Investors who understand the reasons behind market volatility, can take advantage of the arising investment opportunities.

Myth 1

Volatility is bad

Fact

It's a natural part of the market landscape

Volatility is a fundamental part of the market. Post the Global Financial Crisis, however, asset purchases by developed market central banks have kept market volatility abnormally low. This phenomenon may or may not continue.

Extended periods of low volatility can make investors complacent and take on too much risk to achieve one's financial goals.

Myth 2

Don’t invest when markets are volatile

Fact

It can be a time of opportunities, too

When markets dip, fear causes stocks to be oversold, creating opportunities for investors.

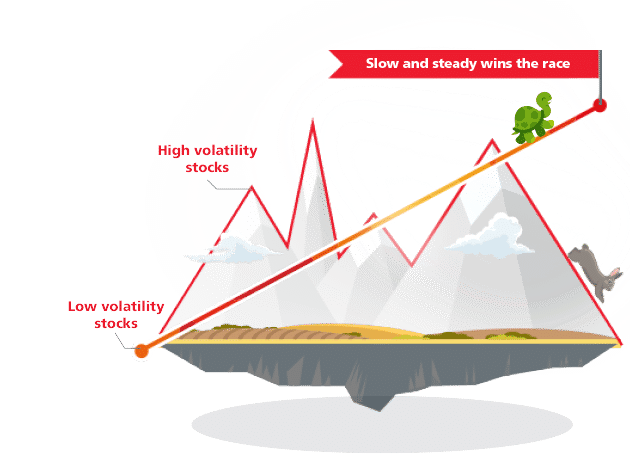

Myth 3

Low volatility stocks = low returns

Fact

They outperform high volatility stocks in the long run

Academic research as early as 1967 shows that low volatility stocks outperform high volatility stocks over the long term. This anomaly is seen across multiple regions and countries.

Having well-defined financial goals can help investors ride through choppy markets and stay the course during turbulent times.