Executive Summary

- Singapore’s AAA rating, and the breadth and maturity of the SGD bond market continue to attract investors seeking quality and stability.

- Even after recent gains, SGD bonds offer similar or better returns on a hedged basis when compared to their equivalents in developed markets.

- SGD bonds have delivered stable returns through major market shocks such as the Global Financial Crisis, COVID-19 and Fed rate hikes.

As Singapore marks six decades of nation-building, the Singapore dollar (SGD) bond market has evolved in step with the nation’s journey of growth and progress. The SGD bond market has grown into the fourth largest local currency bond market in Asia and stands among the most developed in the region. Singapore Government Securities and quasi-sovereign bonds comprise around 76% of the market size, and corporate bond issuances have increased over time.1

The increasing breadth and maturity of the SGD bond market has sparked greater issuer and investor interest. Global corporates are tapping the SGD bond market to fund their operations and to diversify their funding sources. In 2024, SGD-denominated non-sovereign bond issuance surged to a decade high, with 126 deals totaling S$31.2 billion — a 57% increase year-on-year2. At the same time, institutional demand remains robust, supported by ongoing capital inflows into Singapore.

The healthy credit profiles and lower default risk of Singapore companies and the country’s AAA sovereign credit rating have been drawing investors to this market. Singapore is one of the few economies in the world to enjoy and retain a AAA rating, underpinned by strong economic fundamentals and a stable political environment. The SGD bond market is increasingly appreciated by investors for its lower volatility vis-à-vis other bond markets, even developed market ones.

Count on me

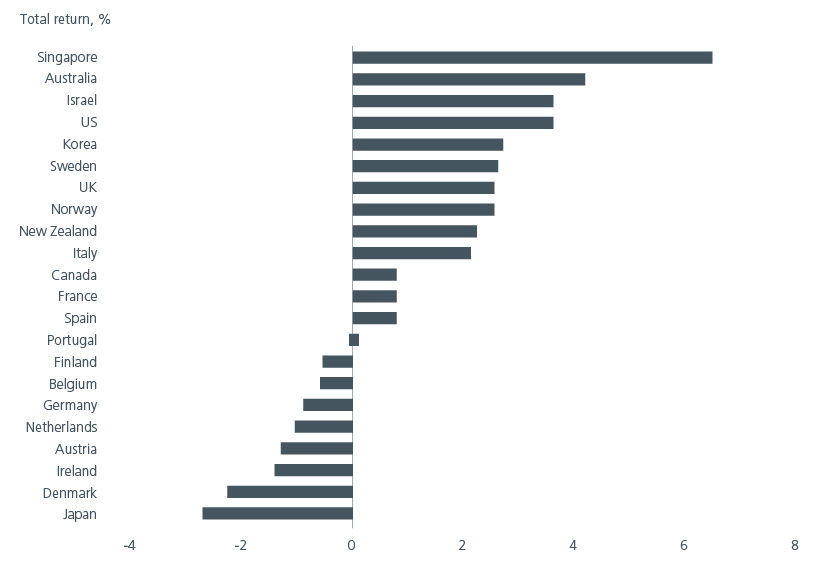

While yields have been declining across the various SGD bond maturities, reflecting broader market dynamics such as lower inflation expectations, central bank policy shift, and increased demand for safe assets, on a total return basis, SGD bonds have outperformed peers in developed markets in the first half of 2025.

Fig 1: SGD government bonds outperformed peers in 1H 25

Source: Bloomberg as of 27 June 2025

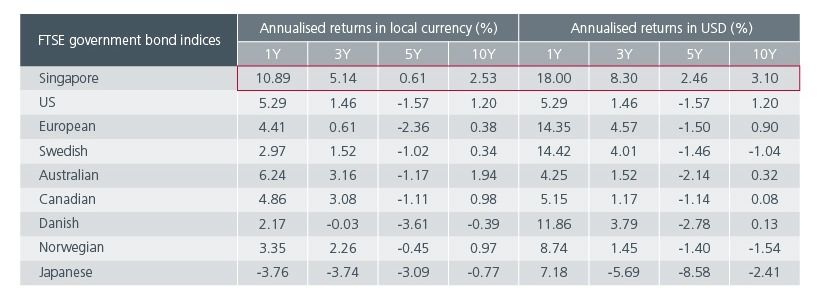

This outperformance is not a one-off as over the 1-, 3-, 5-, and 10-year horizons, the SGD government bond market has consistently outpaced other AAA-rated sovereign bond markets, both in local currency and USD terms.

Fig 2: SGD government bonds show consistent strength vs AAA peers

Source: FTSE world government bond indices as of 30 June 2025

Despite the outperformance of SGD bonds over the last year, SGD bonds still offer similar to better returns when compared to their equivalents in developed markets on a hedged basis. Singapore based investors hence have the potential to benefit from holding a core allocation to SGD bonds given similar to better returns without incurring high hedging costs.

Furthermore, the Singapore dollar is perceived to be a safe haven currency with lower volatility. Given the country’s stable macroeconomic fundamentals and the Monetary Authority of Singapore’s exchange rate policy, the currency has generally been on an appreciating path over the long term, making it an attractive option that investors can turn to during periods of uncertainty.

Stronger together

History too shows that SGD bonds have provided stable returns across periods of market volatility. During the Global Financial Crisis, SGD bonds stayed resilient and delivered a positive return. Similarly, they held up better than equities during the 2015 Chinese stock market correction, outperformed during the 2020 COVID-19 outbreak and fell less through the US Fed’s rate hiking cycle in 2022.

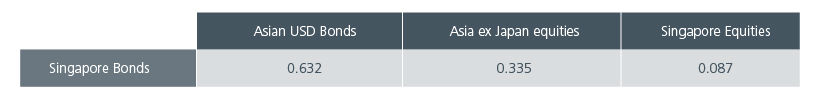

As such, SGD bonds serve as an effective tool for mitigating downside risk in investment portfolios. Their low correlation with Asian USD bonds and other asset classes, in particular Singapore equities, enhances portfolio stability over the medium to long term.

Fig 3: SGD bonds have low correlation with other asset classes

Source: Bloomberg as at 30 June 2025 based on 10-year monthly correlation data. Singapore Bonds represented by Markit iBoxx ALBI Singapore (SGD), Asian USD Bonds represented by the JP Morgan Asia Credit Index (USD), Singapore Equities represented by MSCI Singapore Index (SGD), Asian Equities represented by MSCI AC Asia ex Japan (USD)

The road ahead

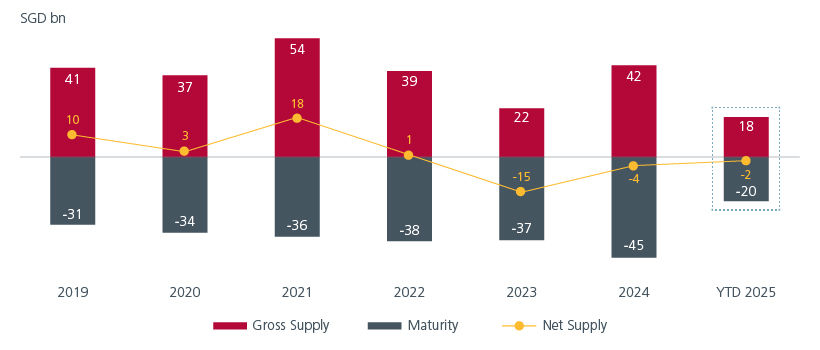

SGD bonds are poised to continue its strong outperformance in 2025 on the back of positive technicals. Demand has been robust as evidenced by the high bid-to-cover ratios in primary deals and strong performance in secondary markets. Net negative supply in 2023 and 2024 due to high all-in yields made it unattractive for many bond issuers to come to market and we expect this supply trend to persist into 2025, providing a strong tailwind for SGD bonds.

Fig 4: SGD bonds’ net supply expected to remain negative in 2025

Source: Eastspring Investments, Bloomberg as of 25 June 2025. Excludes T-bills and bonds that are smaller than SGD 100m. Only bonds that were issued or matured/called till 25 June 2025 is taken into account in the “YTD 2025” bar.

Despite the decline in SGD rates over the last 6 months, we remain constructive on duration given Singapore’s growth and inflation outlook, and we will look to extend duration on spikes in rates.

Whilst SGD credit spreads have tightened more than their equivalents in developed markets over the last 3 months, valuations are still compelling after taking into account hedging costs. Coupled with solid fundamentals and positive technicals, we believe that SGD bonds continue to deserve a core allocation in investors’ portfolios.

Sources:

1 Asiabondsonline, size of local currency market as at 1Q2025

2 https://www.straitstimes.com/business/invest/singapore-dollar-bonds-remain-a-core-income-allocation-as-markets-bounce-back

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).