Executive Summary

- Transition leaders are strategic additions in a forward-looking portfolio, as they not only advance global climate goals, but also unlock long-term value for investors.

- Companies leading the climate transition capture transition revenue opportunities and are also committed to carbon reduction in a manner practical to their operations. They include companies that develop climate mitigation solutions as well as those that enable climate adaptation.

- In trying to identify transition leaders, it is key to guard against transition washing. It is also important to be mindful of any potential unconscious bias against Emerging Markets and certain high emissions sectors.

This is the last of our 3-part series on Just transition – the process of shifting to a more sustainable economy in a way that is fair and inclusive. In our first article, we made the case that tapping into companies early in their transition journey can be extremely rewarding for investors. In our second article, we demonstrated how active sustainability-themed engagement can drive corporate changes, or result in enhanced due diligence that can ultimately lead to enhanced long-term financial performance and value creation. In this article, we share how investors can spot future climate transition leaders, amid the rapidly evolving landscape of climate policies and technologies, and lack of standardised reporting.

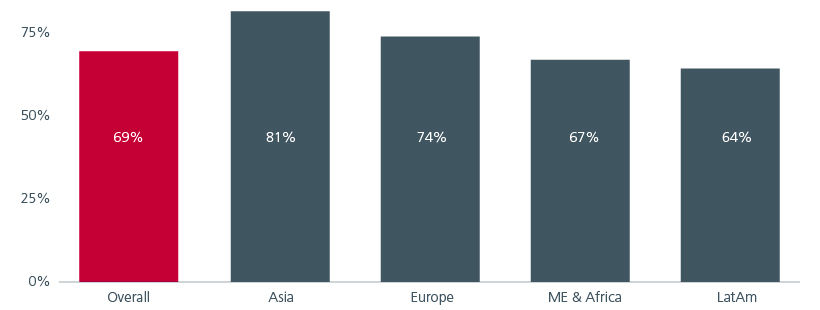

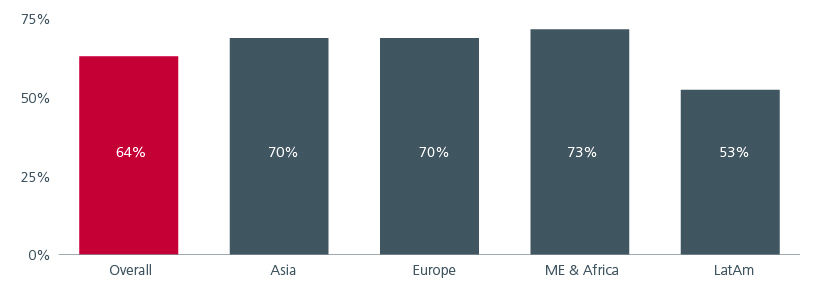

Besides helping to advance climate action, climate transition leaders also enjoy other business benefits. In a recent survey of Emerging Market (EM) companies, 69% of the companies surveyed felt that sustainability enhanced their core business, with Asian companies scoring highest at 81%. See Fig. 1. Meanwhile, 64% viewed sustainability as an opportunity to show industry leadership, including enhanced reputation and credibility. Fig. 2. Hence, adding transition leaders in investment portfolios can potentially improve return outcomes over the long term.

Fig. 1. % of respondents who feel that sustainability enhances core business activities

Source: BofA Global Research. EM issuer sustainability survey: results. June 2025.

Fig. 2. % of respondents who believe that sustainability helps enhance industry leadership

Source: BofA Global Research. EM issuer sustainability survey: results. June 2025.

The marks of a leader

What defines a climate transition leader? Is it a company that excels at capturing transition revenue opportunities (doing more good) or one that strongly demonstrates a genuine commitment to reducing its carbon emissions (doing less bad)? Should the focus be on companies that develop climate mitigation solutions (such as clean energy and carbon capture) or those that enable climate adaptation (like water management and resilient infrastructure)? We believe that the answer should be “all of the above”, with certain tilts making more sense for companies in their respective sectors and markets of operations. Context-specificity is required to potentially spot growth that takes advantage of solving for market opportunities and deliver product-impact in a climate changed world

The challenge for investors is to identify these companies in a systematic manner that balances scale/ coverage and uniformity-of-approach. This is even more difficult in EMs given the different climate taxonomies across the region, the varying stages of economic and industry development, as well as the differences in the quantity and quality of data available.

In trying to identify transition leaders, it is key to guard against transition washing – where claims, acts or omissions give the impression that a company is transitioning to a more sustainable operating model than it actually is. It is also equally important to be mindful of any potential unconscious bias against EMs and certain high emissions sectors by over emphasizing public and/or certified net zero pledges as these commitments can be affected by data availability, different stages of disclosure maturity and/or consideration of each country’s Nationally Determined Contribution (NDC). While we do consider the progress made on these fronts, we encourage an open approach that considers business-cycle variations across the investment cycles. In other words, these parameters should not be taken as a limiting factor upfront but should be considered in the context of how they evolve in parallel with concrete actions, macro-changes and cashflow management for climate transition at the business-level over time.

Screening for winners

In September 2024, Eastspring Investments and Prudential launched the Eastspring-Prudential Framework for Climate Transition Investing, endorsed by the Climate Bonds Initiative1. The framework guides asset owners in navigating investments in climate transition.

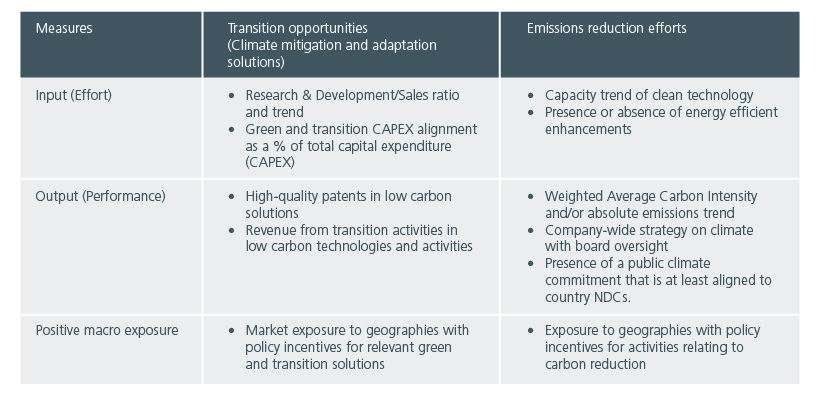

We believe that investors can evaluate companies’ efforts by measuring effort, performance and positive macro exposure across transition opportunities and emission reduction efforts. Fig. 3. Our framework includes companies that are involved in climate mitigation and adaptation solutions as climate-induced reductions in quality of life are almost guaranteed to happen2. Therefore, adaptation solutions are essential in encompassing the social element in a climate transition, and present real investable opportunities.

When evaluating transition opportunities, our framework assesses a company’s entire product development and sales cycle by looking at indicators such as patents, green and transition capital expenditure (CAPEX) as well as green revenue activity. While high quality patents can be a proxy for future transition business growth, the measure carries risks as a singular screen, as not all patents will become commercial products. Meanwhile focusing only on revenue is less forward-looking. On the other hand, focusing only on Green CAPEX may sideline sectors where maintenance CAPEX, instead of growth CAPEX, is needed for energy efficiency upgrades. We therefore try and evaluate businesses holistically along their value chain.

Fig. 3. Assessing companies’ transition activities

Source: Framework for investing in climate transition in the capital markets. With a case study: Eastspring Just Transition Portfolio. September 2024.

Proprietary inputs from external ESG and market data providers as well as internal metrics are used to assign scores to companies based on the above components. These quantitative scores help to differentiate the transition progress for each company, focusing on the incremental changes going forward. This screening helps to achieve a more concentrated universe of investable opportunities.

A strategic addition

Companies at the forefront of the sustainability transition not only contribute to global climate goals, but also unlock long-term value, making them strategic additions in a forward-looking portfolio.

The recent escalation in geopolitical tensions and strategic rivalries have dampened climate finance flows, particularly affecting mitigation efforts in EMs3. Against this backdrop, investor influence becomes even more critical. In the survey mentioned earlier, 62% of EM companies surveyed cited investor demand as a key driver of their sustainability efforts. This highlights the pivotal role asset owners and investors can play—not just in identifying transition leaders, but in actively shaping the climate transition. By directing capital toward companies demonstrating credible and impactful climate strategies, investors can accelerate the shift to a low-carbon economy while potentially enjoying superior outcomes over the long term.

Sources:

1 CBI is a leading international non-governmental organisation mobilising and setting standards for global capital for climate action.

2 The Intergovernmental Panel on Climate Change’s 6th Assessment Report states that a 1.50C future might be very difficult to reach without immediate and drastic decarbonisation.

3 Institute of International Finance. The high stakes of delaying climate action in EMDEs.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).