Executive Summary

- Downward pressure on the US dollar is mounting as the US economy is expected to slow more than Asia’s and interest rate differentials turn more unfavourable.

- The weakening US dollar, combined with the high valuations of US assets make the case for investors to diversify into more attractively priced Asian markets.

- Besides diversifying portfolios and using equity options to participate in the market upside, our three-pronged risk management framework ensures that we manage risks proactively.

In a recent event for Singapore-based institutional investors, we shared out thoughts on the economy and discussed new asset allocation considerations amid the changing market landscape. Here are some of the key takeaways.

Q. Why have equity markets trended higher since the start of the year despite tariff uncertainty and geopolitical tensions?

Equity markets have performed better than expected this year for three main reasons.

First, monetary policy support for markets has been highly favourable - 19 of the world’s 22 largest central banks have eased monetary policy over the past 10 months, including 100bps of cuts by the US Federal Reserve (Fed) late last year. Meanwhile, with the Fed expected to cut rates, this can continue to support asset prices.

Second, delays and temporary exemptions to the US new tariffs limited their increase in cost to the US economy to only 0.2% of GDP in January – July.

Third, this delayed tariff impact allowed earnings in the second quarter to surprise to the upside, driving positive revisions to earnings expectations.

Looking forward, tariffs are likely to be an increasing challenge to growth. In the US, the increase in tariff collections is rising with July collections annualizing to 0.8% of GDP. The recent trade deals increase the US’ statutory tariff rate from about 14% to close to 18% effective August 7 -11. And Section 232 investigations concluding in the fourth quarter will push this statutory rate even higher from early 2026. The economic drag from the tariffs on the US will become more pronounced and the ultimate impact on company margins and US inflation could be a potential source of market volatility.

Q. Why is it increasingly important for investors to diversify beyond US assets?

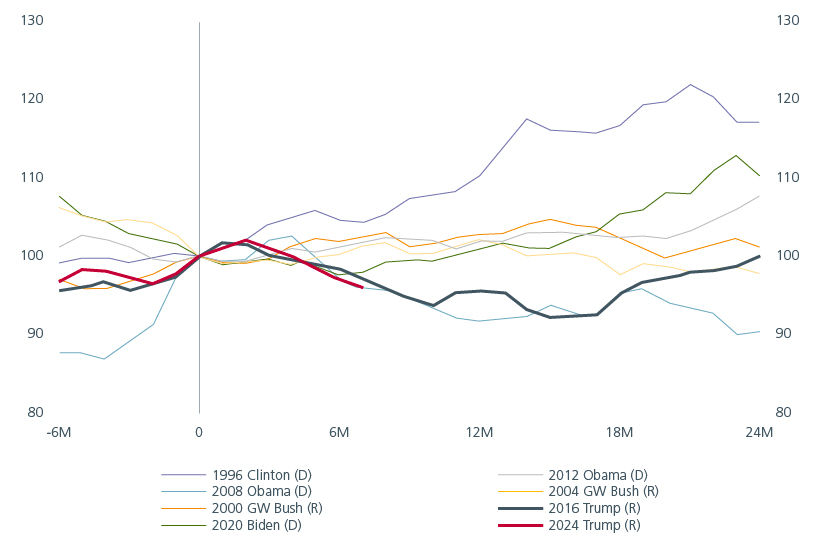

Historically, the US dollar (USD) has served as a diversifier during equity downturns, but this role is being questioned. The USD is expected to trend lower over time, although consensus views should be approached cautiously. The dollar’s trajectory is influenced by relative GDP growth: when US growth lags Asian growth, the dollar tends to weaken. This scenario is unfolding, with the US economy expected to slow more than EM Asia. Interest rate differentials are also moving against the USD, and political factors including a more dovish Fed chair in 2026 add to the downward pressure. It is interesting to note that the USD is following the path it took in the first year of President Trump’s first term, which was also a year of policy turmoil and slower US economic growth. See Fig. 1.

Fig. 1. US broad effective exchange rate

Source: LSEG Datastream. August 2025. Index, election date = 100. 6M before 20 24 after the presidential election.

At the same time, US equities and credit are currently among the most expensive markets globally. While this does not guarantee a downturn, it raises the risk of a “risk-off” episode in which valuations correct. Diversification is essential to manage this risk.

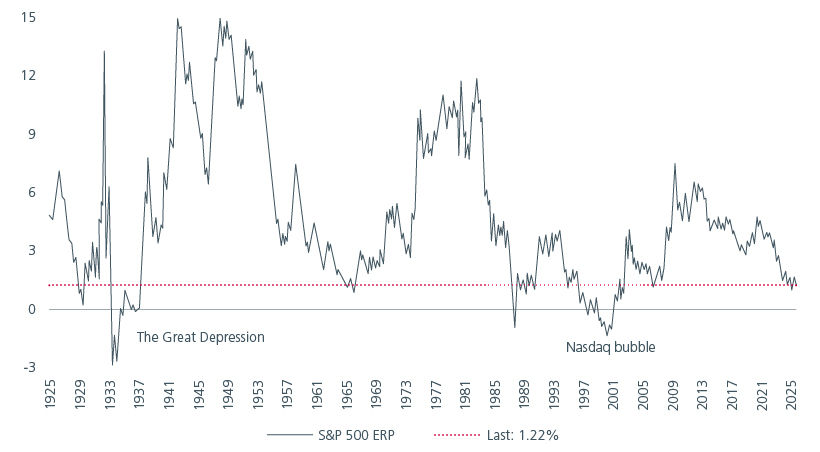

Notably, the US equity risk premium is extremely low, and although it has dipped lower in the past, current levels suggest limited upside for US equities. See Fig. 2. Other markets, including Japan, China, and some of the smaller Asian markets, are showing positive earnings revisions and are not as richly valued. Moreover, dollar weakness has historically supported non-US assets. As the US economy slows more than emerging Asia, interest rate differentials may move against the dollar, enhancing the appeal of Asian assets. Diversifying away from the US allows investors to tap into regions with better valuations and growth prospects such as Asia and the Emerging Markets (EM), while also managing portfolio risks more effectively.

Fig. 2. S&P 500 Equity risk premium since 1925

Source: The use of indices as proxies for the past performance of any asset class/sector is limited and should not be construed as being indicative of the future or likely performance of the Fund.

Q. Should Asia-based investors consider hedging their USD exposures?

Fed rate cuts and slower US economic growth point to stronger Asian currencies which makes hedging USD exposures increasingly relevant for Asia-based investors. In addition, the USD currency that is traditionally considered a diversifying asset that performs during risk-off events, is behaving differently in the current risk regime which makes it unattractive to hold as a diversifier. As a result, investors must weigh the costs of hedging and the potential upside when thinking about their exposures to USD-denominated assets. For USD bond allocations, using bond futures instead of cash bonds can help reduce the need for currency hedging while still benefiting from falling yields.

For Singapore dollar (SGD)-based investors, although the SGD is currently at the top of its trading band, it can potentially strengthen further against the USD if the dollar weakens against the euro and yen. SGD-denominated bonds have outperformed peers in the developed markets in the first half of 2025 and continue to attract investors who are seeking quality and stability. At the same time, the Singapore equity market is a relatively defensive lower beta market which offers attractive valuations and high dividend income from Real Estate Investment Trusts and the banks. While US Investment Grade credit and Treasuries used to be an attractive proposition for their higher yield as well as currency diversification, this investment thesis has weakened more recently given the tight credit spreads and weaker USD expectations.

Q. What are the potential risks facing global markets?

Some key risks include the uncertain implementation of tariff rules or that Trump surprises with more aggressive than expected sectoral tariffs in Q4 2025 and Q1 2026 as the result of current Section 232 investigations. For Asia specifically, a risk is that Asian trade deals with the US create tension with China because of requirements to impose tariffs or other impediments to trade with China.

At the same time, geopolitical tensions still loom. Supply-side inflation shocks may emerge in the near-term, which could raise inflation expectations. That said, we note that these events have historically not had a long-lasting impact on risk assets.

Meanwhile, China’s growth slowdown continues to weigh on global growth. China’s economic recovery requires more substantial and targeted stimulus. The property downturn continues to stress households, while persistent deflation risks global spillovers. We expect the Chinese government to support growth through increased subsidies and other measures. However, a shift towards fiscal consolidation could lead to an earlier-than-expected slowdown.

There are also upside risks which include, but are not limited to, the US economy proving to be more resilient to tariffs than expected. The Fed could also cut more than expected, causing risk assets to melt up.

Q. How are you managing portfolio risks in the current environment?

We are diversifying portfolios across asset classes and geographies. Where possible, we are using equity options to participate in the market upside while limiting the downside. We are also diversifying into gold and Treasury inflation-protected securities (TIPs) to hedge against stagflationary risks.

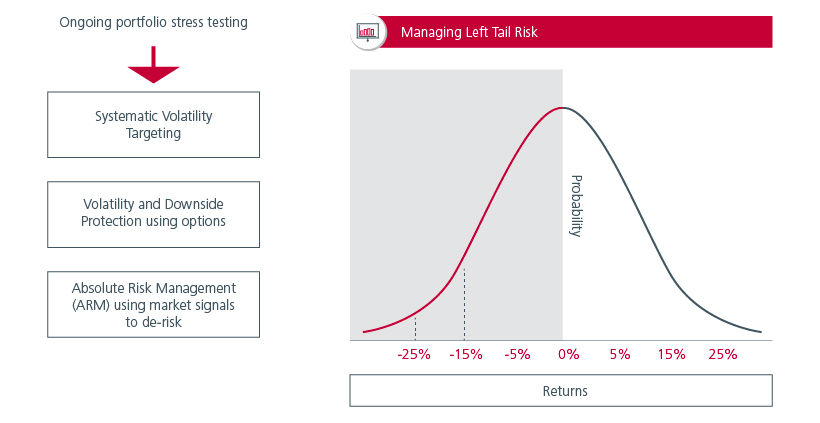

We manage risk proactively, not reactively. For portfolios with a total return mandate, we stress test the portfolios regularly to assess resilience across different economic and market scenarios. Our three-pronged risk management framework (See Fig. 3) includes Systematic Volatility Targeting, where we derisk the portfolio if any asset classes display unusually high levels of short-term volatility, independent of the underlying cause. We also seek to protect portfolios opportunistically via option strategies, guided by market pricing or stress test outcomes. For example, we would purchase cost-effective protection for portfolios rather than reacting to market events. Meanwhile, we practice Absolute Risk Management where we leverage back tested market signals to derisk and raise cash when warranted.

Fig. 3. Protecting portfolio’s absolute return

Source: Eastspring Investments. For illustration only.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).