A study ^ shows that

60%

of EPF members do not have sufficient EPF savings to last until the age of 75.

https://www.fimm.com.my/wp-content/uploads/2021/12/Literacy-Survey-Report-v1-1-8.pdf

But that doesn’t just stop there, EPF also reported that only 18% of members have the minimum savings target of RM 228,000 in their account by 55 1. Which left a monthly withdrawal of RM950 to cover basic needs for the next 20 years after retirement! While the numbers seem worrying, EPF has launched a self-service i-Invest online platform within the EPF i-Akaun (Member) portal.

Via EPF i-Invest, members of EPF may transfer up to 30% of the amount from their EPF Account 1 in excess of basic savings to be invested in funds approved under the EPF-MIS. Combined with Eastspring Investments proven track record of award wins 2, members of EPF have the power to control and monitor their own investments.

1 https://www.thestar.com.my/business/business-news/2018/10/27/are-retirement-schemes-sufficient-for-Malaysians

2 Past performance is not necessarily indicative of future performance. The grantors of the awards are not related to Eastspring Investments Berhad.

EPF Members Investment Scheme

This EPF Members Investment Scheme (”EPF-MIS”) allows EPF members to transfer a portion of their savings from Account 1 for investments in order to potentially increase their retirement savings.

Benefits

Investment in unit trust funds provide potentially higher returns compared to bank savings or fixed deposits.^

Diversification of EPF retirement savings through investment in unit trust funds.

Flexibility to choose your own fund manager.*

Simpanan Shariah Accounts

Effective 1 January 2017, members who have opted for Simpanan Shariah are only allowed to invest in Shariah-compliant unit trust funds approved by EPF.

^Higher returns are generally associated with higher investment risks.

*Approved fund managers by the Ministry of Finance as informed by the EPF.

Who is eligible?

Age below 55

Member has not reached the age of 55 on the date the application is received.

Malaysian; OR

Non Malaysian (registered as EPF Member before 1 August 1998); OR

Permanent Resident.

Age 55 and above

Member has reached the age of 55 on the date the application is received.

Malaysian; OR

Non Malaysian (registered as EPF Member before 1 August 1998); OR

Permanent Resident.

Investment amount is a withdrawal from Akaun 55 or Akaun Emas.

How much can an investor invest?

Age below 55

Member may transfer the amount of savings as follows:

Up to 30% of the total savings exceeding the Basic Savings in Account 1.

Eligiblity formula: (Account 1 - Basic Savings) x 30%

Minimum investment amount is RM1,000.

Application can be made through an a Fund Management Institution's ("FMI") Agent/Counter and i-Akaun (Member).

Age 55 and above

Member may withdraw the savings as follows:

Any amount in Akaun 55 or Akaun Emas by retaining RM1,000 in the account.

Not applicable to Basic Savings.

Minimum investment amount is RM1,000.

Application can be made through i-Akaun (Member) only.

What is the investment frequency?

Application through FMI’s Agent/Counter

Investment can be made at anytime (subject to eligible investment amount in 3 months time).

Allow to invest in multiple unit trust funds through FMI/Institutional Unit Trust Scheme Adviser ("IUTA"), authorised by EPF.

Only one FMI per application.

Application through i-Akaun (Member)

Investment can be made at anytime (subject to eligible investment amount in 3 months time).

Allow to invest in multiple unit trust funds through FMI/IUTA, authorised by EPF.

Only one FMI/IUTA per application.

More features and requirements

Members should only invest in or switch to any EPF-MIS fund that is active, i.e. any EPF-MIS fund that has not been suspended or terminated by EPF or withdrawn by the relevant authorised FMI.

Redemption proceeds will be channeled back to the Member’s EPF Account 1.

Force Redemption will only happen if Eastspring ceases to be an authorised FMI or the termination of an EPF-MIS fund or the expiry of the holding time limit of a money market fund as stated below.

Money Market Funds

Subscription of money market fund is not allowed. However, Members may switch from a non-money market fund to a money market fund and the time limit for holding the money market fund is only for a maximum period of six (6) consecutive months.

Instruction should be provided to Eastspring on whether to channel the investment back to the Member’s EPF Account 1 or to switch into any non-money market fund that is active before the expiry of the time limit. As the default option, the investment will be liquidated, and the redemption proceeds will be channeled back to the Member’s EPF Account 1.

Switching between money market fund is prohibited.

Members must not artificially switch between money market funds and non-money market funds in order to circumvent the holding time limit of a money market fund as stated above.

Invest via i-Invest

Convenient

Transaction, all online.

No Cash Investments

Don’t have cash savings? Use your EPF savings!

Diversify

Get exposure to local or foreign funds

Why invest with Eastspring Investments fund?

- Proven-track record with our award-winning funds. 3

- Global expertise and deep Asian insights to capture investment opportunities in Asia and around the world. Know more about us, here.

3 Past performance is not necessarily indicative of future performance. The grantors of the awards are not related to Eastspring Investments Berhad.

Funds available for EPF Member’s Investment Scheme

Eastspring Investments Equity Income Fund Fund

Eastspring Investments Equity Income Fund invests in equities and equity related securities of companies with market capitalization of up to RM5 billion at the point of acquisition.

Eastspring Investments Dana al-Ilham

Eastspring Investments Dana al-Ilham invests in a portfolio of undervalued Shariah-compliant equities and equity related securities with growth potential.

Eastspring Investments MY Focus Fund

Eastspring Investments MY Focus Fund invests in a focused portfolio of up to (but not limited to) 30 Malaysian stocks that are expected to provide medium to long term capital appreciation.

Eastspring Investments Balanced Fund

Eastspring Investments Balanced Fund The Eastspring Investments Balanced Fund seeks to provide investors with capital appreciation and a reasonable level of current income by investing in a mixed portfolio of companies with good dividend yield and low price volatility and a portfolio of investment grade fixed income securities.

Eastspring Investments Growth Fund

Eastspring Investments Growth Fund seeks to provide investors with long-term capital appreciation by investing principally* in large companies** which will appreciate in value. *Principally refers to minimum 50% of the Fund’s NAV. **larger companies generally refer to companies with market capitalization of RM2 billion or above at point of requisition.

Eastspring Investments Dynamic Fund

Eastspring Investments Dynamic Fund seeks to provide investors with capital appreciation by actively investing in equity and equity-related securities. For defensive consideration, the Fund may invest in debentures and money market instruments.

Eastspring Investments Dana Dinamik

Eastspring Investments Dana Dinamik seeks to provide investors with capital appreciation by actively investing in Shariah approved equities and equity-related securities. For defensive considerations, the Fund may invest in Shariah approved debentures* and money market instruments. * Shariah approved debentures refer to sukuk.

Eastspring Investments Dana al-Islah

Eastspring Investments Dana al-Islah seeks to provide investors with a stable income* stream and an opportunity for capital appreciation from Shariah-compliant fixed income and equity securities. * Income distributed to a Unit Holder will be reinvested into additional Units unless Unit Holder opts for the distribution to be paid out.

Eastspring Investments Equity Income Fund

A fund that invests in equities and equity related securities of companies with market capitalization of up to RM5 billion at the point of acquisition.

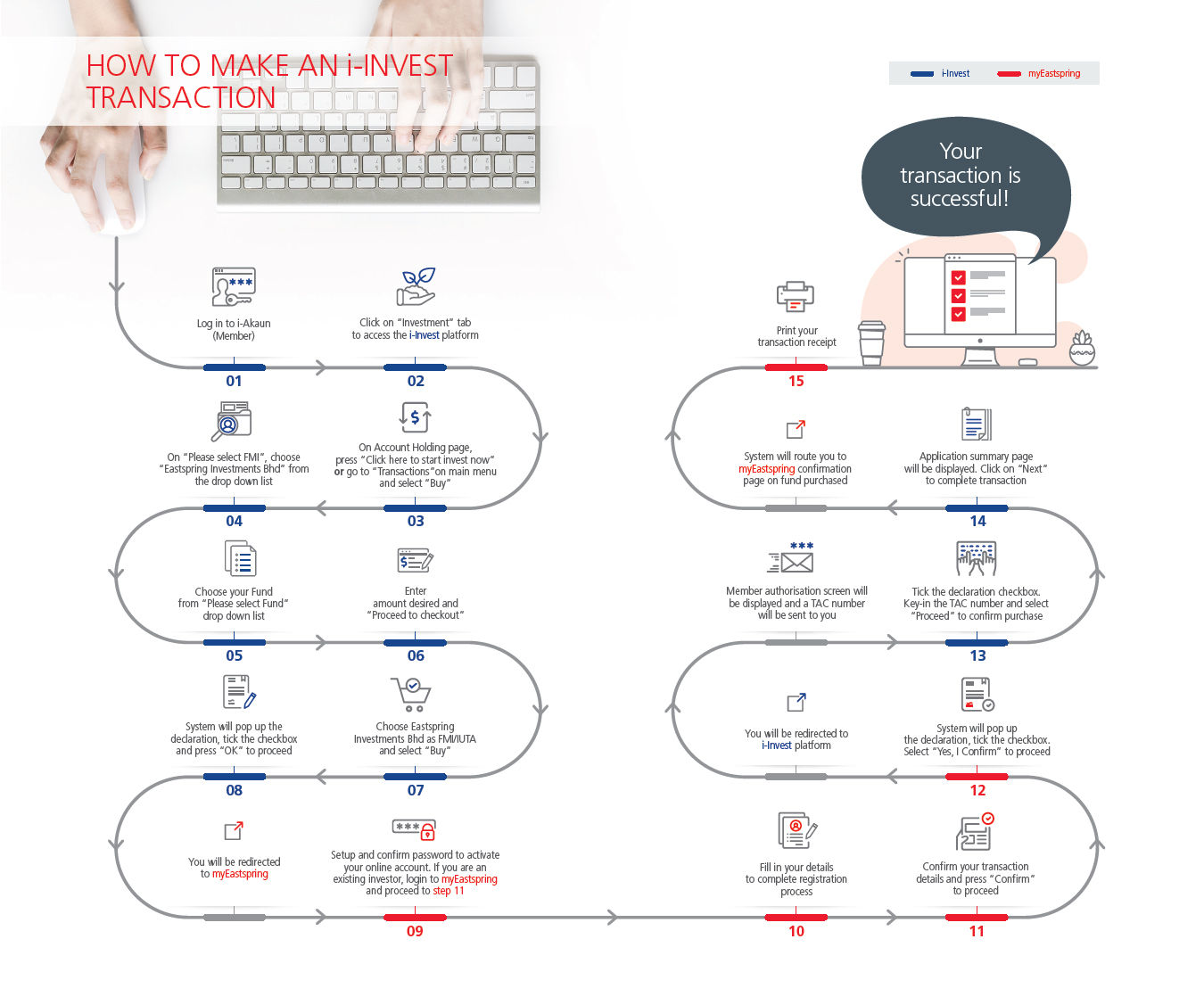

How to start your investment

Eligible members can now make informed investments in unit trust funds via i-Akaun portal. Here’s how:

To download the steps below in PDF format, click here.