Executive Summary

- MSCI China is up more than 30% in the last one year, demonstrating that there are rewarding opportunities in China equities despite ongoing tariff noise and China’s macro challenges.

- Despite the widening GDP growth differential between the US and China, MSCI China continues to trade at a significant discount to MSCI US.

- With China equities regaining attention after being overlooked by many investors in recent years, the market now presents enhanced potential for alpha generation and significant upside.

The MSCI China Index is up 32.2% from a year ago and 17.2% year to date1 . This may come as a surprise to some, given the multiple twists and turns in the ongoing tariff negotiations with the US, and China’s still challenging economic outlook. See Fig. 1. Indeed, China equity market’s gains have stoked global investor interest. The Institute of International Finance reported that non-resident equity inflows to China turned modestly positive at USD1.4bn in May.

Fig. 1. MSCI China trending higher despite tariff noise

Source: Bloomberg. Various news sources. Eastspring Investments. August 2024 to 12 June 2025.

Recalibrating exposures

The recent USD depreciation vs. key developed nations, and the US economy’s moderated growth outlook have led investors to recalibrate exposure toward markets that have more predictable policies at relatively attractive valuations.

In our 2025 mid-year outlook report, we noted that we expect subdued US growth of 1.2% to 1.5% for 2025E (from 2.8% in 2024) with risk skewed to the downside. Meanwhile, we expect the Chinese economy to grow close to 4.4% this year (from 5% in 2024). The Chinese government has announced fiscal support of close to 2% of GDP to ensure the economy will achieve its targeted growth. In fact, the People’s Bank of China has also begun cutting interest rates and increasing special lending for multiple sectors of the economy.

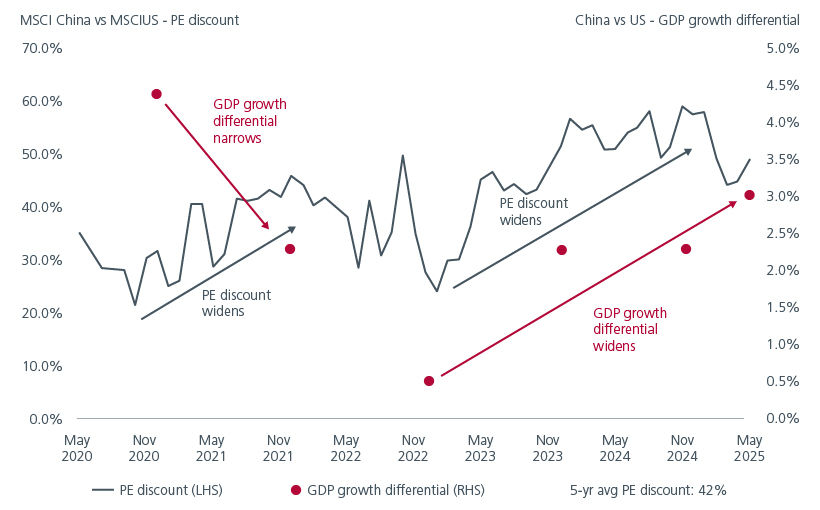

Despite the increasing US-China GDP growth outlook differential, MSCI China’s discount to MSCI US remains elevated, at above its 5-year historical average. Fig. 2.

Fig. 2. China and US: PE discount vs GDP growth differential

Source: MacroMind. June 2025.

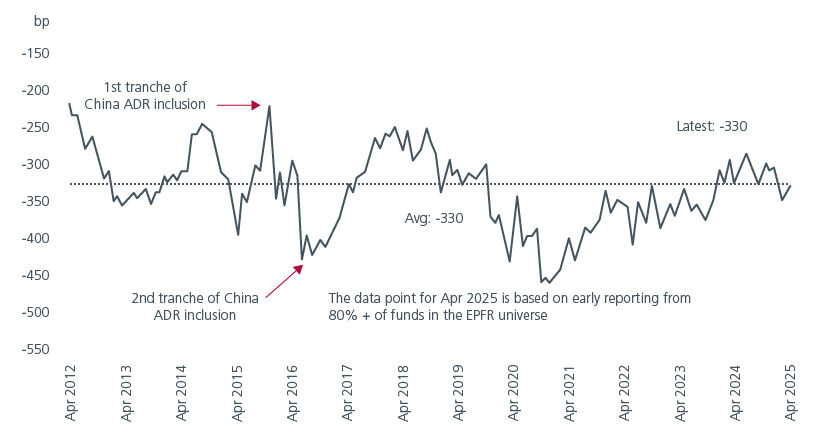

At the same time, the current low fund exposure to China among global active funds suggests that there is room to increase allocation to China equities. On average, active funds globally are still underweight China equities by 3.3% relative to their benchmarks. This underweight position could hurt their relative performance if the China equity market continues to perform well. See Fig. 3.

Fig. 3. China allocations in active funds globally (OW/UW)

Source: MSCI, EPFR, Goldman Sachs Global Investment Research. Includes Global Emerging Markets, Asia ex Japan, Global & Global ex-US funds. AUM: USD1.1tr.

Selective strength

Within China equities, selected investment themes have thrived despite the uncertainty relating to the outcome of US tariff rates, China’s lingering deflationary environment, and its property sector challenges. Over the last year, selected stocks linked to AI-related infrastructure and smart manufacturing (e.g. robotics, new electric vehicles,) have outperformed, supported by their technological advancements. In addition, investor sentiment towards the innovative drugs sector was buoyed after several drug companies presented strong clinical data at the annual American Society of Clinical Oncology (ASCO) meeting in June; enhancing their international recognition and global market potential. Meanwhile, the new consumption theme which focuses on products and services favoured by Chinese Gen Zs has also fuelled gains in related stocks. As well, the RMB’s 3% appreciation against the USD since its recent low in September 2024, has further boosted earnings for selected stocks within the MSCI China Index.

We continue to pursue a barbell strategy as markets are likely to remain volatile. As such, we like defensive stocks such as:

- Companies with reasonable valuations and solid fundamentals that pay out attractive dividends.

- Companies that excel at offering wealth management services: we favour those that have clear roadmaps on how to gain market share through high demand services, while delivering steady shareholder returns.

- Consumer staple companies that are champions in both China and overseas markets, which are relatively insulated from tariffs.

We also favour growth compounders that can capitalise on growth opportunities in the market. These include:

- Consumer companies that offer services and products that appeal to Gen Zs in China and overseas.

- Sector champions which generate notable benefits from product and service innovation, and that have either diverse global manufacturing networks or strong pricing power.

Reasons to re-engage

The recent performance of China equities over the past year highlights exciting opportunities for investors, showcasing that rewarding prospects remain despite ongoing tariff discussions and broader economic challenges.

Investors can thrive by strategically selecting stocks that benefit from emerging sector trends, strong company fundamentals, and promising earnings growth outlook. Over the last decade, the performance difference between the top and second-best investment styles within the MSCI China Index has averaged around 8 percentage points p.a. This market divergence allows for a nimble, style-neutral approach, empowering investors to tap into the market’s most promising investment opportunities.

Historically, the MSCI China Index has delivered standout periods of growth, suggesting an active, adaptable strategy is key to navigating this market. With China equities regaining attention after being overlooked by many investors in recent years, the market now presents enhanced potential for alpha generation and significant upside. As China equities continue to overcome challenges, they offer a compelling case for renewed investor interest, making now an opportune time to take a closer look at this dynamic market.

Sources:

1 Bloomberg. In USD terms. As of 4 July 2025.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).