Executive Summary

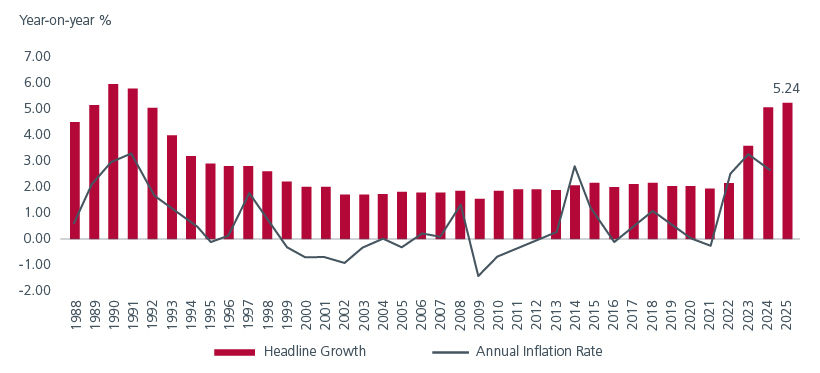

- Japan is transitioning from a deflationary to a reflationary economy, driven by sustained wage growth, inflation, and policy normalisation. Meanwhile, measures such as government subsidies and food reserves aim to ease inflation and boost spending power.

- Corporate governance reforms have led to improved board accountability, capital efficiency, and shareholder returns. Ongoing regulatory pressure and market activism continue to push companies toward greater transparency and efficiency.

- Japan equities offer broad and deep alpha potential, backed by strong balance sheets, reform momentum, and deeply discounted valuations. From large-caps to undiscovered small-to-mid-caps, active investors have multiple avenues to capture upside.

After years of being defined by sluggish growth, entrenched deflation, and demographic headwinds, investor sentiment towards Japan began shifting meaningfully in mid-2023, spurred by structural reforms and macroeconomic changes. Signs of sustained inflation, increased wage hikes, and renewed corporate efforts to enhance capital efficiency, transparency, and shareholder returns have collectively redefined the narrative.

This turning point prompted a reassessment of Japan’s equity markets, which have attracted the attention of global investors after being overlooked for years. While this optimism has been tempered at times by macro headwinds, ranging from trade tensions and currency volatility to global demand uncertainty, the reality is that on-the-ground we continue to see opportunities that are far too compelling to ignore.

The policy pivot

By 2024, signs of sustained inflation and rising wages began to emerge in Japan; the Shunto spring wage negotiations had resulted in a record average pay hike, the highest in over three decades. This gave the Bank of Japan (BoJ) the confidence to shift away from its ultra accommodative policy, end its negative interest rate policy and lift the policy rate to a range of 0.0% to 0.1% in March 2024.

The Bank of Japan’s gradual policy normalisation continued with a rate hike to 0.25% in July 2024, driven by broadening wage growth and rising inflation expectations. This was followed by a further increase to 0.5% in January 2025, the highest in 17 years on the basis that Japan was progressing towards durably achieving its price goal.

Meanwhile, wage growth has notably risen in three consecutive years amid labour shortage, with similar trends observed in overall production and capital expenditure as well. This virtuous cycle is instrumental in turning the deflationary economy with sluggish growth into a reflationary one fuelled by more robust domestic consumption and investments.

However, the Japanese public has struggled with elevated inflation stemming from rising food and energy prices. This has thus far offset the benefits of Japan’s wage growth on domestic consumption. In response, the government has taken inflation-relief measures via releasing strategic rice reserves and importing from other nations, as well as curbing household electricity and gas prices. If these measures can begin to take effect in the following months, it should allow more room for the wage growth to translate into higher real wages and spending power for the Japanese public.

Fig. 1: Higher wages thus far have been offset by elevated inflation

Source: Eastspring Investments, Ministry of Health, Labour and Welfare, BofA Global Research, Cabinet Office, MIAC, MHLW as of 8 July 2025

Separately, Japan has thus far been able to navigate its trade and economic relations with the US, with the two countries coming to an agreement in late July 2025 with a tariff rate of 15%, one of the lowest rates among major economies and more favourable than prior market expectations. The agreement not only positions Japan as one of the US’ preferred trading partners, but it also provides more clarity on Japan’s economic outlook, which may enable the BoJ to continue normalising rates.

The reform dividend

Japan’s corporate governance landscape has undergone a structural transformation over the past decade, driven by regulatory reforms, market pressures, and a growing recognition among corporates of the need to align with global best practices. The introduction of the Stewardship Code in 2013 and the Corporate Governance Code in 2015 marked a turning point, setting higher standards for transparency, accountability, and shareholder engagement.

While corporate reform has long been a central theme in Japan, momentum persists as regulators continue to push for structural improvements under the directives of the Financial Services Agency and the Tokyo Stock Exchange (TSE). The Corporate Governance Code has been revised multiple times to enhance board independence and shareholder engagement. TSE has redefined market segments in 2022 with more stringent liquidity and governance requirements, while actively encouraging companies—particularly those with persistently low price-to-book ratios—to disclose concrete plans for enhancing capital efficiency and shareholder returns.

The key reform pillars include:

a) Board accountability: Japanese companies are increasingly aligning management with shareholder interests, driven by stronger board oversight, more independent directors, and growing activist engagement

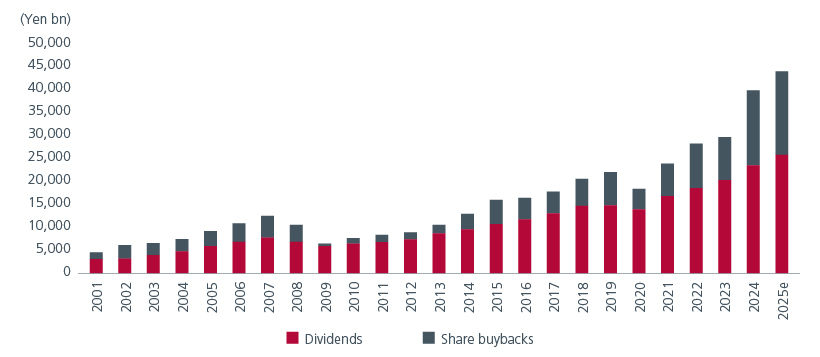

b) Capital efficiency: Many companies, especially small-to-mid-caps (SMIDs), have high levels of net cash. The pressure to deploy this cash productively has intensified. Shareholder payouts have surged, with buybacks nearly doubling in 2024 and dividend growth becoming a consistent theme

Fig. 2: Rising trend in share buybacks and dividends

Source: Nomura as of 7 July 2025. FY 2025 is Nomura estimate. Based on company's data and Toyokeizai and Nomura estimates

c) Portfolio rationalisation: Driven by activism pressures from private equity and foreign investors, and regulatory pressure from TSE, companies are streamlining portfolios—divesting non-core assets, sharpening focus on core strengths, and unwinding cross-shareholdings

For investors, these changes are not only improving the risk-return profile of Japanese equities but are also unlocking new sources of alpha across both large-cap and SMID segments. Notably, SMIDs and value-oriented companies—often characterised by low price-to-book ratios and underutilised cash reserves—are particularly well positioned for re-rating.

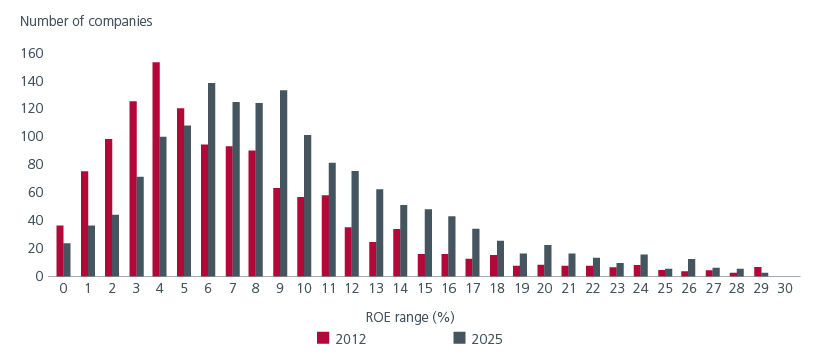

The reforms have led to a steady improvement in margins and return on equity (ROE) across the market. The reduction of cross-shareholdings has improved board accountability to minority shareholders and facilitated a more dynamic market for corporate control, including a rise in contested takeovers and mergers & acquisition activity.

Fig. 3: A steady improvement in return on equity

Source: Eastspring Investments (Singapore). BofA Global Research, QUICK as at end June 2025. Based on TOPIX constituents with actual ROE.

While Japan historically lagged global peers in these metrics, the gap is narrowing as companies focus on sustainable earnings and capital discipline. The ongoing reforms are not just a regulatory box-ticking exercise—they are fundamentally reshaping corporate behaviour, capital markets, and the investment landscape. Japan Exchange Group’s CEO claimed in June 2025 that market reform is only “15% to 20% there”, a statement that suggests more changes are to come in the next several years.

The re-rating runway

Japanese equities present a powerful combination of balance sheet strength, governance improvement, attractive valuations, and untapped alpha—especially among small and mid-cap names.

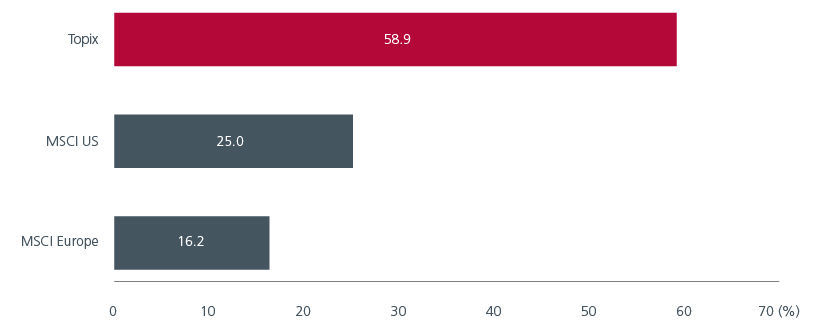

First, Japanese corporates are unusually well capitalised. Almost half of TOPIX non-financial companies hold net cash on their balance sheets—far higher than in the US (25%) or Europe (16%). This financial conservatism acts as a buffer during turbulence and offers optionality: as corporate governance reforms pressure management to deploy excess cash, we expect increasing share buybacks and dividends—not just from large caps but also undervalued SMIDs. This also provides ample dry powder for capex and M&As, which have reached record levels this year and seem poised to maintain the strong momentum.

Fig. 4: Japan corporates outpace peers in positive net cash reserves

Source: Nomura, as of 5 March 2025. Ratio is the number of positive net cash companies divided by the number of index composite companies,

Beyond the well-known large-cap exporters, Japan’s equity market is highly diverse and deep. Significant opportunities exist in sectors tied to domestic consumption and services, many of which remain under-researched and under-owned by international investors. Small-to-mid-cap companies stand out as an untapped source of alpha. These businesses often trade at sizeable discounts to intrinsic value despite strong fundamentals and catalysts for re-rating. An attributing factor is that they often have minimal analyst coverage—some estimates suggest over 40% have no coverage—making them fertile ground for fundamental stock pickers.

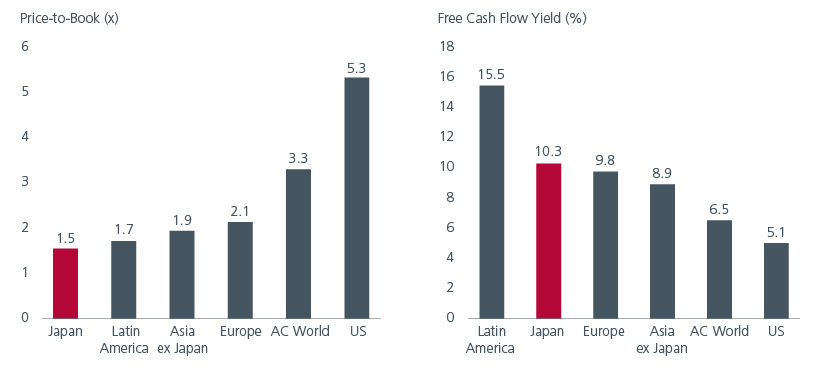

Valuation metrics reinforce the opportunity: Japan’s forward price to earnings (P/E) and price-to-book (P/B) multiples sit at material discounts to global peers despite rising ROEs and free cash flow yields. This valuation gap reflects lingering scepticism—rooted in deflationary history rather than current fundamentals—and offers a margin of safety for value investors. While challenges such as tariff risks, currency volatility, and shifts in global market sentiment may intermittently create headwinds, these dynamics also generate dislocations that skilled active managers can exploit.

Fig. 5: Japan stands out for attractive valuations and strong cashflow

Source: Eastspring Investments, MSCI Indices, Refinitiv Datastream as of 30 June 2025. Indices used: MSCI Japan Index, MSCI Europe Index, MSCI AC Asia Pacific ex-Japan, MSCI EM Latin America Index, MSCI AC World Index, MSCI USA Index

In summary, Japan’s unique blend of corporate conservatism, reform momentum, and deeply discounted valuations provides a broad and deep opportunity set. From defensive large caps to undiscovered SMIDs, and from domestic growth stories to global exporters, investors have multiple avenues to capture upside as structural catalysts play out.

The case for value

Japan presents compelling diversification benefits, underpinned by distinct alpha drivers such as domestic consumption recovery, corporate reform momentum, and de-risked balance sheets. Importantly, the breadth of the market means that investors relying solely on passive strategies risk overexposure to large-cap, export-oriented companies, overlooking the broader spectrum of opportunities emerging in domestic sectors and smaller market capitalisations that active, value-focused managers can navigate.

Our purely bottom-up investment process is designed to systematically exploit behavioural biases—such as extrapolation and risk aversion—that persistently lead to mispricing. Capturing these inefficiencies requires a disciplined and repeatable approach. We begin by screening a universe of over 2,000 companies, applying consistent valuation anchors to identify high-impact outliers—stocks where the price meaningfully diverges from intrinsic value.

Our in-depth research efforts focus on the most mispriced opportunities that offer the greatest potential return. We focus on sustainable earnings drivers rather than short-term reported results, using a consistent valuation framework to uncover long-duration value. This emphasis on fundamentals sets us apart from a market often driven by near-term sentiment.

The strength of our approach lies not only in process, but in culture. Our team’s long-standing experience in the Japan market, combined with a collaborative environment of challenge and debate, ensures disciplined execution across market cycles. This foundation is critical to delivering strong, long-term performance in a market where value continues to be the most effective lens for alpha generation.

No longer a fringe play

Japan is undergoing a once-in-a-generation transformation that is fundamentally reshaping its economy, corporate sector, and capital markets. The result is a steady uplift in market-wide ROE and margin expansion that have long lasting implications for investors.

Despite these transformative shifts, global allocations to Japan remain modest, even though many reforms are now tangible. This disconnect between perception and reality creates a fertile environment for value-oriented strategies. As reforms deepen and management teams increasingly focus on capital discipline, Japan’s undervalued equities are well positioned for re-rating, creating opportunities for investors willing to look beyond the headline indices.

As Japan transitions into this new phase of sustainable growth and improved governance, it should no longer be viewed as a tactical or peripheral play, but a core part of equity allocations for investors seeking differentiated, long-term sources of return. Value investors with discipline, engagement, and bottom-up insights are best positioned to capture Japan’s reawakening.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).