Executive Summary

- With its large number of high dividend yielding companies, a corporate culture that is increasingly focused on shareholder returns and attractive all-in bond yields, Asia is a compelling region for income seeking investors.

- From equity options underwriting to seizing cross currency bond opportunities, there are innovative strategies which active managers can adopt to enhance income.

- Risk management is central especially when taking advantage of income-enhancing tactical opportunities. For end investors, it is important to understand the sources of income – not just focus on a high headline yield.

Many investors look for income from investments, but does it matter where and how that income is generated?

We believe that Asia has unique features that helps it provide investors with quality and sustainable income. Compared to the rest of the world, Asia Pacific ex Japan has the highest number of companies (>400) with dividend yields above 3%, reflecting a strong management culture that focuses on shareholder returns. Asia’s high dividend paying companies are found in both stable as well as high-growth sectors, potentially offering investors income and growth. At the same time, government -led initiatives to improve corporate governance and shareholder returns are rising in Asia. As for Asia’s bond markets, they still offer investors attractive all-in yields. The structural rise in domestic investor participation in some of Asia’s high yielding bond markets such as Indonesia and India have also helped to lower market volatility.

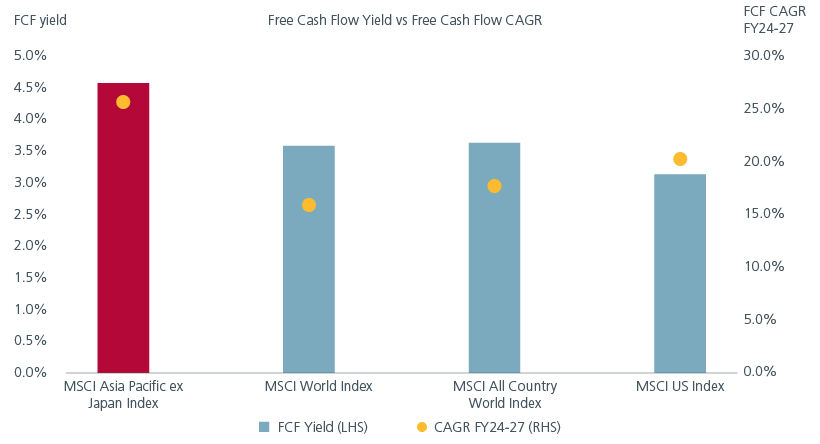

Fig. 1. Asia corporates beat on cash flow metrics

Source: Bloomberg, Eastspring Investments as at 31 December 2024, The use of indices as proxies for the past performance of any asset class/sector is limited. Past performance is not necessarily indicative of the future or likely performance.

Asian economies are also underpinned by a diverse and evolving set of growth engines. Earnings revisions are improving across the region and domestic consumption appears to be recovering in India. Meanwhile Taiwan, South Korea and China are benefiting from their leadership in advanced technology while ASEAN’s prospects are supported by its manufacturing capabilities and tech-adjacent growth.

As active managers tap on Asia’s income edge, there are innovative strategies that can help to boost income, but it is important that they do not compromise on risk.

Q. How are you approaching income enhancement given today’s market environment?

Christina: Our approach is a blend of longer‑term positioning and selective, tactical opportunities. At the core, we maintain longer‑term holdings in income‑generating stocks, where we focus on fundamentals such as business quality, balance‑sheet strength, and cash flow sustainability. Alongside this, we layer on tactical strategies. This can include dividend capture opportunities, where we position around dividend ex‑dates, as well as selectively positioning ahead of sizeable special dividends when we believe the market has not fully priced them in. We also make use of covered calls - writing single‑stock options over existing holdings to generate additional income.

Rong Ren: We are focused on enhancing income through strategies that are repeatable and uncorrelated. One area is option underwriting, where we sell short‑dated, out‑of‑the‑money foreign currency (FX) options to harvest the gap between implied and realised volatility in selected FX pairs. Asian currency regimes tend to exhibit managed volatility and we aim to harvest volatility premia without taking meaningful directional FX risk.

We also seek to take advantage of cross‑currency basis opportunities. When funding dislocations appear, swapping between USD and local currencies can add incremental carry. That said, we only act when the uplift clearly exceeds liquidity and transaction costs.

Q. How do you think about risk management as you look to enhance income?

Christina: Risk management is central, particularly when combining longer‑term positions with more tactical strategies. We are laser‑focused on potential catalysts across our holdings, and that becomes even more important when strategies are shorter‑dated or more tactical. For example, timing is key when using covered calls. Writing options ahead of known events such as earnings announcements can create unintended outcomes, where the option moves in‑the‑money and the costs offsets the premium earned.

By comparison, dividend capture and positioning around special dividends tend to align more closely with our core fundamental skill set. While these strategies are generally less exposed to the risks associated with options, we remain on the look-out for potential catalysts which can cause outsized portfolio downside.

Rong Ren: Agree with Christina that risk management is front and centre when we manage portfolios. In option underwriting, we keep tenors short to limit gap and gamma risk, stay strictly in out‑of‑the‑money strikes, and cap deltas and notionals. This is to ensure that any potential losses are limited. We also avoid executing near major macro events and regularly run stress tests to validate portfolio resilience.

For cross‑currency basis trades, we only take advantage of such trades when the currency moves are driven by technical funding flows. We prefer liquid short‑to‑medium tenors, and size positions accordingly to avoid excessive portfolio volatility. Having clear pre-set exit triggers is important. At the same time, aligning with liquidity needs help ensure basis carry stays incremental rather than directional.

Q. Is there “good” and “bad” income?

Christiana: I believe that there is no “good” or “bad” income, only poorly understood income. If you buy a high dividend stock for the long term but fail to discern that the high dividend yield is a one-off and the stock collapses in the next quarter, then you have misunderstood the stock and have taken on outsized capital risk, despite generating some income in the short term. If, however, you have identified that the same stock is high dividend yielding because of a special situation and you capture this tactically over the short term, and size the position accordingly, then you would have generated income while managing capital risk more effectively.

Rong Ren: For me, good income tends to be transparent, often coming from well‑understood structural premia such as volatility or basis premia. It is typically generated using plain‑vanilla instruments, with clearly defined exposures, and limited tail risks. Good income should also be repeatable and scalable.

By contrast, bad income often looks attractive on the surface but is exposed to deep tail risk, excessive leverage, or have path-dependent, opaque structures. Bad income tends to have liquidity risks, making the trade potentially difficult to exit during periods of market stress, or hinges on a single macro outcome being right.

Q. What are some considerations which end investors should bear in mind when investing for income?

Christina: Be vigilant and discerning. Getting drawn in by a high headline yield can be dangerous if the yield is not sustainable. Invest with managers that have both your capital and income in mind.

Rong Ren: Understand where the extra income is coming from and what the worst‑case outcomes could look like. For institutional investors, any income‑enhancement strategy should sit comfortably within the portfolio’s risk budget and liquidity profile, particularly during periods of stress. These strategies should support overall portfolio resilience, rather than introduce new vulnerabilities.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).