Executive Summary

- Concerns over the sustainability of the US’ fiscal deficit and potentially a weaker USD are reducing the attractiveness of US Treasuries.

- Asia local currency bonds offer diversification benefits, with low to moderate correlations to major developed market bonds.

- With inflation subdued across Asia, and high real yields, now may be the time for investors to explore the potential of Asia’s local bond markets.

In a world of shifting macroeconomic tides, Asia’s local currency bond markets are emerging as a compelling destination for global investors. The confluence of a rising US fiscal deficit, weakening US dollar, subdued inflation across much of Asia, and higher real yields in the Asia region is creating a favourable backdrop for these assets. For investors seeking diversification, income, and resilience, the case for Asia local currency bonds has rarely been stronger.

US’ rising fiscal deficit redefines the playing field

In our mid-year outlook, we noted that the new US budget may have negative long-term implications for US Treasuries. At the same time, while the USD would probably maintain its reserve currency status for the foreseeable future, concerns over weaker US growth, the sustainability of the US’ fiscal deficit and growing geopolitical tensions have all contributed to a reassessment of the USD’s dominance. We believe that this is likely to drive some further repatriation of funds out of the USD over the next year.

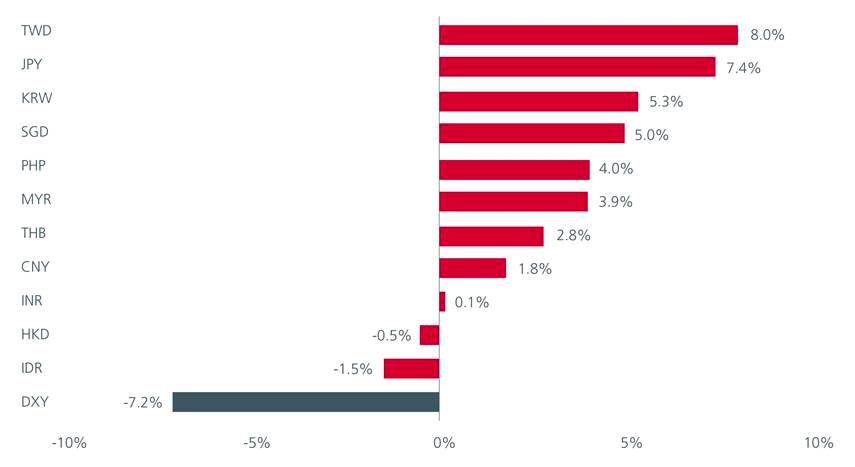

Asian currencies are likely to strengthen as a result. In recent months, the USD has depreciated against most major currencies, including those in Asia. See Fig. 1. This trend enhances the appeal of local currency bonds for foreign investors, as currency appreciation can amplify total returns. Moreover, as the USD weakens, the relative attractiveness of US Treasuries and other US assets diminishes, potentially prompting investors to diversify and seek alternatives with better risk-reward profiles. Asia currency exposure may also be attractive to USD investors who are looking to diversify.

Fig. 1. Asian currency movements against the USD (year to date)

Source: Bloomberg. As of 15 May 2025.

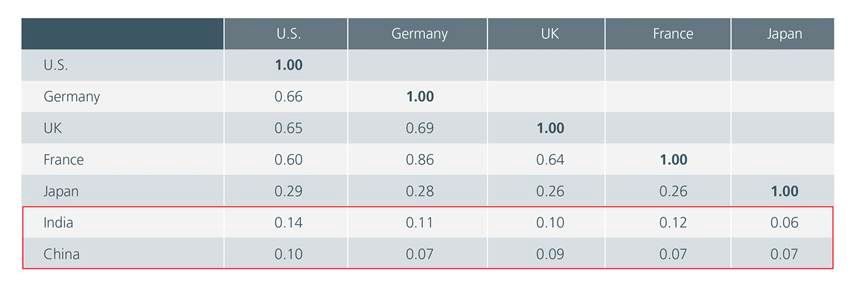

Asia local currency bonds offer diversification benefits as they exhibit low to moderate correlations to US Treasuries and to other major developed market peers. This is increasingly valuable in today’s volatile environment. Fig. 2.

Fig. 2. Correlations between bond yields, 1995 to 2025

Source: Bloomberg, IIF. May 2025.

The asset class has also matured significantly. As of end April 2025, the outstanding value of local currency bonds in Asia reached USD 1339 bn, comprising over 2000 issues from more than 390 issuers.1 The size of the market reflects not only the region’s economic growth but also regulatory reforms and increased foreign participation. As more Asia local currency bonds get included in global benchmarks, passive flows are likely to rise, further supporting valuations. For example, India government bonds were included in the JP Morgan Government Bond Index – Emerging Markets from 2024 while South Korea's government bonds are set to be included in the FTSE Russell World Government Bond Index starting in April 2026.

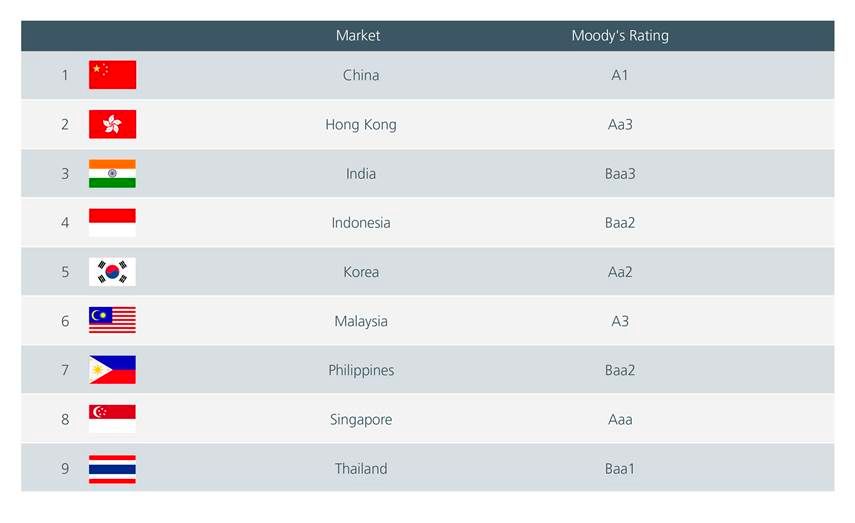

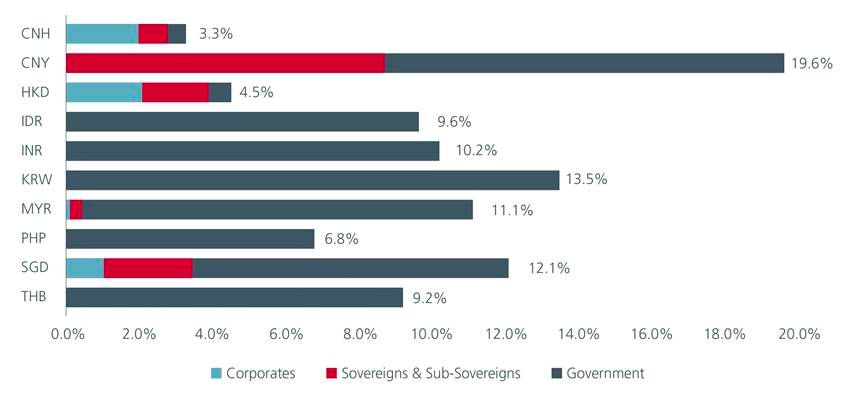

Asian sovereigns are key issuers in local currency bond indices. With many of Asia’s government bond markets having investment-grade ratings, they potentially offer investors both quality and yield. Fig. 3. Corporate issuers are relatively more active in China, Malaysia, Singapore and Thailand. Fig. 4.

Fig. 3. Asia – ratings (Moody’s)

Source: Moody’s as of 30 April 2025.

Fig. 4. Sector breakdown by currency

Source: Eastspring Investments. Markit iBoxx ALBI Index. As at 30 April 2025. Due to rounding, the numbers presented may not add up to the totals indicated and the percentages may not reflect the absolute figures for the same reason. The chart above is for illustrative purposes and may not be indicative of the future or likely performance of the markets.

Real yields: Asia’s quiet advantage

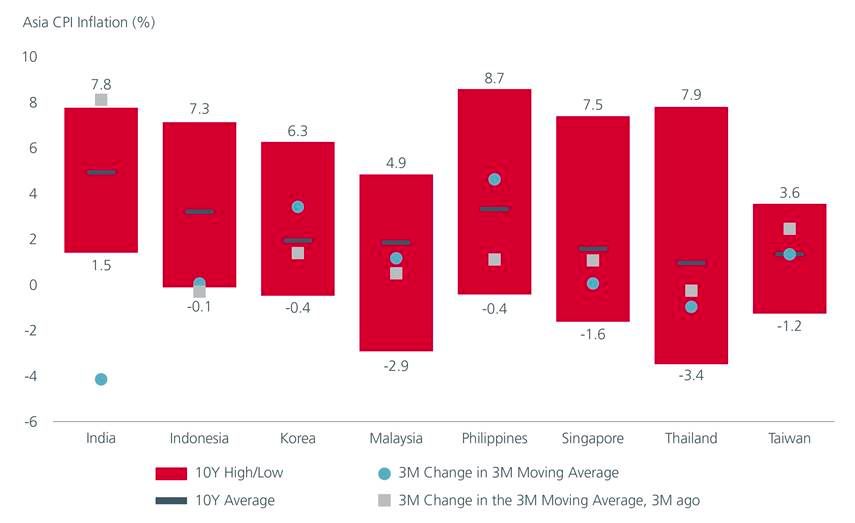

While inflation remains sticky in the US and parts of Europe, Asia tells a different story. Central banks in the region have largely succeeded in anchoring inflation expectations. Fig. 5. In India, for instance, inflation has declined to a six-year low of 3.2% year-on-year, driven by falling food prices. Similarly, in the Philippines, inflation is subdued, with weak domestic demand allowing the central bank to maintain a dovish stance.

Fig. 5. Asia inflation appears contained

Source: LSEG Datastream. May 2025.

Moderate inflation gives Asian central banks room to maneuver. In 2025 to date, central banks in India, Indonesia, Korea, Singapore, China, Philippines and Thailand have already cut rates or eased. More easing is expected going forward. This policy flexibility supports bond prices and provides a stable environment for income-seeking investors.

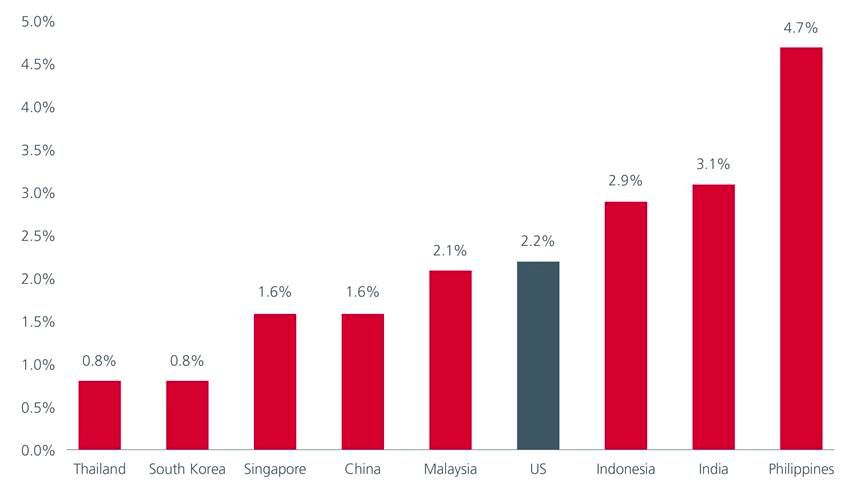

With inflation under control and nominal yields still elevated, real yields in Asia are among the most attractive globally. For example, real yields in Indonesia, India and Philippines are currently higher than the US’. Fig. 6.

Fig. 6. Asia vs US real yields

Source: Bloomberg. May 2025. Inflation data as of latest available. Yields may be an estimation in some instances, as some local currency bonds have wide bid-asks.

This yield advantage is not just a function of policy rates. It reflects deeper structural strengths such as prudent fiscal management, improving credit fundamentals, and growing domestic investor bases.

Besides tailwinds from potential rate cuts, many of the markets also enjoy idiosyncratic drivers such as strong domestic demand in Indonesia, Malaysia, India, South Korea and China. Meanwhile, Singapore, one of the few remaining AAA-rated government bond markets in the world, enjoys a safe haven status given its low volatility and high credit rating.

A timely opportunity

Asia local currency bonds offer a rare combination of yield, stability, and diversification. As the global economic order evolves, these assets can play a key role in global bond portfolios. With the US dollar under pressure, inflation subdued across Asia, and high real yields, now may be the time for investors to take a closer look at what Asia’s local bond markets have to offer. In markets like Indonesia and Malaysia to a lesser extent, steep yield curves offer opportunities for duration plays, especially ahead of anticipated rate cuts. In the near term, market volatility—driven by trade tensions, geopolitical risks, and uncertain US trade policy—may create entry points for nimble active investors.

Access expert analysis to help you stay ahead of markets.

Sources:

1 Markit iBoxx ALBI (USD unhedged).

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).