Both Shariah and ESG investing are not new concepts and need no introduction. Both seek to promote responsible behaviour and as such have overlapping principles. This has led to their natural pairing and triggered a growing demand for Shariah ESG solutions in Malaysia and around the globe; Malaysia launched its Shariah ESG index, the FTSE 4Good Bursa Malaysia Shariah Index, in 2021 while Nasdaq saw its first listing of Shariah-compliant and ESG-aware exchange-traded fund in early 2022.

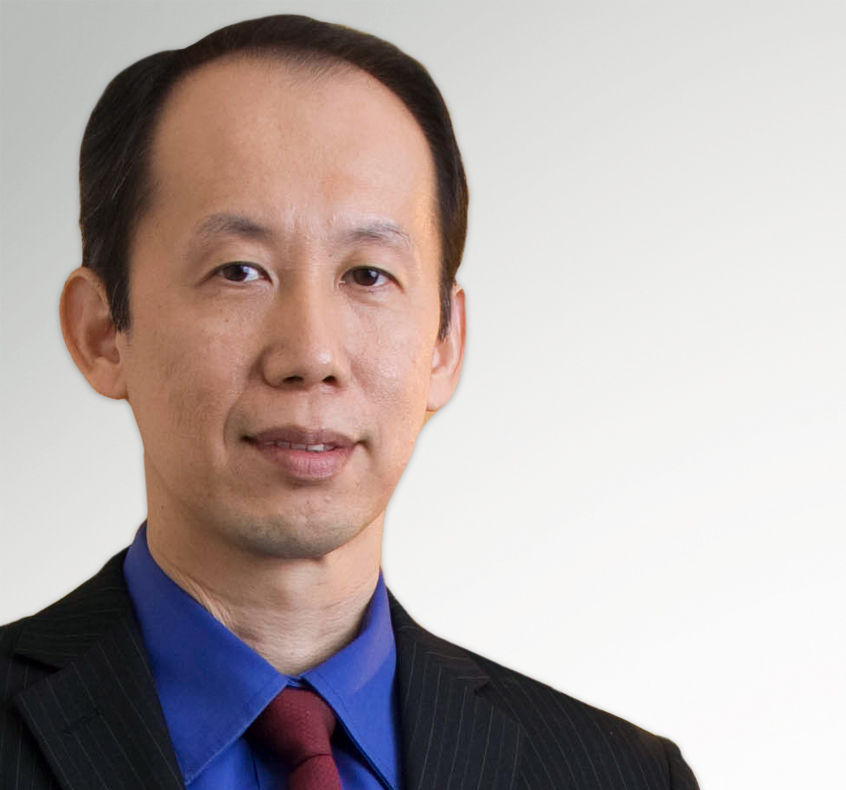

While the pairing of ESG and Shariah in the equity space gets more news headlines, it is worth noting that fixed income Shariah investments are also showing signs of this trend. In recent years there has been an uptick in environmental, social and governance (ESG)-related sukuk issuances. The sukuk market is important for ESG given that it has grown larger than the conventional bond market owing to the various incentives given by the Malaysian government to develop the market including preferential tax treatment for both issuers and investors.

Fig 1: Outstanding sukuks and conventional bonds

Growing demand for green sukuks

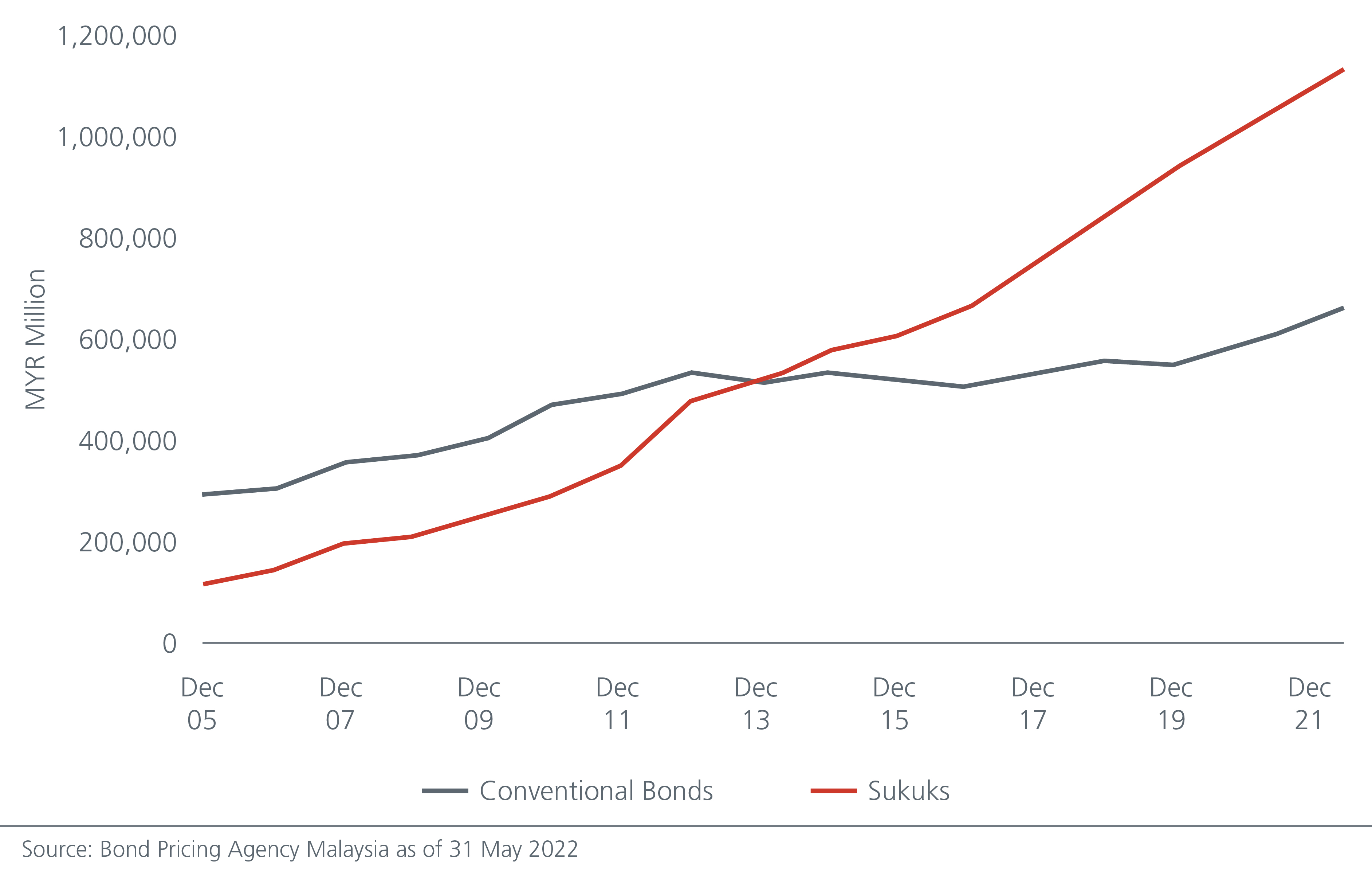

In the primary market, sustainable-sukuk issuances have gained traction. According to Ernst & Young Consulting, Malaysia leads in sustainable and responsible investing (SRI) sukuk issuance among the ASEAN6 countries, accounting for USD3.9 billion of issuance value or 56% of the total ASEAN SRI sukuk issuance, as of November 2021 on a CAGR of 278% between 2016 to 20201.

Notable issuances include the world’s first green SRI sukuk by a Malaysian company to finance the construction of large-scale solar photovoltaic power plants in 2017 and the world’s first sustainability sukuk by the Government of Malaysia in 2021. This maiden issuance via a special-purpose vehicle is in line with the government’s recently launched Sustainability Development Goals (SDGs) Sukuk Framework.

Fig. 2: ASEAN6 value of sustainable sukuk issuances, 2016-2021

Malaysia’s regulatory initiatives are supportive of Shariah ESG solutions

Two main statutory bodies i.e., Securities Commission Malaysia (SC) and Bank Negara Malaysia (BNM) have been entrusted to support the government’s push in sustainable investments.

In 2014, the SRI sukuk framework was launched by the SC to promote socially responsible investment and financing. The framework lays the foundation for a conducive and systematic ecosystem for both investors and companies that look to tap the market by aligning definitions and standards to United Nation’s Sustainable Development Goals, with emphasis on transparent reporting.2

In 2018, the SC established the SRI Sukuk and Bond Grant Scheme, which allows issuers to claim back up to 90% of the costs incurred on independent expert reviews of sustainable sukuk issuances under the SC’s SRI Sukuk Framework and bond issuances under the ASEAN Green, Social and Sustainability Bond Standards3.

In 2021, BNM introduced guidelines to help financial institutions categorise economic activities to meet climate objectives and promote the transition to a low-carbon economy. These guidelines complement the Value-based Intermediation Financing and Investment Impact Assessment Framework (VBIAF) Guidance Document issued by BNM in November 2019. The VBIAF is the foundation for ESG considerations in the financial sector, and whilst it is premised on Shariah tenets, its framework has universal application for financial institutions targeting to incorporate ESG measures in their operations.

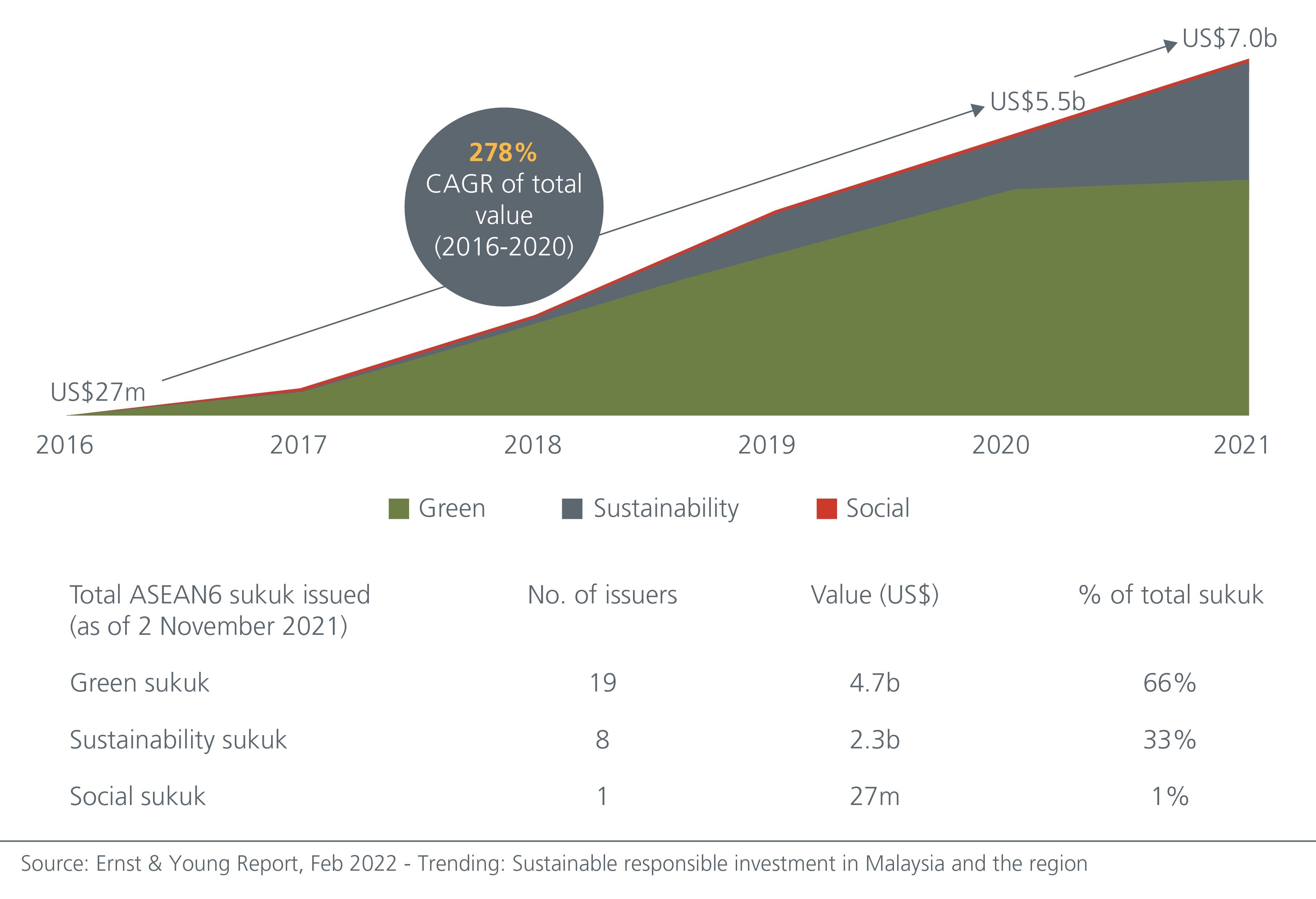

Fig 3: Shariah format has been the preferred mode for ESG issuances

Malaysia’s regulatory initiatives are supportive of Shariah ESG solutions

In our earlier article Do Well by Doing Good, we highlighted how Shariah and ESG combined delivered a better equity performance against the broader market and a standalone ESG index. Similar conclusions can be drawn for fixed income, in the Malaysian context at least.

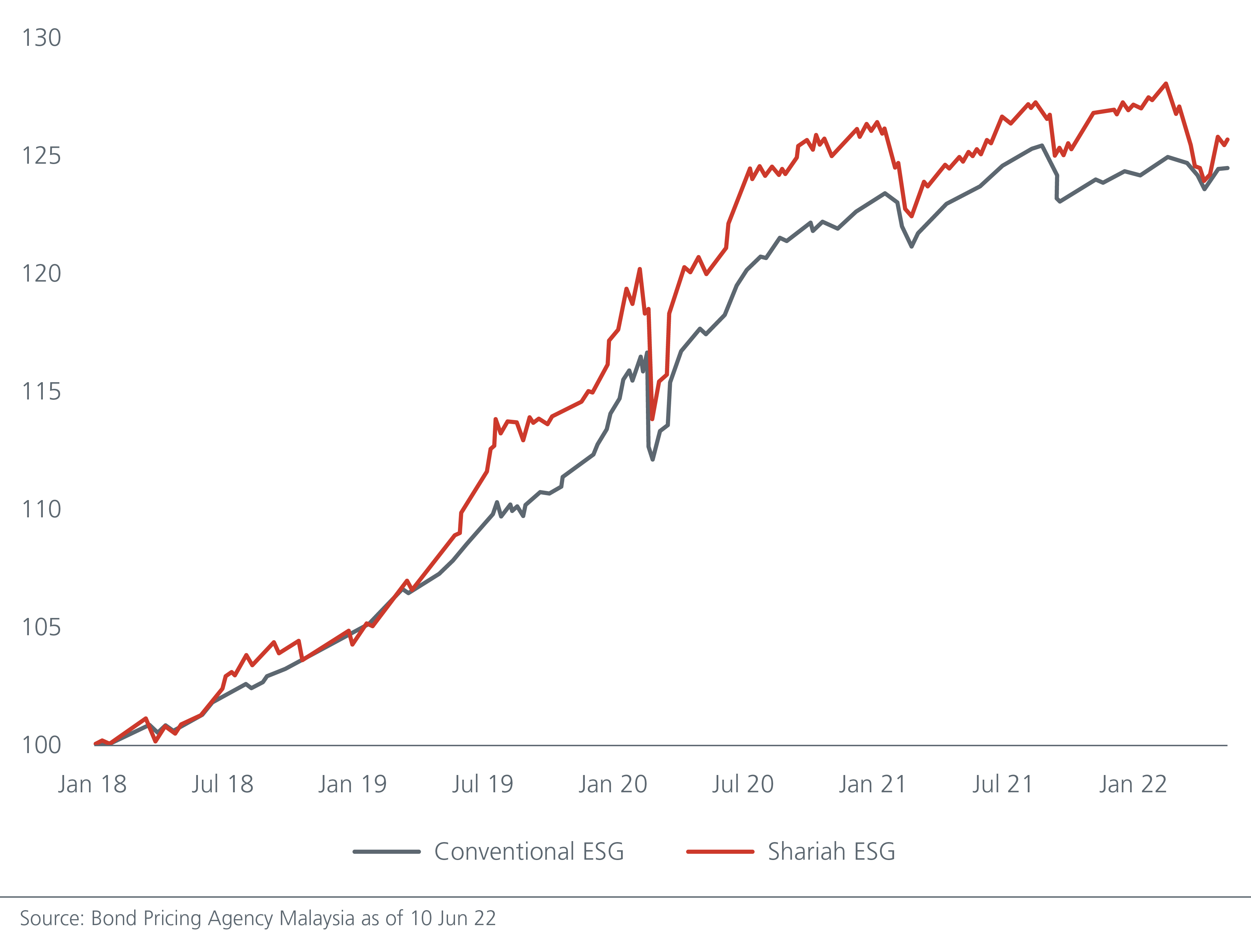

Fig 4 depicts the performance of BPAM ESG Index, broken down into its conventional and shariah components. Evidently, the Shariah ESG sub-index has outperformed its conventional counterpart ESG sub-index since inception. This goes to show that it is possible to be rewarded for doing good and this transcends beyond the equity space.

Fig 4: ESG sukuks leading ESG bonds in performance, 2018-2022

Delivering returns to you, the planet, and the next generation

We strive to uphold the philosophy of responsible stewardship which is inherently embedded within the Shariah principles. Instead of being seen as a competing force, we see ESG investment philosophy as complementary to Shariah investing by fine-tuning the approach for greater good, social justice and inclusive spirit in a more systematic manner.

We have seen and believe that we will continue to see quantifiable rewards for investors in the Shariah ESG space, both in equity and fixed income. While reaping the rewards today, we must also sow the foundation for our planet and the next generation’s better future.

Sources:

1

https://www.ey.com/en_my/news/2022-press-releases/01/malaysia-is-prime-issuer-of-sustainability-sukuk-in-asean-with-uss3-9-billion-of-total-issuance

2 Securities Commission Sustainable and Responsible Investment Sukuk Framework – An Overview

3 https://www.sc.com.my/resources/media/media-release/sri-sukuk-and-bond-grant-scheme-to-encourage-capital-market-fund-raising-for-sustainable-development

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing. Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.