Executive Summary

- India continues to be one of the most compelling structural stories for global investors, underpinned by a confluence of structural, macroeconomic, and demographic tailwinds.

- Amid promising growth, India is also navigating challenges including trade headwinds, inflationary spikes and elevated unemployment. Government reforms and policy interventions will be key to addressing these concerns and reinforcing India’s long-term growth narrative.

- With India equities’ elevated valuations long being a key concern for global investors, the market’s recent correction creates valuable stock-picking opportunities for active investors.

Amid recent trade headwinds, India is still expected to remain the fastest growing major economy this decade, supported by a young population, improving physical and digital infrastructure as well as a large domestic market that will continue to present compelling long-term opportunities for investors.

India rose from being the 12th largest economy in the world (in terms of nominal GDP) 20 years ago, to the fourth largest in 20251 , and aims to increase its share of global GDP to 8% by 2040. This vision aligns with “Viksit Bharat 2047”, a roadmap to becoming a developed economy.

Multiple engines firing

Amid the new US tariffs, there are mitigating factors that will support India’s growth in the near term. These include frontloaded monetary easing, timely fiscal spending, a resilient rural outlook and easier credit conditions. The rationalisation of the GST (effective 22 September 2025) is also expected to boost consumption and improve the ease of doing business, while having a relatively muted impact on the fiscal deficit.

Meanwhile India’s long-term growth drivers remain intact. Although India’s growth drivers may mirror those seen across emerging Asia, it is the rare convergence of all these forces within a single economy that sets India apart.

A large youthful population provides a formidable workforce that is being further enhanced by the government’s upskilling initiatives. A focus on STEM (Science, Technology, Engineering, and Mathematics) education has bolstered India’s position as an innovation hub as well as a global hub for skilled, technology talent. Meanwhile, rapid urbanisation has created jobs, lifted income and attracted investments.

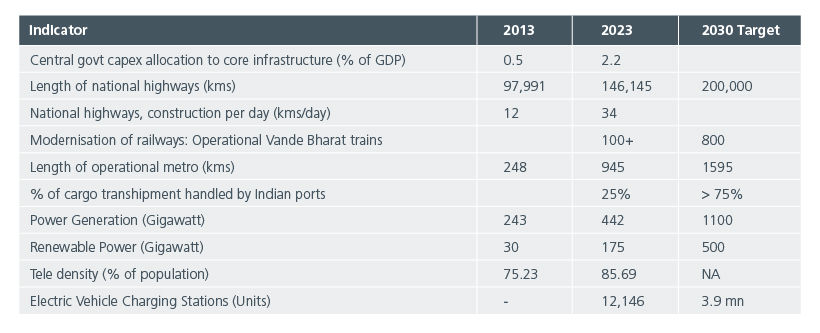

At the same time, significant infrastructure development has raised productivity, lowered supply chain and utility costs. Fig. 1. The improvements in infrastructure have not just been confined to roads, highways, ports and airports - the deployment of digital public infrastructure through the likes of Unified Payments Interface2 and Aadhaar3 has transformed access to financial and social services as well as education. This has lifted economic inclusion and contributed to growth. Meanwhile, robust economic growth has created a rapidly growing middle class, which is driving a virtuous cycle of growth through increased consumer spending, greater capital formation and higher value add activities.

Fig. 1. Expansion of key infrastructure and target for 2030

Source: Government documents. Knight Frank Research.

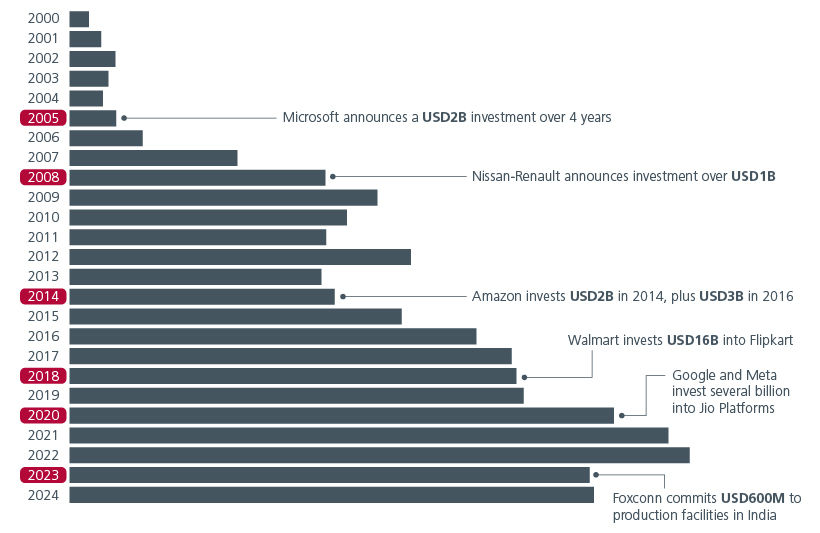

India’s growth and developmental agenda, backed by a strong electoral mandate, has accelerated the transformation process over the last few years. Its democratic credentials have also enhanced its global image, helping to attract foreign investment. Foreign Direct Investments (FDI) in India have increased 20-fold from FY2001 to FY2025. Fig. 2. At the 15th India-Japan Annual Summit in August 2025, leaders from both sides reiterated their commitment to deepening ties, with plans to boost cooperation in key sectors such as telecommunications, clean energy and mineral resources. They emphasised business-to-business collaboration to strengthen supply chain resilience, with Japan expected to invest ~USD 68 bn in India over the next decade.

Fig. 2. Foreign Direct Investment in India

Source: Department for Promotion of Industry and Internal Trade, RBI

The government has also demonstrated significant commitment to fiscal consolidation over the years, bringing down the fiscal deficit from its pandemic-era peak of 9.2% of GDP in FY2021 and meeting its deficit target of 4.8% of GDP for FY 2024–25. As an acknowledgement of the government’s commitment to fiscal consolidation, sustained infrastructure investments and prudent public spending, S&P Global Ratings upgraded India’s credit rating from ‘BBB-‘ to ‘BBB’ on 14 August 2025, the first upgrade in 18 years, while maintaining a stable outlook on its long-term ratings.

Inflation, which reached double digit highs in the 2010s, fell to 1.55% in July 2025, helped by easing commodity prices. Inflation has historically been a challenge for India given its agricultural dependency. With a large portion of India’s inflation being food-based, poor rainfalls can lead to crop failures and price spikes. Being a large importer of crude oil has also made India vulnerable to spikes in global oil prices. Coordinated efforts by the central bank and the government through supply side interventions, liquidity management and fiscal prudence will be needed to keep India’s inflation contained.

On the manufacturing front, initiatives like Make in India and Production Linked Investment schemes have helped to strengthen India’s position as a global manufacturing hub. Job creation within the manufacturing sector, together with the government’s skill development and training programmes are important in helping to alleviate India’s unemployment situation. With the shifting tariff landscape, India may need to relook at its trade strategy. In 2024 and 2025, India significantly increased the number of trade agreements it signed, including a landmark deal with the European Free Trade Association (EFTA). This built on earlier pacts signed in the early 2000s with countries like Australia, Mauritius, and the United Arab Emirates. Meanwhile, on the sidelines of the Shanghai Cooperation Organisation summit on 31 August 2025, Prime Minister Modi and China President Xi expressed optimism over improving bilateral ties and strengthening economic cooperation through trade and investment. At the point of writing, India is in trade negotiations with the European Union. New trade frameworks can unlock new export opportunities and attract more FDI.

Meanwhile, the possibility of a trade resolution with the US cannot be ruled out. The Comprehensive Economic and Trade Agreement (CETA) recently signed by the UK and India in July 2025 potentially serves as a template for what India may be willing to offer to foster long-term bilateral trade ties. Although India waived off duties on 91% of UK’s exports as part of the agreement, the gradual pace of implementation can help to limit the impact on India’s domestic industries. At the same time, India’s current low share of key imported goods in the UK, such as pharmaceuticals and engineering goods, suggest that there is significant export upside for Indian companies.

As India strives to realise its economic potential, its equity market is also making strides. India accounts for more than 16%4 of the MSCI Emerging Markets (EM) Index, up from 6.7% in 2009. For investors, India has become a market that is too large to ignore.

The evolution of India’s equity market

Since inception5, the Nifty Index has delivered annualised total returns of 12.8% p.a. in rupee terms with a standard deviation of 22.7%. 5-year annualised total returns stand at 18.1% p.a. in rupee terms or 13.9% p.a. in USD terms6.

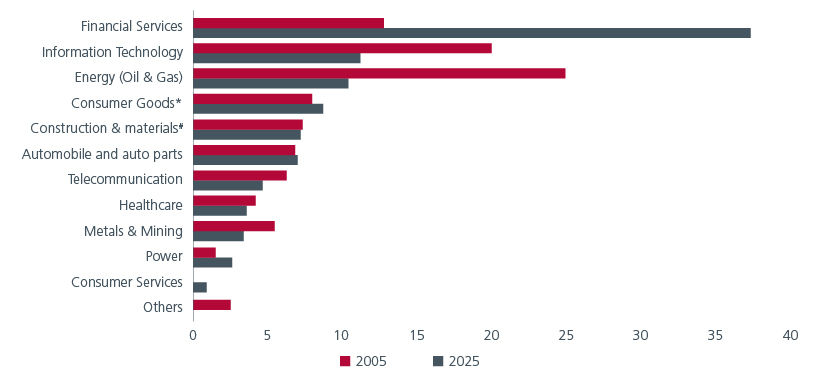

Sector weights have also shifted significantly over the last 20 years. Fig. 3. Notably, the weighting of the largest sector - financials services - has become even larger, driven by the growth of private banks, NBFCs, and insurance companies. Meanwhile the weighting of the second largest sector, Information Technology (IT) sector has moderated. This trend contrasts with the broader MSCI Asia ex Japan index, which suggests that investors in the Indian equity market are exposed to structurally different performance drivers and can benefit from diversification benefits. At the same time, the Indian technology sector consists primarily of IT services companies which generate a large part of their revenues by offering outsourcing and enterprise solutions for global B2B clients. This contrasts with the large US tech companies, like the Magnificent 7, which dominate sectors like AI, cloud infrastructure, and consumer electronics and invest heavily in R&D. As such, India’s technology stocks provide a different earnings, valuation and volatility profile compared to their US counterparts.

The weightage of India’s energy sector in the index has also declined over the years, reflecting diversification away from traditional oil & gas companies. That said, we are seeing a number of companies within this sector transitioning to renewables and investing in solar and wind projects. Meanwhile, Consumer Services (e.g., e-commerce, digital platforms) have emerged as a new sector, reflecting changing consumption patterns.

Fig. 3. Sector weightings – Nifty 50 (2005 vs 2025) (%) 7

Source: National Stock Exchange of India. Percentages may not round up to 100 due to rounding. *Includes Fast Moving Consumer Goods and Consumer Durables. #Includes Construction, construction goods and capital goods.

Over the years, the roles of Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs)8 within the Indian stock market have also evolved. Before the COVID-19 pandemic, FII flows were a significant factor influencing market movements. However, the pandemic period marked a turning point. While FII outflows rose as foreign investors sought refuge in their home markets, DIIs and retail investors stepped in and helped to stabilise the market. Since 2020, the number of demat accounts9 has risen from 40.9 mn to 201.6 mn in July 202510. In the first quarter of 2025, DIIs owned 16.9% of Indian capital markets, moderately exceeding FIIs at 16.8%11. The rising influence of DIIs reflects the growing maturity and depth of India’s domestic investor base, which plays an important role in supporting market stability and future growth. This is evident in August 2025 where domestic investors supported the Indian equity market amid intensified foreign investor outflows following the US tariff announcements.

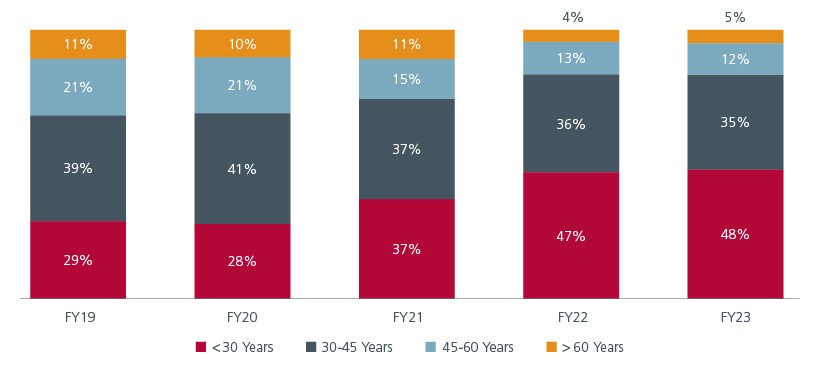

Retail participation, especially among the younger generation, has increased, aided by the Systematic Investment Plan (SIP), government reforms (e.g. tax incentives and regulatory reforms), increased financial literacy as well as easier access to digital platforms. Fig. 4. The rising participation from younger investors expands the investor base and potentially provides a strong foundation for the market to flourish, as the government continues to provide a supportive regulatory framework and greater financial education.

Fig. 4. Retail participation in capital markets (across age groups)

Source: Motilal Oswal presentation.

The compelling case for India equities

India continues to be one of the most compelling structural stories for global investors, underpinned by a confluence of structural, macroeconomic, and demographic tailwinds. The themes of consumption, infrastructure, digital transformation and manufacturing expansion which are integral to India's structural growth narrative continue to hold up strong. These themes can be found across different market segments, underscoring the attractiveness of a diversified flexible market cap approach. While India offers promising growth, it is also navigating challenges including trade headwinds, inflationary spikes and elevated unemployment. Government reforms and policy interventions will be key to addressing these concerns and reinforcing India’s long-term growth narrative.

With India equities’ elevated valuations long being a key concern for global investors, the market’s recent correction creates valuable stock-picking opportunities for active investors. As India’s weight in the MSCI EM Index continues to climb, global investors cannot afford to ignore this dynamic market.

This whitepaper is a collaboration between Eastspring Investments and ICICI Prudential Asset Management Company (IPAMC). IPAMC is the Investment Advisor for various India centric funds managed by Eastspring Investments.

Sources:

1 IMF. World Economic Outlook. May 2025.

2 An instant real-time payment system developed by the National Payments Corporation of India to facilitate inter-bank transactions through mobile phones.

3 Aadhaar is the world’s largest biometric program, enabling previously unbanked people to open accounts and gain financial inclusion at very low or no cost. As of 2022, 1.3 billion people had an Aadhaar ID.

4 MSCI. As of 31 August 2025.

5 NSE Indexogram. Inception date: April 1996. Returns as of 29 August 2025.

6 Bloomberg. As of 31 August 2025.

7Nifty 50. Journey of 25 years. National Stock Exchange of India.

8 Includes mutual funds and insurance companies.

9 Dematerialized account: An electronic account used to hold securities like shares, bonds, and mutual funds in digital form.

10 SEBI

11 ACE Equities.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).