Executive Summary

- There have been some bright spots in China’s recent economic indicators. The worst for the economy appears to be behind us, although the road ahead remains bumpy.

- China’s attractive valuations and low exposures among investors make it a compelling long-term investment, especially when compared against expensive markets which had outperformed in the last 12 months.

- A sustainable market rally in China would require implementation details of the government’s equipment upgrade and consumer trade-in programme, as well as further fiscal and monetary easing. Signs that policy makers are moving ahead of the curve would also be a key catalyst.

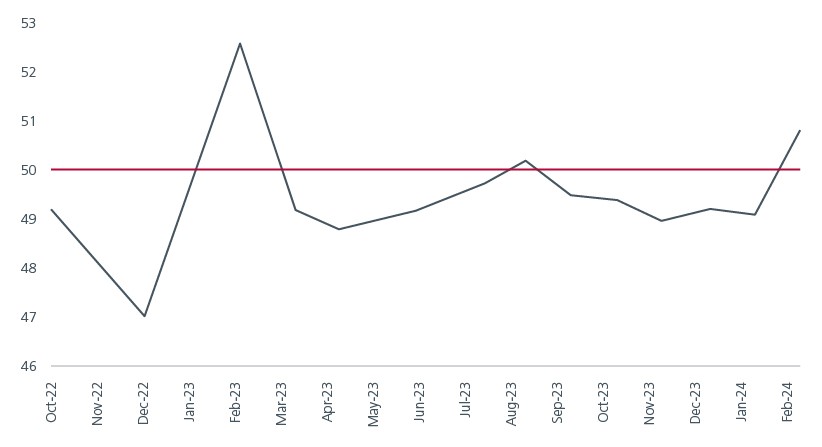

At the point of writing, the China A-share market (CSI 300 Index) is up year to date on the back of bottom fishing by investors and state-ordered buying1. The gains have come against a backdrop of (modestly) improving economic fundamentals. Power generation grew 8.3% yoy in January to February while industrial production increased 7% from the year before, beating consensus expectations of a 5.2% gain. Exports during the first two months of the year were 7% higher than the year before, versus expectations of a 1.9% increase. February’s consumer price inflation also inched up +0.7%yoy after four months of deflation. More recently, the NBS manufacturing PMI beat market consensus by rising to 50.8 in March from 49.1 in the previous month, supported by gains in new orders and production. This was the highest reading in 12 months and reflects an improvement in both external and domestic demand. Fig. 1. Have China’s economy and market turned the corner?

Fig. 1. China’s manufacturing PMI

Source: Bloomberg. As of April 2024.

Exports and consumption are key

We believe that the worst for the Chinese economy is behind us, although the road ahead remains bumpy. Infrastructure spending is expected to moderate this year as the central government focuses on containing the local governments’ already elevated debt-servicing burdens. The PBOC’s largest one-time cut to the 5-year Lending Prime Rate in February was an important signal that the government wishes to stabilise the property sector. The government’s urban renewal projects can help to further stabilise the property sector but not cause a strong rebound. Nevertheless, the property sector should continue to exert less of a drag on the broader economy going forward.

Exports and consumption will be key to helping China achieve its 5% GDP growth target for 2024. Amid geopolitical and trade tensions, China has been diversifying its export destinations from the US and Europe to developing countries. Product upgrades, product mix improvements and increasing competitiveness have created significant export opportunities for Chinese auto, battery, construction, solar and grid equipment. In line with the key goal of developing “new quality productive forces” as highlighted in the 2024 Government Work Report, the government has indicated that it will encourage large equipment upgrades and trade-ins of consumer goods. This will help to boost consumption.

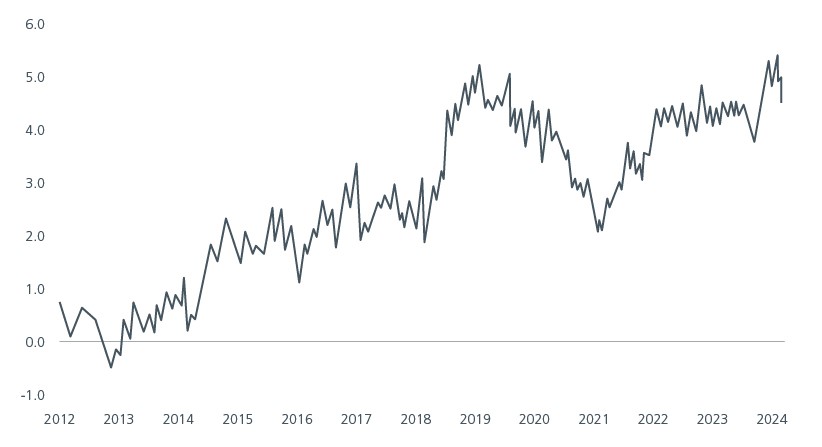

Compared to China’s economic and market downturn in 2015/16, we note that the picture on the company front appears to be more encouraging. Overseas revenues account for 15% of total revenues, up from 12.5% in 2015. Leverage as measured by net debt to EBITDA (Earnings before interest, taxes, depreciation and amortisation) ex property has fallen significantly and free cash flow generation is close to its historical high since 2012. Fig. 2. This has enabled companies to lift their capital returns to shareholders with the dividend payout ratio now at 33% vs 29% in 2015/2016.

Fig. 2. Trailing free cash flow yield

Source: Factset, UBS, Note: MSCI China is used as universe.

Keeping the faith

The CSI 300 Index is currently trading around a 12-month forward price to earnings ratio of 10.3x, close to its 10-year historical average2 following the recent rally. Meanwhile, most professional investors3 currently have an underweight position in the market although we note that global investors have turned net buyers of onshore shares via a link with Hong Kong for a second consecutive month in March.

While China’s growth is not as strong as before, it does not mean that the market is devoid of opportunities. The capital goods, consumer durables, energy, banks, and utility sectors have delivered high single-digit to mid double-digit returns year to date4. For now, we are adopting a barbell investment strategy. On the one hand, we like companies that have low valuations, stable dividend yields and stable fundamentals. This is balanced against exposure to companies that are gaining market share from global peers or well positioned to benefit from the future technology boom in promising growth sectors.

China’s attractive valuations and low exposures among investors make it a compelling long term investment, especially when compared against expensive markets which had outperformed in the last 12 months. In our view, a sustainable market rally would require implementation details of the equipment upgrade and consumer trade-in programme, as well as further fiscal and monetary easing (ie cuts to interest rates and the reserve requirement ratio). Signs that policy makers are moving ahead of the curve would also be an important catalyst for the market.

Access expert analysis to help you stay ahead of markets.

Sources:

1 Bloomberg. YTD returns for CSI 300 in RMB terms as of 2 April 2024.

2 FactSet, I/B/E/S, CSI. As of 22 March 2024.

3 BofA Global Fund Manager Survey. March 2024.

4 Bloomberg, FactSet, MSCI, CSI. Bottom-up calculation based on current constituents and weights. As of 22 March in RMB terms.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).