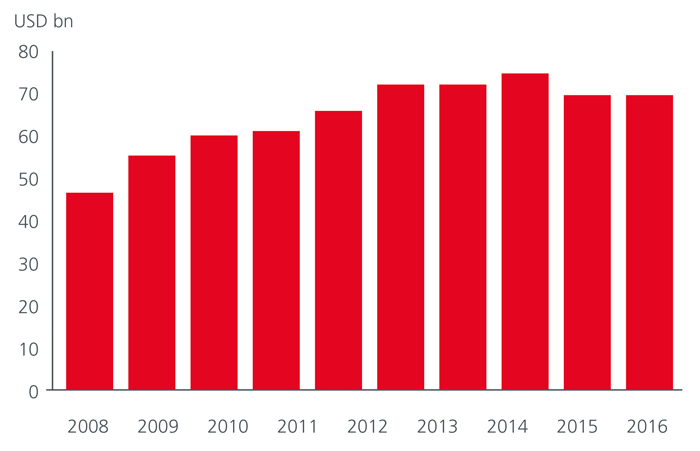

Shariah assets under management are forecast to reach USD77 billion by 2019 2. This growth trajectory is likely to maintain its momentum as wealth continues to accumulate; investment myths are overcome; strides are made in standardization; and increasing regulatory initiatives provide more transparency and comfort, while continued innovation in Shariah-compliant investment vehicles offer more choices for investors.

AUM GROWTH

The assets under mangement (AUM) of total global Islamic funds has grown significantly, registering a CAGR of 8.5% from 2004 to 2016. The total number of Shariah funds has also grown rapidly at 14% CAGR from just 285 in 2004 to an estimated 1220 currently3. Malaysia and Saudi Arabia continue to dominate in Shariah investments, where more than two-thirds of these funds are domiciled, whilst the rest are spread out across 35 other jurisdictions. The total size of Islamic AUM is only ever going to get larger as the inherent demand is overwhelmingly larger than the current size of total Islamic AUM indicates. As the supply side of the equation gets better together with enhanced regulatory structures, many pension and institutional funds will begin to embrace the principle more fully.

In Malaysia’s case, the country’s biggest private pension fund, the Employees’ Provident Fund (EPF), introduced its Simpanan Shariah (Shariah Savings) scheme in August 2016 to provide an option for members to convert their conventional EPF account to one that is invested in accordance with Shariah principles. The EPF expects to invest an average of RM25 billion in Shariah assets annually and to allocate a minimum of 45% of its funds to Shariah assets5.

At present, it is estimated that close to half of the USD7 trillion in global sovereign wealth funds belong to predominantly Muslim countries. Most of these funds may not yet have specific allocations for Shariah mandates but the coming years will likely see much higher allocations in Islamic assets. Demand for Shariah-compliant assets has never been higher.

DEMOGRAPHICS

One of the most powerful drivers of Islamic finance has been demographics. Muslims represent nearly a quarter of the world’s population but probably less than 5% of financial assets are Shariah-compliant. Income per capita of predominantly Muslim nations, outside of GCC countries, are still relatively low but are nevertheless growing at a strong rate. Although the historical heartland of Islam is the Middle East, the region only accounts for 20% of the global Muslim population. More than two–thirds of Muslims are in the Asia-Pacific region, predominantly in the Indian subcontinent and Southeast Asia, and the demographics there have impressive strong growth dynamics. On average, gross domestic product of the member countries of the Organisation of Islamic Cooperation (OIC) is estimated to grow at nearly twice the rate of the global average.

CHALLENGES

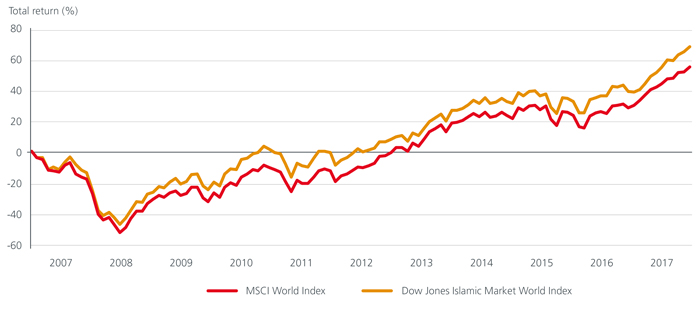

Shariah investing has come a long way since the early 1990s. One of the challenges of this investment principle has been the perceived lack of investment opportunities and financial assets as well as poorer fund performances compared to its conventional cousins. However, the global financial crisis of 2008/09, where sub-prime credit wreaked havoc in financial institutions, was like a coming of age for Shariah-compliant equity funds. The Dow Jones Islamic Market World Index is still hanging on to its outperformance over the MSCI World Index over a ten-year period (2007-2017). A significant contributor of outperformance is not just down to the absence of banks and financial institutions, but also the fact that screening procedures largely exclude highly leveraged companies. This represented a strategy that worked extremely well especially in a low growth environment.

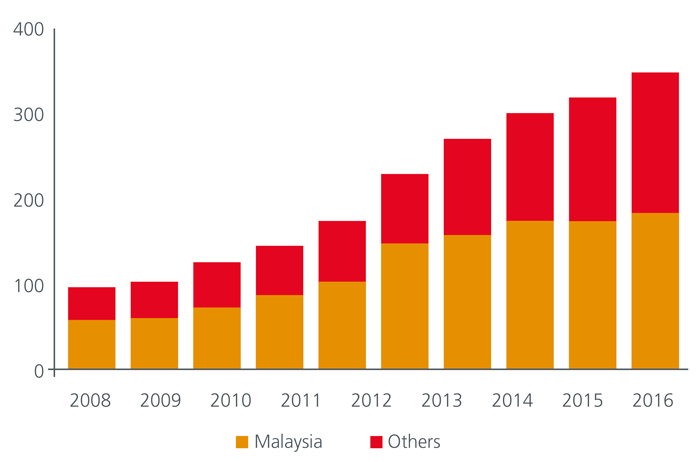

One of the other key challenges with Shariah investing is the availability of Shariah-compliant financial assets. On the supply side, the growth of the sukuk market has been an important factor in the overall growth of Islamic finance. The sukuk market has grown rapidly over the past 15 years, expanding at a CAGR of 20%. Total Malaysia-domiciled sukuk outstanding valued at USD174.4 billion makes up 54% of total global sukuk outstanding as at end 20157. Increasingly more corporates are contemplating issuing sukuk rather than conventional bonds as they can tap into the liquidity pool of Shariah funds and Islamic banks.

Other challenges include fees8 and governance. Shariah funds are currently more expensive to manage, requiring a board of Islamic scholars to perform an audit each year while also holding responsibility for supervision of the fund. Portfolio managers must screen investments carefully to ensure they are compliant, and ringfence and redirect any non-compliant income to charity.

MARKET DEVELOPMENT

Malaysia has always positioned itself as the leading global Islamic financial centre and the government has been supportive with initiatives led by the regulators. To enhance its value proposition as a global Islamic finance hub, the Securities Commission is advocating several key strategies such as tapping the synergies between Shariah investments and socially responsible investments, developing new products such as private equity, setting up multi-currency funds and promoting cross border transactions.

Continued product innovation, we believe, will be key to the development of the Islamic finance markets by adding depth to the availability of Shariah-compliant securities and products. One of the key developments to watch out for in this space will be initiatives such as that of Permodalan Nasional Berhad (PNB), the shareholder of Malaysia’s largest banking group, to carve out 20% of Maybank shares into Islamic or i-shares through a ring-fencing mechanism. If successful, this can access billions in value of a previously closed sector and truly widen the investment opportunities for Shariah funds.

Eastspring Investments Berhad and Eastspring Al-Wara’ Investments Berhad manage a total of USD1.64 billion in Shariah-compliant assets in Malaysia, including money market, bond, equity and multi asset funds, as well as an Islamic small cap fund.

Sources:

1 Shariah-Compliant Funds. Shariah-compliant funds are

investment funds which meet the requirements

of Shariah law and the principles articulated for “Islamic finance.

2 Thomson Reuters, Global Islamic Asset Management Outlook.

3 IFSB, Islamic Financial Services Industry Stability Report 2016.

4 IFSB Islamic Financial Services Industry Stability Report 2016.

5 5The Employees Provident Fund, 17 January 2017 statement release.

6 Bloomberg.

7 Securities Commission Malaysia, Islamic Fund And Wealth Management Blueprint.

7 https://www.ft.com/content/8dd627c8-01c9-11e4-ab5b-00144feab7de?mhq5j=e5.

7 Thomson Reuters, MIFC.

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing. Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.