Summary

The Chinese government set a GDP growth target of around 5% at the recent National People’s Congress. We expect China’s economic recovery to take place in three stages and see further upside for the China A-share market as the recovery supports earnings growth and investors shift from beta seeking to alpha generation.

How has the re-opening impacted the Chinese economy to date?

Consumer spending was strong through the Chinese New Year and the latest data show that the 18-city subway passenger traffic (7-day moving average) has reached 115% of 2019’s level. Restaurant revenue and movie ticket sales have also exceeded 2019’s levels. Credit demand, as measured by M2 and corporate loans, has shown signs of improvement. Meanwhile, both China’s manufacturing and non-manufacturing Purchasing Managers’ Indices (PMI) returned to above 50 in January and improved further in February, signalling a relatively broad-based recovery.

We see China’s economic recovery unfold in three stages. In stage 1, the demand for services should rise as mobility normalises but still-weak employment and lacklustre household income may cap demand. Policy support will play a key role in the next stage of the recovery. For the first time in four years, we expect China’s covid management, economic and regulatory policies to be aligned to revive economic growth. For the recovery to be sustained in stage 2, corporates must feel confident enough to increase spending and production. Earnings may pick up as the de-stocking cycle ends, potentially in the second half of the year.

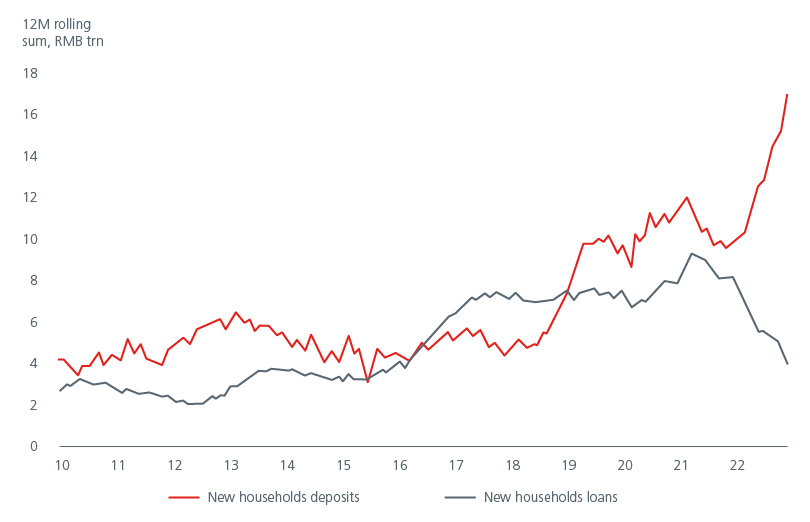

In the final stage of the recovery, following the improvement in corporate earnings and household income, excess household savings is expected to boost consumption. Household deposits have surged on the back of weak spending in 2022, as well as lower home purchases and financial investments. See Fig. 1. For consumption to rebound strongly in 2023, consumer confidence and the labour market would need to improve.

Fig. 1. Households have been accumulating deposits while mortgages have fallen

Source: JP Morgan. Eastspring Investments. As of January 2023.

What were the key takeaways from the National People’s Congress (NPC)?

The main objectives set out in the Government Work Report at the NPC meeting were at the lower range of market expectations with the GDP growth target set around 5% and the budget deficit at 3% of GDP. There was some disappointment in the market that the government did not announce a big stimulus, especially for the property market. That said, we note that property sales have been quite resilient year to date and the government’s overall tone appears supportive for the sector – with a focus on minimising systemic risks for leading property developers and reducing the interest burden for local governments. The government appears comfortable with the current pace of recovery and is unlikely to roll out massive stimulus as long as the recovery is sustainable and there are no systemic risks. We believe that the policy directives continue to support our stance of seeking opportunities in strategic sectors such as high-end manufacturing, new energy, consumer and medical services.

Has or will China’s re-opening lift inflation?

China’s CPI inflation was 1.0% in February, rising at the slowest pace since February 2022. Relatively muted inflationary pressures in China to date have given the central bank room to keep interest rates low, in contrast to the rest of the developed and emerging economies. With pork prices peaking and still weak domestic demand, inflation is likely to remain moderate in the first half of 2023. As such, the People’s Bank of China would probably maintain an easing bias until domestic demand and credit growth rebound more materially. The risk however is that domestic inflation accelerates on the back of a stronger than expected recovery in demand.

As China consumes almost one fifth of the world’s oil, over half of the world’s refined copper, nickel, zinc and more than three fifths of its iron ore, the impact of China’s re-opening on commodity prices bears monitoring. That said, the current recovery is consumption-led, unlike previous recoveries which were concentrated in infrastructure and fixed investments. So, the impact on commodity prices may be more muted. At the same time, the deceleration in the developed economies should weigh on commodity demand and provide some offset.

What does China’s re-opening mean for the rest of Asia?

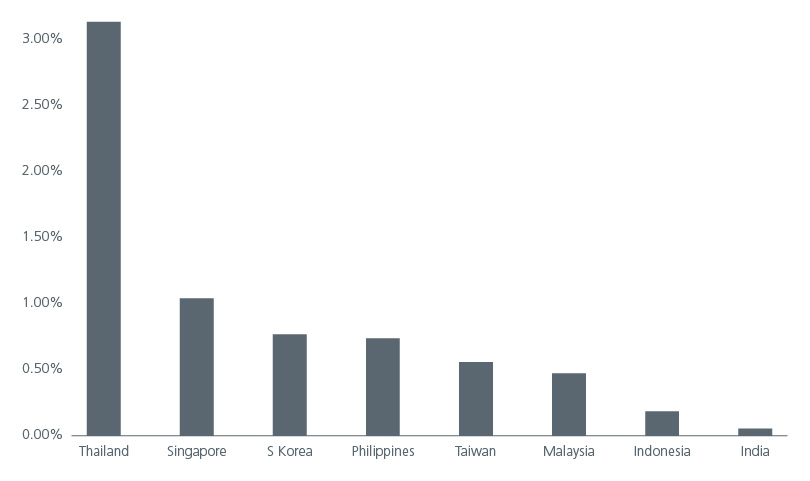

Besides impacting commodity prices, China will affect Asia via the tourism and trade channels. Asia is one of the key destinations for Chinese outbound travel and should enjoy tailwinds as Chinese tourists return. Based on 2019 data, Thailand, Singapore and Korea had enjoyed the greatest amount of Chinese tourist spend (as a percentage of GDP) within Asia. See Fig.2.

Fig. 2. Chinese tourist spend as % of GDP (2019)

Source: WTTC, HSBC. February 2023.

Asian exports should also benefit from China’s recovery. Historically, within Asia, Taiwan, South Korea and Malaysia have accounted for the highest value add in consumer goods supply to China (as a percentage of GDP). However, with consumption likely to be biased towards the pent-up demand for services (such as domestic and cross-border travel, dining in etc) rather than goods, the uplift to Asian exports may be more moderate.

The China A-share market has rallied 12% since November, following optimism of China’s re-opening. Is there more upside for the market?

We believe that there is further upside for the China A-share market. Compared to the China offshore market, China A-shares’ higher correlation to China’s macro policies and higher representation of local champions (“little giants”), suggest that the market should benefit to a greater extent from the government’s supportive policies.

The market’s initial rally was led by investors’ desire for greater beta exposure and had largely benefitted benchmark and large capitalisation stocks. Inflows had also focused on re-opening plays such as the consumer-related stocks. As confidence over China’s recovery increases, we expect to see inflows seeking alpha opportunities and focusing on sectors which in line with the government’s strategic priorities. These would include the Electric Vehicle (EV) and EV supply chain, renewables, healthcare, and advanced manufacturing industries.

Easing regulatory crackdown on the internet platforms may also help boost investor sentiment. The sector’s recent news flow has been positive – China’s central leadership has reportedly given an initial nod to restart Ant’s listing plans in Shanghai and Hong Kong. Didi, China’s ride hailing giant, has also been allowed to register new users after a one-and-a-half-year hiatus. In addition, regulators handed out 88 video games licenses in January. The recent shift in the government’s stance acknowledges the internet platforms’ importance in creating employment and lifting consumer confidence.

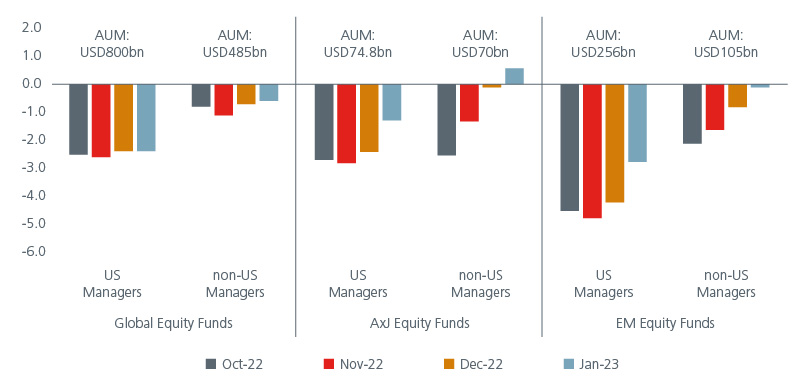

With offshore investors still mostly underweight China in their portfolios (See Fig. 3.), there is upside for the A-share market as portfolio exposures rise. We believe that there are ample stock picking opportunities for active investors going forward as portfolio managers have not had the opportunity to visit and conduct due diligence on new companies in the last three years – just in 2022 alone, the A-share market raised a record USD84 bn in new listings from 428 IPOs. Although the China A-share market is no longer as cheap as it was at the end of 2022, China’s economic recovery should support earnings growth going forward.

Fig. 3. Active weights of China/HK equities (%)

Source: MorningStar, FactSet, EPFR, Morgan Stanley Research; notes: the fund universe of each category is formed by the largest 30 active mutual funds under MorningStar regional category. We exclude ESG funds, income funds and systematic funds. All the covered funds are benchmarking to either MSCI or FTSE standard regional indices of All Country World, Asia ex-Japan, or Emerging Markets. February 2023.

Is China’s property slump over?

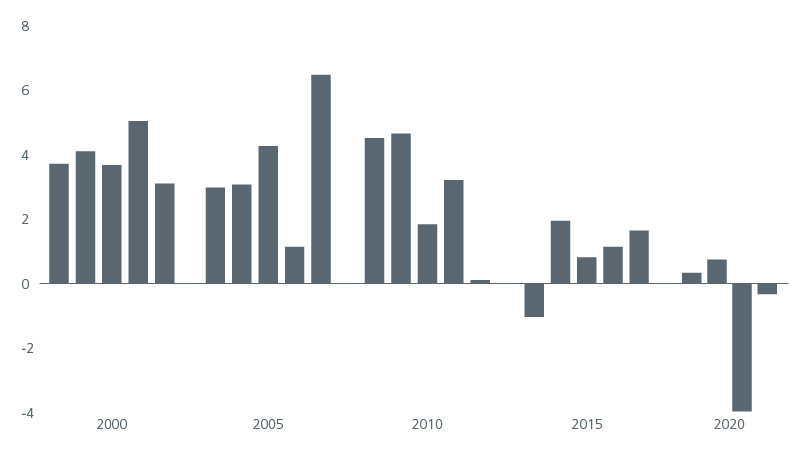

Since November 2022, the central government has rolled out a series of policies to improve the liquidity position of property developers and stabilise the property sector. Policy support has continued in the new year. Locally, cities have cut first home mortgage rates, lowered down payments and extended home subsidies. Since the start of the year, a number of developers has selectively replenished their landbanks, suggesting improving liquidity positions. Furthermore, the ability of property developer Dalian Wanda to successfully tap the offshore bond market twice in 2023 is also a sign that confidence is slowly returning, although investors remain highly selective. In addition, recent sales data showed a notable pick up especially in the secondary housing market, pointing to better home buyer sentiment as well. It will take time for the recovery in the secondary market to fully feed through into new home sales, but we expect the overall property market to stabilise and see some turnaround no later than in the second half of 2023. On balance, the sector should be less of a drag to growth in 2023 compared to 2022. Fig. 4.

Fig. 4. Growth contribution to GDP of the property sector (%)

Source: UBS. February 2023.

What are some of the key risks that investors need to be mindful of?

Besides keeping an eye on inflation, the nascent stabilisation of the property sector also bears monitoring as access to financing remains key. Active management and hedging strategies can help mitigate these risks.

The state of US-China relations will also continue to be an important consideration for investors. The US technology sanctions and especially chip embargos potentially hurt China’s production and export of technology products. However, as US-China tensions accelerate import substitution, there is room for local champions to emerge in the software, semiconductors, industrial automation, and medical devices sectors, potentially creating attractive opportunities for investors.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).