Investing in Islamic China A shares – side stepping regulatory risks

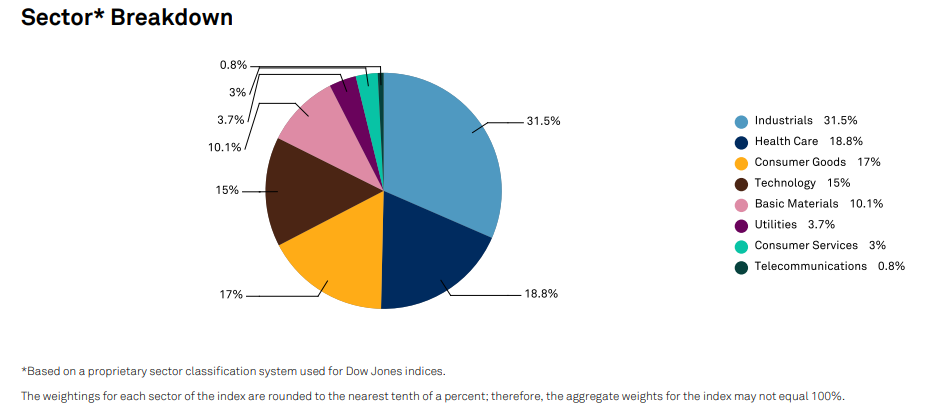

It is now a well-known fact that since Chinese regulators first pulled the plug on Alibaba’s IPO of Ant Financial in late 2020, investing in China has not been an easy ride with multiple rounds of regulatory crackdowns that involved various areas of the economy. Some sectors that were hardest hit were related to internet, education, property, and healthcare. China’s push for common prosperity has led to investors favouring new economy sectors such as renewables, electric vehicles, semiconductors and high-end industrial manufacturing that are more aligned to the government’s national objectives. A quick look at the constituents in Dow Jones Islamic A-share 100 index indicate that these are few sectors that are well represented.

Source: S&P Dow Jones Islamic Market China A 100 index fact sheet, as of February 28, 2022.

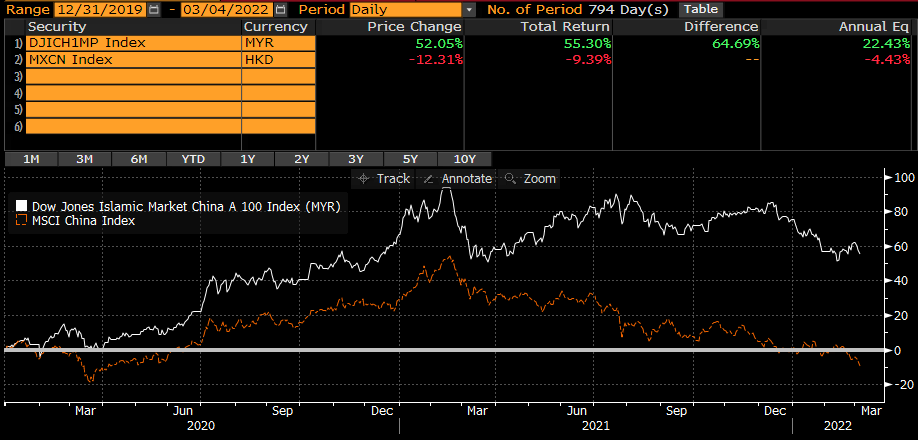

In contrast, there was little exposure to sectors that were under pressure from the regulatory crack such as those in the internet and property sectors. The simple reason for this was most Chinese internet companies are listed offshore either in Hong Kong or the United States, while most property companies do not meet the Shariah requirement of total debt divided by trailing 24 month market capitalisation of less than 33%1 . This has led to the onshore Islamic A-shares2 outperforming the conventional China market (as represented by MSCI China) as can be seen below:

1 This requirement is based on S&P Dow Jones Islamic Market Indices Methodology https://www.spglobal.com/spdji/en/documents/methodologies/methodology-dj-islamic-market-indices.pdf

2 Onshore Islamic A-shares are represented by the Dow Jones Islamic A-share 100 Index

Source: Bloomberg, 4 Mar 2022

This year, China markets have gotten off to a poor start on the back of worries over rising global interest rates as Global Central Banks led by the US Federal Reserve move to counter rising inflationary pressures. Geopolitical risk arising from the Russia-Ukraine conflict and the lingering Covid-19 pandemic adds to further concerns.

Amidst this rising back drop of volatility, investors could fare better by allocating into the A-shares market with an Islamic investing approach that weighs more heavily to sectors supported by national policies in China, where growth is more domestic focused. The Islamic A-shares market as represented by the Dow Jones Islamic Market China A 100 Index has vastly outperformed the conventional MSCI China Index in recent times and could continue to do so given continued market volatility

Source: Bloomberg , 4 March 2022

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing. Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.