Summary

The SGD bond market, which is one of the most advanced in the Asian region, has proven to be a reliable income source and an effective portfolio diversifier. Furthermore, the healthy credit profiles of Singapore companies, attractive yields, and the country’s triple-A sovereign credit rating have been drawing investors to this market.

In 2022, central banks tightened monetary policy aggressively in the face of elevated inflationary forces and geopolitical tensions. As a result, bond yields rose to their highest levels in years and bond prices hit lows. Based on current valuation levels, bond investors can enjoy a decent return as well as earn a stable coupon income. Nevertheless, the volatile market conditions in 2022 nudged investors to diversify their portfolios into higher-rated, lower-risk bond investments such as sovereign bonds in developed markets.

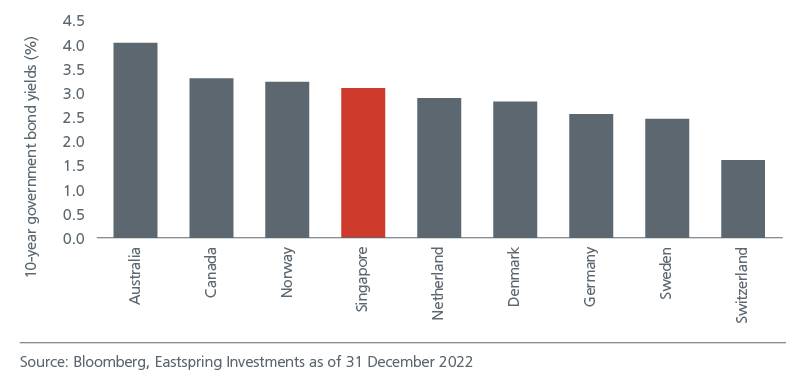

Given the softer growth and more benign inflation outlook, investor preferences have tilted towards high quality assets such as Singapore government bonds. Singapore is one of the 11 countries in the world to enjoy the highest AAA rating with a stable outlook 1. Meanwhile the United States is only rated AA+ despite having the largest economy in the world. Singapore government bonds thus offer attractive yields among the highest-rated sovereigns. See Fig 1. This relatively safer haven status has been drawing investors to this market.

Fig 1: Singapore government bonds offer attractive yield

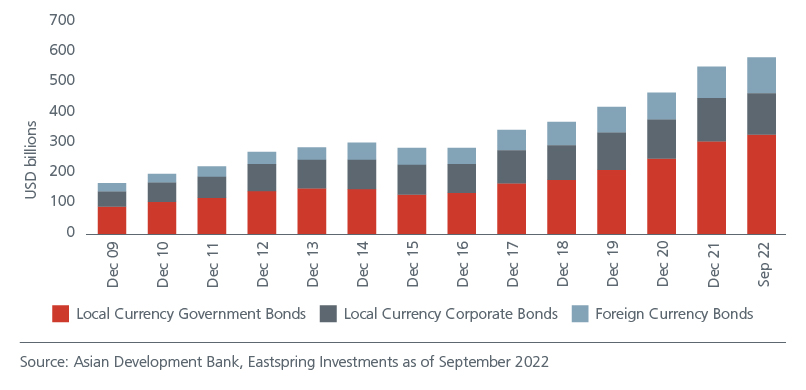

Meanwhile, total outstanding corporate bonds expanded at an annualised growth rate of 11% between 2007 and 2021, on the back of accommodative monetary policies and good investor demand. In fact, 2021 was a record year for the SGD bond market as total issuances reached a nine-year high. See Fig 2. The amount of outstanding SGD bonds is on track to reach another new high in 2022.

Fig 2: Singapore’s bond market continues to grow steadily

Resilience despite volatility

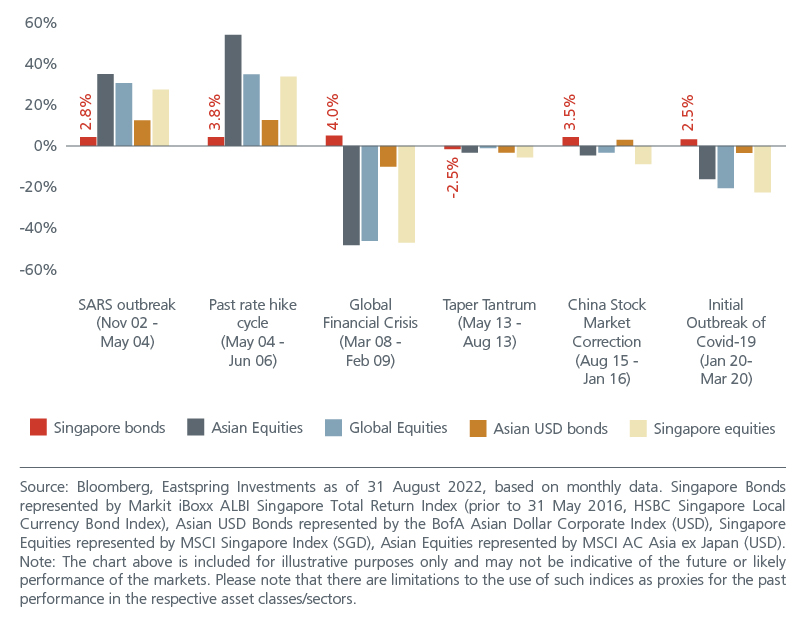

History also shows that Singapore bonds have provided stable returns during periods of market volatility. While most financial assets witnessed sharp declines during the Global Financial Crisis (GFC), Singapore dollar denominated bonds stayed resilient and delivered a positive return to investors between March 2008 and February 2009.

The GFC was a well-telegraphed point in financial market history. It was a period of extensive market stress as wider credit spreads brought about losses in the Asian USD bond market while global and Asian equities dropped as much as 47% and 50% respectively. Singapore bonds also held up better than equities during the 2015 Chinese stock market correction and outperformed by an even wider margin during the onset of the coronavirus outbreak in 2020. See Fig 3.

Fig 3: Singapore bonds deliver relatively stable returns amid market events

Singapore bonds have also shown resilience in the face of past rate hikes. Between May 2004 and June 2006, the US Federal Reserve lifted the Fed funds rate from 1.0% to 5.25%, all in the face of rising inflation and slower economic growth. Yet Singapore bonds still recorded positive returns.

While no one can predict the future performance of Singapore bonds in the face of the ongoing rate hikes by the Fed, we take comfort that Singapore bonds have historically exhibited a much lower risk measure than Singapore equities. The 5-year standard deviation for the asset class has consistently remained below 5%, even amid a market crisis. On the other hand, the volatility for Singapore equities exceeded 20% during GFC. 2

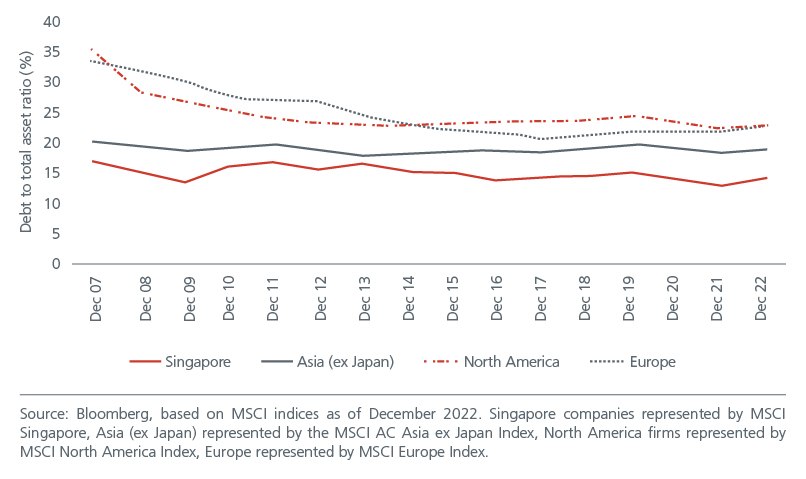

Healthy credit profiles

The balance sheets of Singapore corporates and banks remain largely sound relative to other countries. Financial gearing is much lower than the other countries thanks to the significant deleveraging prior and during the 2008 GFC. See Fig 4. Meanwhile, the profitability metric (measured by operating margins) of Singapore corporates has been rising vis-à-vis peers since 2015 and remains stronger than peers in the US, Europe, and Asia ex Japan.

Fig 4: Singapore corporates have lower debt levels

Furthermore, across the regions, there has been an improvement in operating margins from pre-pandemic levels. US and European businesses are operating at their best levels in years. Corporate earnings should be bolstered as the growth recovery kicks in. Improving profitability will in turn strengthen debt servicing ratios. The default risk of Singapore companies is thus expected to be low.

Singapore bonds still a viable investment

The SGD bond market is one of the most advanced in the Asian region, having made up of a composition of Singapore Government Securities (SGS), quasi-sovereign bonds, corporate bonds, and structured securities. There is an increasing demand from institutions in Singapore, such as insurance companies, for Singapore dollar bonds, precipitated by the need to invest the growing assets managed at their end.

The good news is that the supply dynamics are looking good. The Singapore government is planning to borrow SGD 90 billion over the next 15 years to help finance the country’s “nationally significant” infrastructure projects. This includes sustainable and green projects to help the country to transition to a low-carbon economy by 2030. This will lead to a stream of new government bond issuances in the future.

For investors worried about the impact of further rate hikes on fixed income prices, it is worth noting that Singapore bonds have remained a reliable income source and an effective portfolio diversifier. Bonds generally provide diversification benefits as they help to reduce volatility and improve the risk-return profile of a portfolio. While Singapore bonds do not generally outperform riskier asset classes such as equities over the long run, they have a track record of stable and positive returns. In addition, considering the low gearing ratios of Singapore companies, healthy credit profiles, triple-A sovereign credit rating and increased demand for good quality assets, bond issuers are in a better position to withstand the potential unfolding economic challenges.

Sources:

1 S&P, Eastspring Investments, 30 November 2022. The credit ratings and definition are solely statements of opinion of the credit rating agency and not statements of fact or recommendations to purchase, hold, or sell any securities or make any other investment decisions. The credit rating may also be subject to suspension, change or withdrawal at any time by the credit rating agency.

2 Bloomberg, as tracked by the MSCI Singapore Equity Index.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).