suisse. These events have contributed to a slowdown in overall economic growth, especially in China, and have led to sharp upward inflationary pressures and interest rate hikes. In addition, the emergence of new AI technologies has dominated markets as investors throw money at the stocks they expect will dominate the new era. This has led to extremes of market concentration in the market capitalisation indexes, as we discussed in our earlier article.

As we enter 2024, investors are facing a high degree of uncertainty, with ominous headlines dominating the news. The ongoing Ukraine-Russia conflict and Israel-Gaza conflict have led to volatility in crude oil prices across Brent and WTI. Additionally, lower growth and increased risk premiums in Chinese assets may lead to an overall decline in asset valuation and reduced capital inflows. Furthermore, developed markets are grappling with looming deficits, waning demand, and the possibility of recessions, while upcoming elections in the US and UK add to the overall sense of uncertainty.

It is crucial to remember that the stock market is a marathon, not a sprint. Low volatility strategies prioritise stability and loss avoidance, providing a steadier path towards financial goals even amidst market fluctuations.

We recommend that long-term investors consider exposure to low volatility solutions. By doing so, investors can maintain their equity exposure and capitalise on the long-term equity premium, while simultaneously mitigating potential losses, reducing concentration risk and diversifying performance sources in these uncertain times. Past experience suggests that this avoids some of the wild swings in valuation that are seen over a market cycle and leads to higher risk-adjusted returns.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).