Executive Summary

- ESG-driven disruption is reshaping industries. The ability to understand the drivers that are transforming sectors and the skill to identify companies that will thrive can add significant alpha to bond portfolios.

- ESG evaluation reveals investment risks and opportunities that may be overlooked within existing frameworks. As such, ESG-focused bond portfolios can deliver superior risk-adjusted returns for investors over the medium to long term.

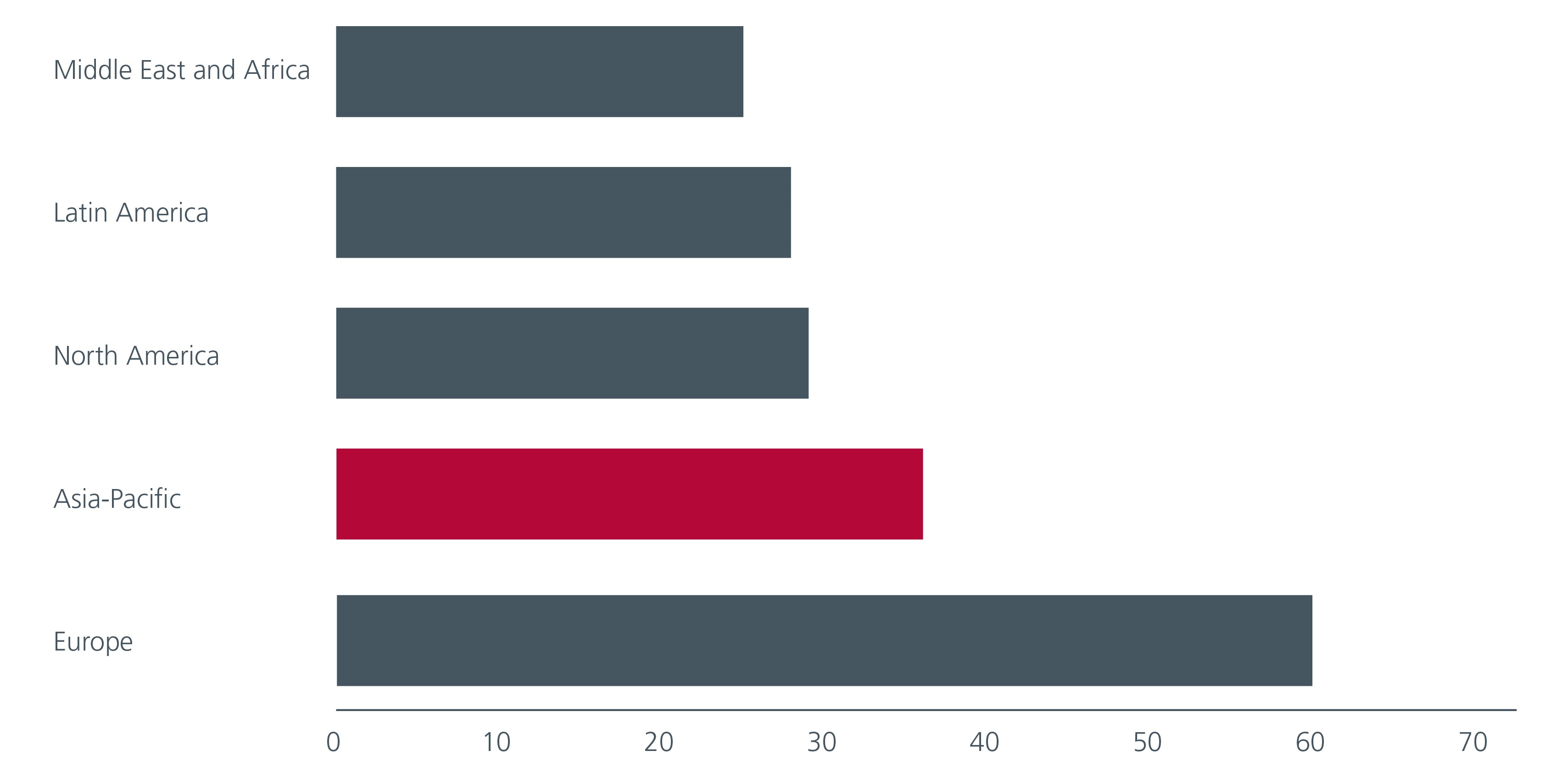

- The ability of companies to thrive amid ESG-driven disruption is highly dependent on the support provided by policymakers. Globally, Asia-Pacific has the second highest share of companies that implement the climate disclosures recommended by the Taskforce on Climate-Related Financial Disclosures (TCFD).

Contrary to the misconception held by some, Environmental, Social and Governance (ESG) evaluation not only meets sustainable objectives but also aligns with financial returns. By assessing ESG factors, ESG evaluation reveals investment risks and opportunities that may be overlooked within existing frameworks. Consequently, ESG-focused portfolios can deliver superior risk adjusted returns for investors over the medium to long term.

Eastspring’s fixed income team’s ESG framework assesses an entity's ESG risk exposure and preparedness. The underlying logic is straightforward: companies or countries that acknowledge the financial impact of ESG risks and respond promptly are better positioned to navigate challenges and seize opportunities. We aim to differentiate between entities that proactively address ESG concerns from those that do not.

In the last five years, Environmental related issues have stayed firmly in the focus of policymakers, communities, and investors. As a result, environmental-driven disruption is reshaping industries. New leaders are being created while established companies need to adapt swiftly to stay relevant. The ability to understand the drivers that are transforming sectors and the skill to identify companies that will thrive can add significant alpha to bond portfolios. In this article, we highlight three sectors where significant disruption is taking place.

Energy – Fueling sustainability

The significant financial and economic losses to businesses and governments caused by extreme weather events underscore climate change risks. According to the Economic and Social Commission for Asia and the Pacific, Asia’ geographical diversity exposes it to a wide range of natural climate events. As more than 60% of Asia-Pacific workforce rely on sectors highly susceptible to changing weather patterns, these weather events tend to cause more damage to the region (as a percentage of GDP) versus the rest of the world. As a result, policymakers and companies have been developing mitigation (action to reduce greenhouse gas emissions) and adaption (action to adjust to and protect against the impacts of climate) strategies.

Renewable energy plays a key role in climate change mitigation and clean energy transition. Most kinds of renewable energy do not emit CO2 or other greenhouse gases into the atmosphere1. At the same time, renewables energy can contribute significantly to climate change adaption, as many adaptation solutions such as desalination and irrigation are energy intensive2.

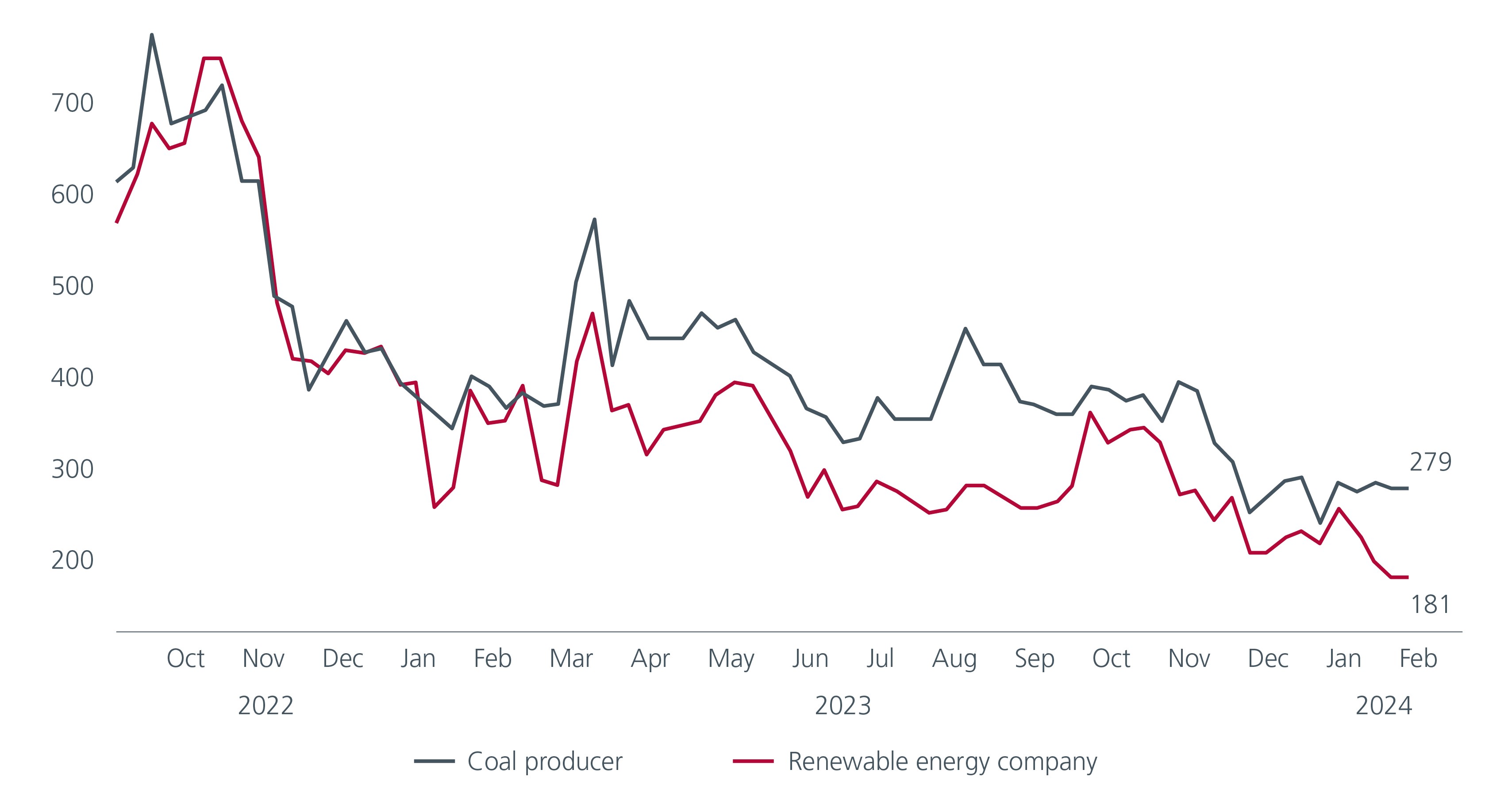

For illustration, we have compared the credit spreads between a well-run coal producer and a leading renewable energy company in Asia, over the period September 2022 to February 2024. See Fig. 1. The renewable energy company consistently outperformed across market corrections and rallies during this period, as it benefitted from the strong investment flows into the sector, as well as from efficiency gains in renewable energy production which have bolstered its profitability.

Fig. 1. Comparison of spreads – coal producer versus renewable energy company (basis points)

Source: Bloomberg. February 2024. For illustration purposes only.

While the coal producer’s bond has underperformed in this analysis, we recognise that there can be instances where coal companies and investors can collaboratively contribute to a fair and equitable transition towards a low-carbon economy which can potentially impact investment performance.

Autos – Electrifying the drive

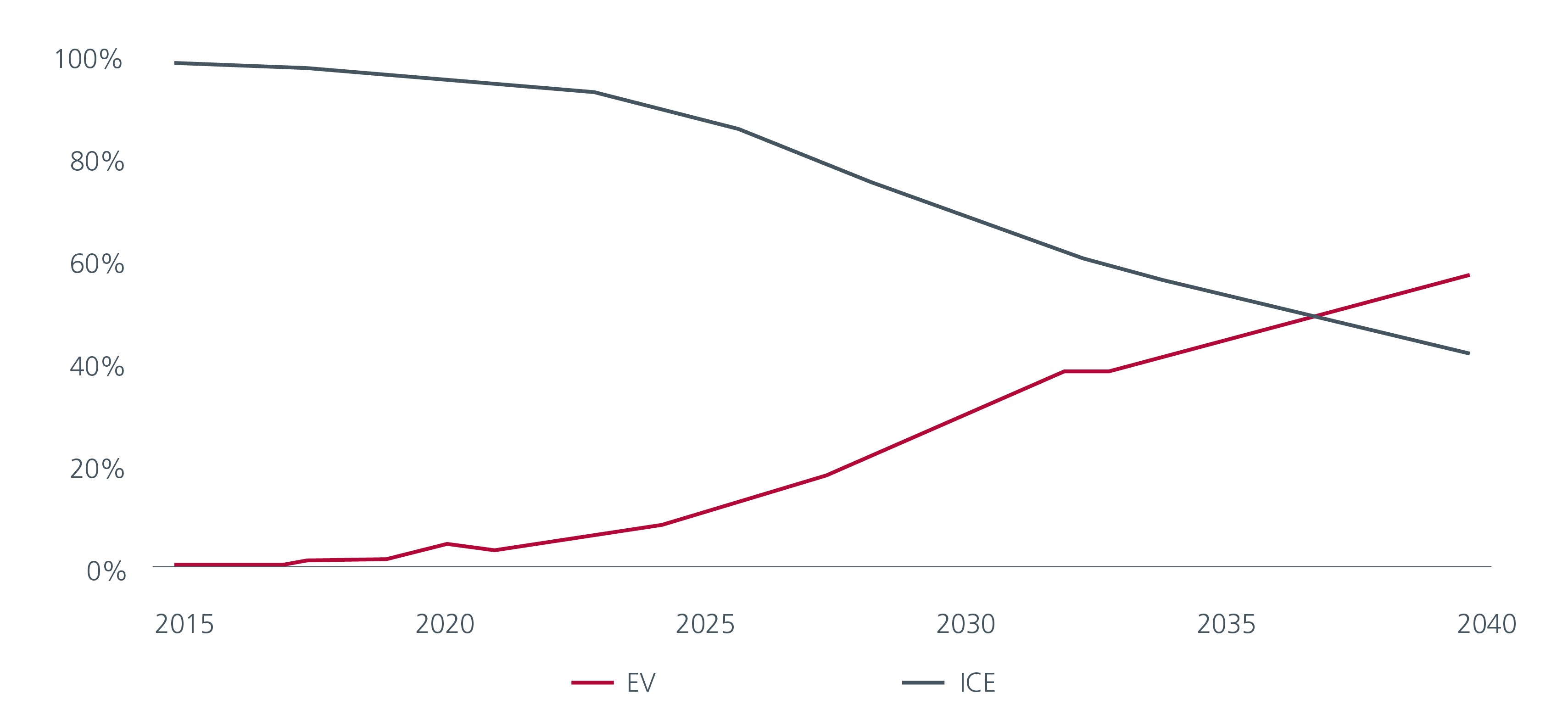

The automotive sector has also experienced significant disruptions as the race towards net-zero has resulted in a gradual phase-out of Internal Combustion Engines (ICE) vehicles. Global electric vehicle (EV) sales are forecasted to surpass gas powered models by 2037. Fig. 2. In Asia, various countries have set targets or announced plans to end the sale or registration of new ICE passenger cars. Notably, Singapore aims to phase out the sale of conventional ICE engine cars by 20303, and China by 20354. Meanwhile, the global New Energy Vehicles (NEV) market is projected to grow 32% in 2024, with total sales expected to reach 17 million units5.

Fig. 2. Global EV and ICE shares of passenger vehicle sales

Asian car makers have been much quicker to embrace the production of NEVs compared to their Western counterparts. This is seen through their capital expenditure plans, product line-ups, pipelines, revenue mixes and trends. Despite the intense competition within the automotive sector, selected Asian car makers have successfully navigated the transition to NEVs over the last decade and enjoyed credit rating upgrades. On the other hand, incumbent industry leaders which have failed to adapt as fast to the NEV transition have seen their market shares decline across key markets. These developments could potentially accelerate as competition heats up further. By identifying and investing in leading NEV companies early, ESG-focused bond portfolios can potentially benefit from narrowing credit spreads.

Financials - Banking on the green financing revolution

Green financing plays an important role in driving the climate transition. A massive amount of capital investment is needed to enable technologies and develop infrastructure that will help us to meaningfully transit from a carbon-based economy. According to the IMF, emerging and developing Asia will need at least USD1.1 trillion annually for climate mitigation and adaptation investments. Actual investment falls short by USD800 billion6. By directing funds into green initiatives, financial intermediaries such as banks can accelerate the transition to a more sustainable future.

However, banks must go beyond mere participation in green financing. They need to invest effort and allocate resources to develop the necessary expertise for evaluating these financing opportunities. This is to ensure that the outcomes of these initiatives align with the intended purposes and that the integrity of green financing is upheld. Banks that proactively cultivate these capabilities gain a first-mover advantage - they not only demonstrate their commitment to sustainable practices, they can also differentiate themselves against the growing number of players in the green finance arena. By enhancing their ability to perform financially significant climate risk analysis and expanding their opportunity set, such banks can strengthen their competitive positioning. We judiciously seek out banks with such characteristics for our ESG-focused bond portfolios.

Asia policymakers: Laying the ESG foundation

Assessing ESG risk exposures and the preparedness in addressing those risks is not limited to companies. The ability of companies to thrive amid ESG-driven disruption is highly dependent on the support and guidance provided by policymakers within their jurisdictions.

Countries that swiftly acknowledge the significance of ESG risks and proactively establish robust frameworks that are guided by regulatory and development bodies, chart a clear path for transitioning toward sustainability in both the public and private sectors. When companies operate within a framework of clear and concise rules and regulations, they can align their strategies confidently. This can in turn act as a catalyst for accelerated growth and development. We believe that companies which operate within such jurisdictions have a natural competitive advantage.

The share of Asia-Pacific firms in adopting climate disclosure recommendations by the Taskforce on Climate-Related Financial Disclosures (TCFD) has grown and is estimated to be the second highest in the world. Fig. 3. Both Hong Kong and Malaysia will mandate disclosures aligned with TCFD recommendations for listed companies. Central banks in China, Japan, and Singapore have also issued guidelines in line with TCFD recommendations7.

Fig. 3. % of TCFD disclosures implemented, by region

Source: Capelle and others 2023 based on data from ICE Data Services; and Financial Stability Board Task Force on Climate-related Financial Disclosures. (% of disclosing firms; 2021)

Delivering ESG-enhanced returns

ESG considerations will continue to disrupt industries and impact credit strength. As companies’ operating landscape becomes more complex on the back of rising climate change risks, increasing geopolitical tensions and evolving sustainability disclosures, jurisdictions that can provide a clear and concise framework of ESG-related rules and regulations will stand out. An asset manager’s structured evaluation of ESG risks and opportunities, and an assessment of the companies’ preparedness to address them can benefit investment outcomes and help ESG-focused bond portfolios deliver superior risk-adjusted returns.

Access expert analysis to help you stay ahead of markets.

Sources:

1 MIT Climate Portal. February 2023.

2 https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2021/Aug/IRENA_Bracing_for_climate_impact_2021.pdf

3 SCMP country report. How Singapore is driving the city towards electric vehicles. August 2023.

4 Wood Mackenzie. China’s 2035 target: No more conventional ICE cars. February 2021.

5 TrendForce. EE Time Asia. December 2023.

6 IMF. Unlocking Climate Finance in Asia-Pacific: Transitioning to a Sustainable Future. January 2024.

7 IMF. Unlocking Climate Finance in Asia-Pacific: Transitioning to a Sustainable Future. January 2024.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).