Executive Summary

My bespoke field tour across Korea’s retail scene - from hypermarkets to convenience stores - offered a better understanding of the Korean consumers’ habits and highlighted the players that were dominating and capturing wallet share. Here are my key takeaways:

- Consumer sentiment remains subdued, as evidenced by shorter queues at shopping malls and more readily available parking—even on weekends. Conditions may pick up in 2H25, following July’s stimulus measures i.e., the coupon distribution scheme to spur spending.

- Online channels are gaining market share, mirroring global trends. Amid shifting consumer shopping preferences, offline channels in Korea face mounting pressure to differentiate their offerings or consolidate to stay relevant.

- Superior merchandising is becoming increasingly important for all retail players with innovative products gaining popularity. Specifically for offline channels, favourable pricing and comfortable shopping experience play a vital role.

The increasing online penetration is not unique to Korea. With more consumers gravitating online for general merchandise and even food, it is no surprise that the online channel takes up 50% of the overall retail merchandise. The leading online player has experienced accelerating e-commerce market share gain to the tune of 4-5% per annum.

This rise of online retail has not only sparked a grab for the wallet share, but also a grab for talent. Online companies are poaching skilled retail professionals from offline retailers, making it hard for the latter to retain talent. The increased competition from online players have pressured some offline segments to consolidate.

Since 2016, hypermarkets have seen their retail market share decline sharply—from 25% to just 12% by 2024. One of the marts I visited had barely 30-40 people across both floors on a Saturday morning. The main reasons for underperforming hypermarket stores were: (1) poor talent retention (2) low investment into the store refurbishment, and (3) poor inventory turnover.

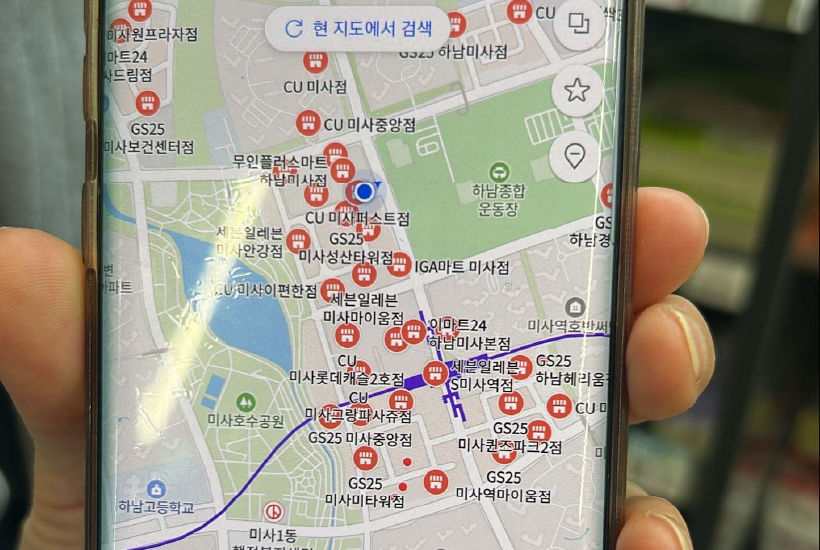

In the case of convenience stores, overpenetration is resulting in consolidation. There are around 55,000 stores serving 51 million people which is population-to-store ratio of just 937. The street that I was on had three convenience stores within a 100-metre stretch! In contrast, Japan has a similar number of stores but a much larger population of 123 million, resulting in a ratio of 2,207 people per store.

As more of the smaller players close, the market share for convenience stores will likely be concentrated among the top two players.

Given the intense competition, some retailers are tailoring offerings to meet the preferences of Korean consumers. Superior merchandising and curated value are key differentiators for both online and offline retailers in Korea.

a) Customer-centric innovative products

An example is the ready meal that was created in collaboration with chefs from the hit Netflix series ‘Culinary Class Wars’ was a hit with consumers when the show premiered.

b) Curating value via membership club formats

A rising trend in Korea’s retail landscape is the growing popularity of membership club-style formats. These stores offer a minimalist shopping environment with bulk-buy pricing advantages, appealing to value-conscious consumers. Despite having a significantly smaller assortment—around 5,000 stock keeping units (SKUs) compared to the 40,000–50,000 typically found in hypermarkets—I found these clubs to be busier than the hypermarkets. The customer feedback is that they appreciate the curated product selection versus the less targeted offerings of traditional hypermarkets.

In summary, the online consumption trend in Korea is accelerating. This shift has led to a slow bleed of weaker offline peers and a winner-takes-all dynamic. Underperforming formats are closing and stronger players are streamlining with competitive differentiation becoming more critical than ever.

From an investment standpoint, this backdrop favours building positions in leaders with a proven track record in execution. We believe that the market has yet to fully recognise the upside-potential from the ongoing consolidation amongst offline retailers, namely reduced competition, innovative product merchandising and superior cost management. As such we will be on the lookout for retail formats that are underappreciated and positioned for a rebound.

Sources:

1 For illustration purpose only

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).