Summary

While the Fed’s rate cut at its September meeting was widely anticipated, its dovish guidance surprised. The resumption of Fed rate cuts despite an outlook for higher US inflation should weaken the USD and push most Asian currencies stronger, stimulating foreign investment flows into the region.

The US Federal Reserve (Fed) cut the Fed Funds rate 25bps to 4.00% - 4.25% and continued its balance sheet runoff, as expected. However, it surprised by increasing guidance for future cuts in this cycle by 25bps. We expect the Fed to cut 25bps at its October and December meetings. The extent to which the Fed cuts in 2026 will depend on how much weakness emerges in the US labour market, but our base case is for 50bps – 75bps of further cuts next year.

To be sure, the quarterly “dot plot” of FOMC participant forecasts now suggests two more cuts by the end of this year and a Fed Funds rate of 3.38% by end-2026 (a range of 3.25% - 3.50%). President Trump’s new appointee to a Fed Governorship, Steven Miran voted for a 50bps cut at the meeting although Chairman Powell said during the post-meeting press conference that 50bps was not widely considered at the meeting.

Chairman Powell’s most notable comment for us was his statement that the Fed does not want any further weakness in the US labour market. We think this reveals a clear willingness to live with inflation of close to 3% in order to try to keep the US unemployment rate below 4.5%, a level that is historically still very low.

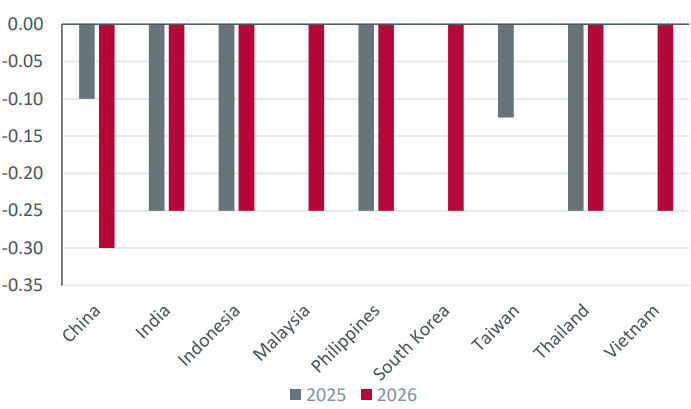

One key implication of the resumption of the Fed’s cutting cycle is that it should create room for further policy rate cuts from Asian central banks. Bank Indonesia anticipated the Fed cut with a surprise 25bps rate cut of its own yesterday. Rate cuts in Asia should increasingly stimulate Asian domestic demand growth, offsetting some of the likely weakness in export growth over the next couple of quarters.

Fig. Forecasts for Asian policy rate changes %

Source: Eastspring Investments. September 2025.

We also continue to think the resumption of Fed interest rate cuts despite an outlook for higher US inflation will weaken the USD. We expect another 2% - 3% of USD depreciation vs. the major currencies. This should push most Asian currencies stronger against the dollar, stimulating foreign investment flows into the region.

Surprise strength in the US labour market is the main risk we see to our outlook. If US employment growth rebounds in the coming months and the unemployment rate does not rise, markets would need to reduce pricing for Fed rate cuts, reducing the incentive for USD depreciation.

Investment Implications

Multi Asset

Our Multi-Asset Portfolio Solutions team had anticipated slowing US growth momentum and a cooling labour market since early April, hence maintaining a positive stance on US duration (US bonds) to reflect this view. Since Liberation Day, markets have been concerned about tariff-induced inflation and the US fiscal position, which had kept US yields elevated until recently.

As recession risks and inflation concerns lingered, the team had complemented the long US duration position with a long position in inflation-linked US Treasuries (i.e. TIPS) to allow portfolios to benefit from a narrowing in US real yields should the tariff-led inflation be greater than anticipated. However given the recent labour market weakness, the team now sees the risk reward trade-off on US Treasuries as less compelling. The team continues to view risk assets - such as US equities and credit - as richly valued with limited safety margins. While a US recession is not expected and Fed easing should support the US economy, growth could still slow more than anticipated.

With yields expected to decline and the US dollar likely to weaken further, global investors are increasingly seeking diversification (beyond US assets), income and resilience. In this environment, Emerging Markets (EM), Asia, and markets with more attractive valuations are well-positioned to capture these investment flows. The team has recently turned more constructive on EM/Asian equities.

Fixed Income

Our Asia Fixed Income team remains highly agile in the volatile environment and are on the look-out for opportunities to add duration on dips. Strong liquidity conditions suggest that any market corrections are likely to be short-lived and should present rebalancing and new investment opportunities.

With historically tight credit spreads, credit selection will be key to navigating the markets. Asian corporate fundamentals remain relatively healthy although some companies may experience weaker margins given slowing growth. Although default rates in Asia are likely to stay low, we prefer to stay defensively positioned within investment grade credits. Given investors’ hunt for yield, we would view any spread widening as an opportunity to re-engage. Further potential USD weakness could benefit emerging and Asian currencies, and drive diversification flows into non-USD bond markets.

Yields of Asia local currency bonds have rallied over the last three months, yet selective opportunities remain from a USD-hedged perspective, driven by the pickup in carry and low bond issuance. We see opportunities in Indian government bonds as valuations have become more attractive, and the rupee has cheapened. However, greater clarity on India’s trade-related headwinds would be needed before adding exposures. Philippines government bonds offer interesting opportunities given its high yield, supportive macros and the central bank’s easing bias. Meanwhile, Malaysia government bonds offer low volatility and compare favourably against the other low yielding sovereigns. Security selection is key given the idiosyncratic risks across the region.

Singapore dollar (SGD) bonds should continue to be supported by the still-resilient Singapore economy and benign inflation. With fiscal discipline under increasing pressure in various parts of Asia as well as in the developed markets, Singapore’s robust fiscal framework has reinforced the appeal of SGD-denominated bonds, helping the Singapore bond market deliver strong returns to date. Moderate issuance and positive technicals are likely to continue to underpin SGD corporate bonds. The valuations of SGD credits and selected statutory board bonds appear relatively more attractive, having lagged the rally in Singapore government bonds.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).