Summary

As we head into 2023, another new normal confronts us. Just as several pandemic-induced changes have become entrenched, inflation is likely to be higher than what it used to be in the decades prior to COVID-19. Consequently, the era of easy money has ended while geopolitical tensions are at a high across the globe. Against this backdrop it is important to be nimble and proactive in one’s portfolio choices and positioning.

2022 was a tough year for most investors. 2023 may be even more challenging. Slower growth and tighter financial conditions in the Developed Markets (especially the US and Europe) are clouding the global economic outlook. There is also a growing acceptance that inflation would be more durable than originally thought and that talks of a US Federal Reserve (US Fed) pivot at this point in time are a bit premature.

Growth risks to intensify

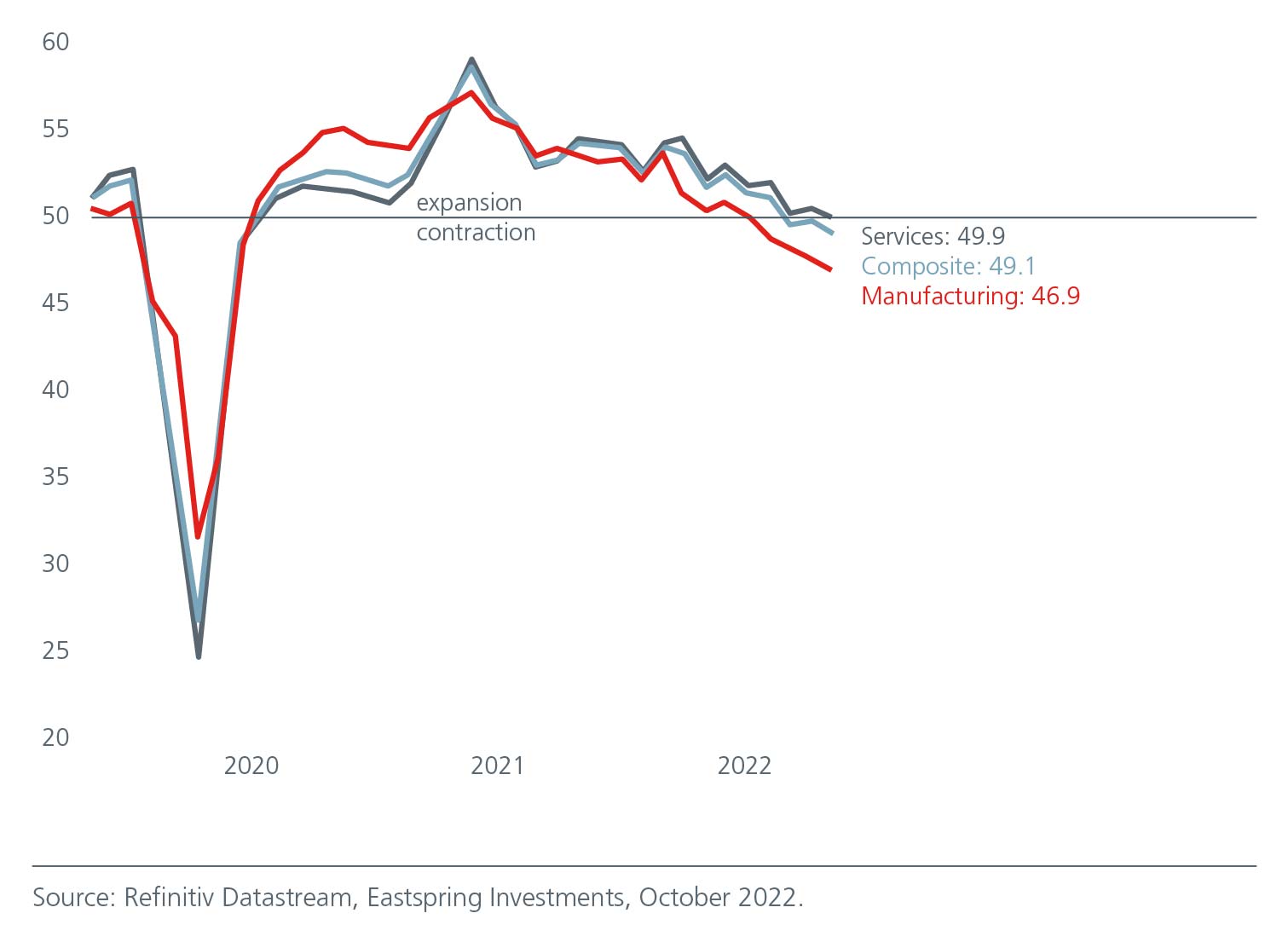

Continued declines in global PMI readings and a broad-based weakening of factory output across regions suggest that the global goods sector is in a recession, prompting comparisons to the 2000-2003 period during which there was a technology-led recession.

Global PMI new orders are falling

Much depends on the inflation trajectory and the consequent impact on monetary policy in Developed Markets (DMs). While there are signs of inflation peaking, tight US labour markets and strong wage growth may force the US Fed to remain hawkish for longer. Meanwhile, high energy prices which have been another inflation driver will likely face more upward pressure especially as China begins to re-open, and this could prolong central banks’ battle against inflation. On the flip side, exogenous factors leading to a decline in commodity prices could bring inflation down rapidly and end the monetary tightening phase earlier than expected.

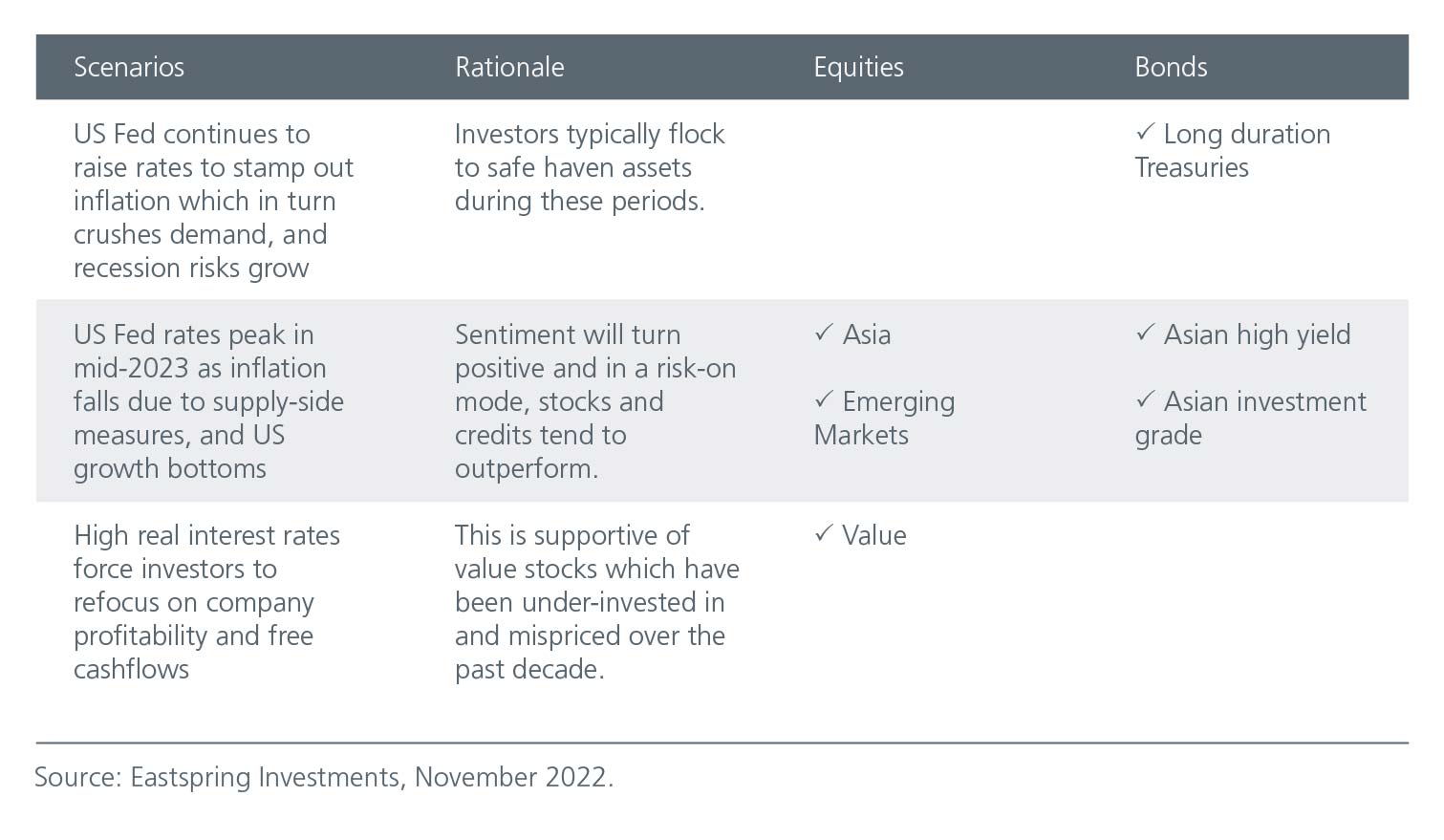

Nonetheless we believe the current conditions will likely extend into the first quarter of 2023. The US Fed is expected to continue tightening monetary policy into 2023, although the magnitude and frequency will depend on how quickly unemployment rises or how fast consumer prices fall. The median projections from the US Fed currently point to further rate hikes in 2023 before falling in 2024. As it stands, it is likely that the US Fed will only reach its peak of the rate hike cycle mid-2023, barring a tail risk event in financial markets.

A better global economy is thus likely to emerge in the second half of 2023 as we navigate past peak inflation and US Fed hawkishness. Any impending US recession will probably be a mild one relative to previous recessions given that the US consumer balance sheets are much more resilient today (even compared to the 2008 Global Financial Crisis).

We acknowledge that equities have more room to decline in a recession, especially as US equities represent approximately 63% of global equities and given the large technology representation in key market cap indices. The extent is however contingent on the magnitude of the recession (i.e., the deeper the recession, the larger the equity drawdowns). That said, further easing of financial conditions on the back of the US dollar peaking will lead to better performance returns for risk assets in the second half of 2023.

Emerging economies relatively resilient

Central banks in Emerging Markets (EMs) have also tightened monetary policy, but generally not to the magnitude and pace seen in DMs. This is because for many emerging economies, domestic demand is typically weaker, wage growth is less robust, and hence inflation dynamics are relatively weaker compared to the US. This can be seen in China, which is experiencing weak domestic demand and weak inflation dynamics, primarily due to COVID restrictions and a weak housing market, among other factors.

Over in Asia, inflation has also been relatively benign partly due to the smaller fiscal stimulus response to the pandemic (unlike the US), less exposure to the energy shocks (unlike Europe), as well as more government subsidies, some of which have been passed onto consumers. Meanwhile Asian central banks have been trying to manage their interest rate differentials to contain currency depreciation and imported inflation. While Asian yields were pressured higher in tandem with higher core DM rates, markets struggled to price in much more tightening from Asian central banks amid a weakening economic backdrop and less sticky inflation.

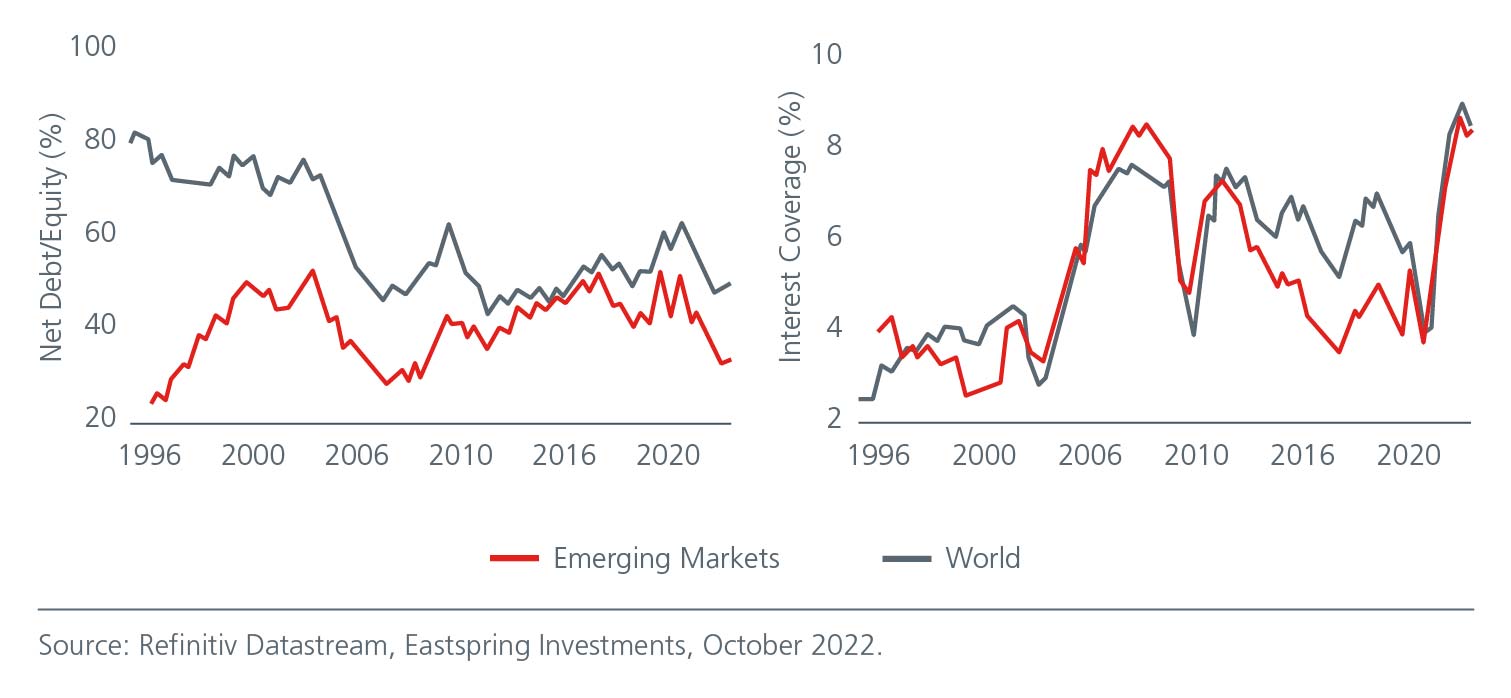

All said, the 2020s have also begun in a very different fashion to the 2010s for EM equities. The 2010s was the perfect backdrop for growth and quality investing as investors were encouraged and rewarded to pay high prices for potential future earnings stability and growth, especially in the e-commerce space. In the early 2020s however, we have seen policy responses to COVID-induced slowdown more focused on investing in the real economy with capital expenditure plans returning and decarbonisation efforts front of mind. Following a volatile year for EMs, we are ending 2022 with a very attractive valuation entry point on a historical context both in absolute terms, but also relative to DMs.

EM non-financial corporate balance sheets are seemingly healthy

Our risk considerations

We believe the current market environment is quite challenging amid increasing tail risk events and geopolitical tensions (i.e., US-China, Russia-Ukraine, China-Taiwan, Iran nuclear talks). Geopolitical risk is notoriously hard to assess because it is dependent on the unpredictable behaviour of its actors. The Russia-Ukraine conflict in 2022 is perhaps a reminder to investors that following a decade of relatively peaceful geopolitical environment, we may be ushering in a new period of skirmishes caused by rivalry between great powers.

Tighter liquidity conditions and higher borrowing costs are other key risks. As interest rates go up, companies that are not producing reliable profit streams will be most affected and vulnerable. US growth and tech stocks are quite susceptible to deteriorating valuations, and as such have seen some de-rating amid rising rates. Only companies that can produce an economic return from their borrowings are going to be creditworthy institutions.

Finally, there is a good chance that the US Fed may push the US economy into a recession if inflation persists. Investors need to remain very vigilant to that potential outcome. The US dollar which has strengthened considerably amid rising rates and souring global risk sentiment will likely remain strong in the near term. Emerging and Asian economies may be forced to intervene to reduce the volatility of their currencies. Rapid reserve drawdowns could increase uncertainty.

Ultimately if the US Fed stamps out inflation by crushing aggregate demand, then we are going to see higher unemployment and slower growth, and investors will likely favour fixed income solutions. On the other hand, if more supply-side measures help to ease inflation, then equities are likely to be in demand. In our view, it is very unlikely that inflation is going to be addressed through supply-side measures alone.

Investment implications

Contributors:

Craig Bell, Head of Multi Asset Portfolio Solutions, Eastspring Singapore

Andrew Cormie, Head of GEM and Regional Asia Value Equities, Eastspring Singapore

Danny Tan, Head of Fixed Income, Eastspring Singapore

Rong Ren Goh, Portfolio Manager, Fixed Income, Eastspring Singapore

Key themes

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).