Executive Summary

- Slower growth, higher inflation and deteriorating fiscal sustainability in the US are leading bond investors globally to seek greater diversification, income and resilience.

- Asian USD bonds offer attractive all-in yields, positive credit fundamentals, and supportive technicals. Historically, Asian USD bonds have exhibited lower volatility compared to developed market bonds.

- For investors looking to diversify their USD assets, Asia local currency bonds offer attractive real yields and potential currency upside. The region’s expected rate cuts should also help to underpin local bond markets.

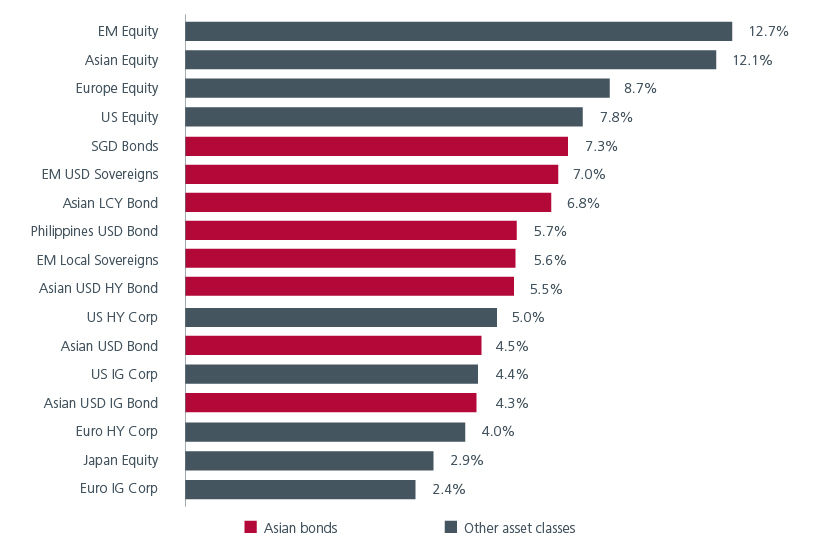

Despite delivering compelling returns year to date versus developed market bonds, (See Fig. 1) Asian fixed income is still not getting the attention it deserves. While Asian investors may be more familiar with the asset class, many global investors still tend to view Asian bonds within a larger global or emerging market bond allocation. However, the US’ slowing growth, higher inflation and deteriorating fiscal sustainability are causing investors to reconsider increasing or maintaining their exposure to the USD or to US assets. Conversely, the fundamentals of Asian fixed income appear much brighter.

Fig.1. Cross asset returns (year to date)

Source: Bloomberg. Eastspring Investments as of 31 July 2025. *Using Markit iBoxx USD Asia ex Japan Total Return Index and its sub-indices as proxy. Please note that there are limitations to the use of such indices as proxies for the past performance in the respective asset classes/sector. The chart above is included for illustrative purposes only and may not be indicative of the future or likely performance of the markets. IG: Investment Grade, HY: High Yield, EM: Emerging Markets, LCY: Local currency

The USD’s decline

The US dollar index (DXY) has fallen 6.3% year to date1 . While we cannot rule out periods of USD rallies from technically oversold levels, the USD’s longer-term trajectory is potentially clouded by the widening US fiscal deficit, President Trump’s choice of Federal Reserve (Fed) chair in June 2026 and any developments that could undermine perceptions of Fed independence in the lead-up.

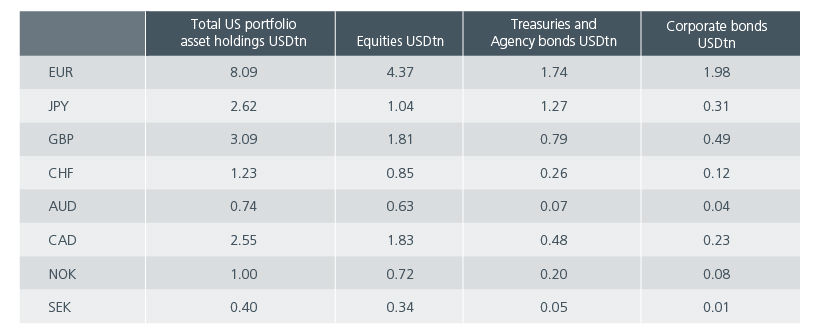

Currently, the sheer size of outstanding foreign holdings of US portfolio assets implies that even small changes in the Foreign exchange (FX) hedge ratio can have a significant currency impact. Fig. 2. That said, multiple factors drive FX hedging decisions, and the USD is likely to remain a reserve currency given the scale, depth, and accessibility of the US capital markets. Even so, investors may be increasingly less compelled to add aggressively to their USD holdings and US assets. Recent reports suggest that investors have turned short USD over the second quarter of this year from neutral at the end of the first quarter, and long at the start of the year2.

Fig. 2. Total US portfolio asset holdings

Source: TIC, Haver, UBS. TIC does not identify “official” holdings by country. July 2025.

As US bond supply and inflation rise, buyers of US fixed income would want to be sufficiently compensated for term risk. Hence there is room for the long end of the US yield curve to creep higher. We note that post the 2008-2009 Global Financial Crisis, Quantitative Easing had helped to cap long term bond yields, a policy backdrop that is not in place today.

Given these developments, it is not surprising that bond investors globally are seeking greater portfolio diversification, income and resilience.

Look east

Asian USD bonds

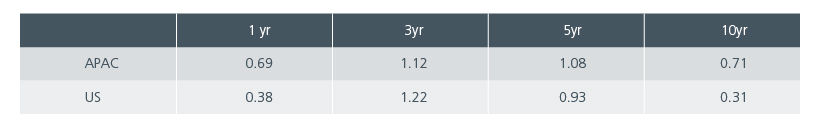

For USD-based investors looking to diversify away from US assets, Asian USD bonds offer supportive technicals and still-attractive all-in yields. Historically, the risk-adjusted excess returns (as measured by the Sharpe ratio) of Asia Pacific Investment Grade (IG) credits have been higher than the US’ over the 1,5 and 10-year periods. See Fig. 3. Although Asian USD credit spreads are currently tight compared to historical levels, credit fundamentals are expected to remain robust given limited corporate exposure to US trade. Most of the Asia Pacific USD bond issuers are relatively insulated from US tariffs due to their domestic focus. Meanwhile, although gross supply of Asia credits is expected to be higher than the previous year’s, net USD bond supply is likely to remain negative as onshore funding costs remain meaningfully lower than offshore dollar funding costs, and bond issuers have access to bank financing/loans.

Fig. 3. Sharpe ratios for investment grade corporates

Source: BofA Global Research, ICE Data Indices, LLC. As of end May 2025.

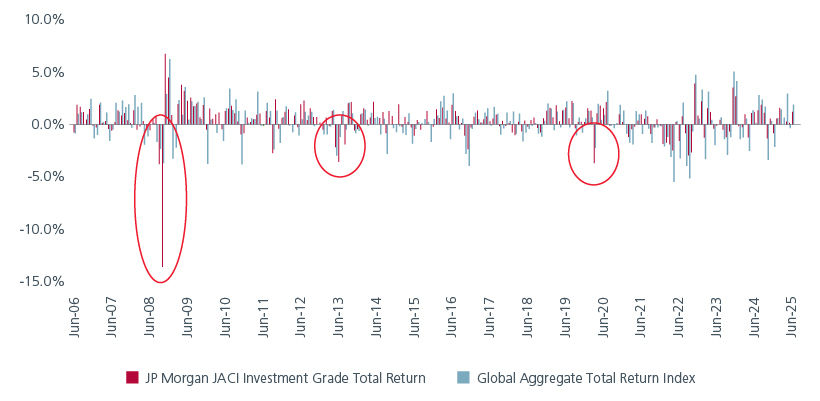

It may come as a surprise that the volatility for Asian IG credits is generally lower than their global IG counterpart’s. Fig 4 shows that from June 2006 to June 2025, the monthly drawdowns for Asian IG credits were mostly smaller than global IG credits’, except during the Global Financial Crisis and the COVID-19 periods.

Fig. 4. Monthly drawdowns

Source: Bloomberg. As of end June 2025.

Asian Local Currency bonds

For investors looking to diversify away from the USD, subdued inflation as well as higher real yields in Asia make a compelling case for Asian local currency bonds. Across the region, Bloomberg estimates show that central banks are expected to cut interest rates from 15 basis points (bp) in India to 60 bp in the Philippines by 4Q 20263. At the same time, differing economic cycles and demand-supply dynamics provide opportunities for active bond managers to add value through duration, currency and credit management.

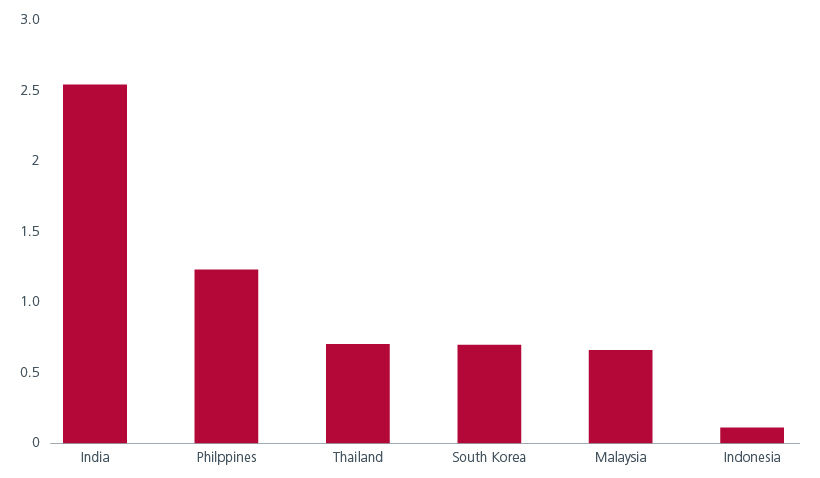

Meanwhile, Emerging Asia’s real yields have risen above historical averages. Fig. 5. India’s nominal bond yield is currently more than 420 bp above its most recent inflation print, with its real yield at 2.5x standard deviation above its 5-year average or 1.5x standard deviation above its 10-year average. Similarly, real yields in Philippines, Thailand, South Korea, Malaysia and Indonesia are also higher than their 5 and 10-year averages.

Fig. 5. High real yields relative to history (z scores)

Source: Bloomberg. Standard deviation of current 10-year real yield relative to its 5-year average. As of 6 August 2025.

At the same time, falling short term money market rates since the beginning of 2025 across key Asian economies reflect flush liquidity conditions and have resulted in strong demand for Asian duration. This has helped to cap yields and make local bond markets less volatile compared to developed market bonds.

Also, over the past 18 to 24 months, we have noticed a structural shift in the CNH market, marked by rising demand, stronger liquidity and more high quality issuers. Chinese investors are seeking higher carry and credit duration amid falling yields and flat yield curves in the Chinese onshore bond market. For these investors, CNH bonds is a natural port of call. CNH bond liquidity has also improved significantly, boosted by increased issuances from high quality companies looking to capitalise on cheap funding and the interest from Chinese investors, including Chinese institutions, life insurance companies and security houses.

Standing out

In a world where traditional safe havens are increasingly compromised by political and macroeconomic uncertainty, Asian bonds stand out as a resilient and rewarding alternative. For investors seeking greater diversification from their USD assets, Asia local currency bonds offer attractive real yields and potential currency upside. Asian central banks’ expected rate cuts over the next 12 to 18 months should also help to underpin local bond markets. Meanwhile for USD-based investors, Asian USD bonds potentially provide higher yields, greater policy stability and lower volatility compared to developed market bonds.

Sources:

1 Bloomberg. As of 22 July 2025.

2 FX flows & positioning in Q2. BofA Global Research. 17 July 2025.

3 Bloomberg weighted 4Q26 forecasts. As of 22 July 2025.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).