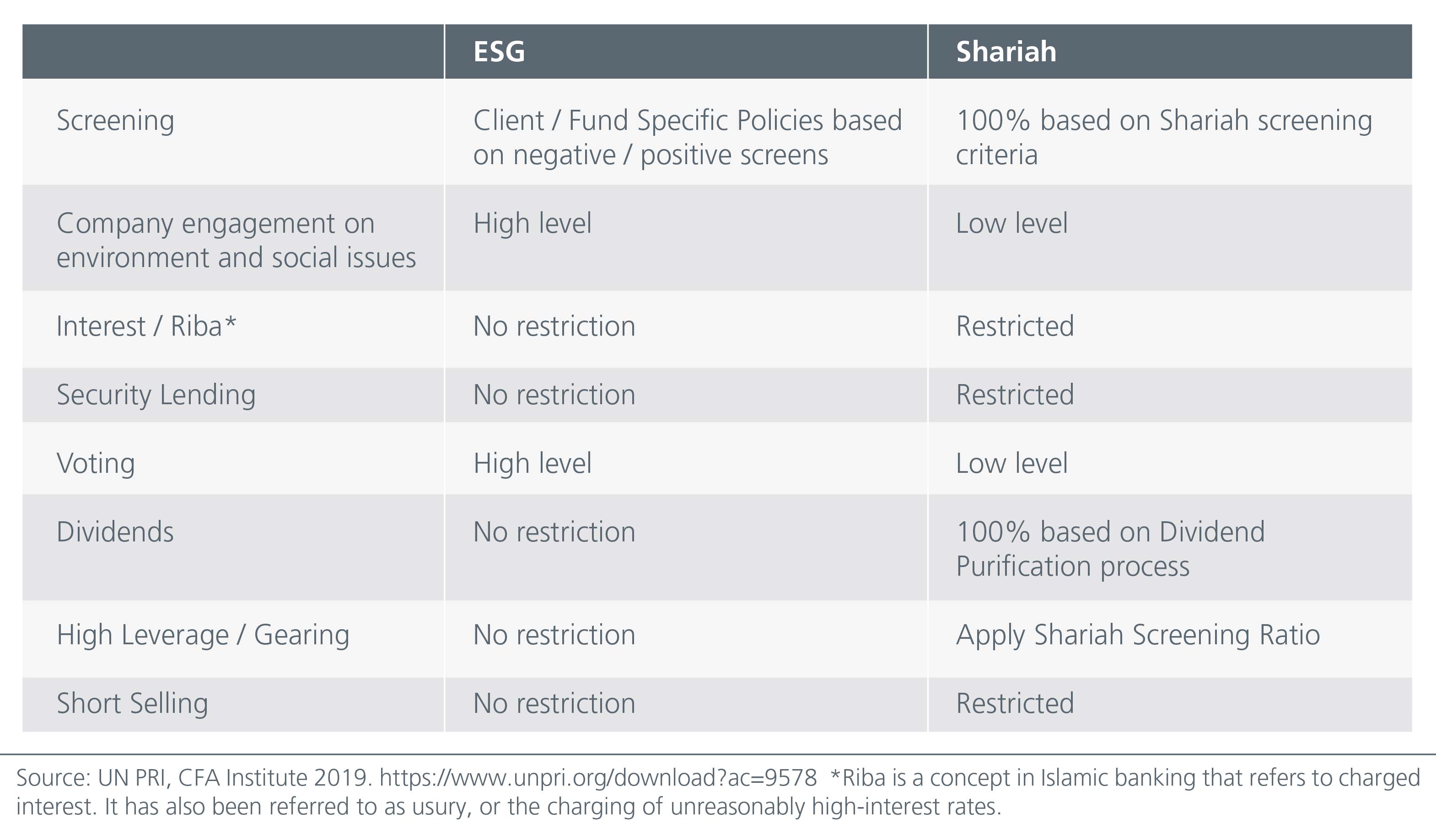

Shariah investing seeks to promote responsible behaviour by being good stewards of the society and environment. Shariah or Sharia is the religious law of Islam and the key principles of Shariah investing are a) the prohibition of interest bearing instruments, security lending and short selling and b) the use of negative screening to exclude high leverage companies, prohibited goods or services defined by rules of Shariah such as (industries involved in tobacco, alcohol, weapons and non-halal products).

ESG investing too seeks to promote responsible behaviour by integrating environment, social and governance factors to achieve sustainable outcomes. The ESG approach looks at more intricate issues to mitigate risks and enhance long-term returns and screening is one of the most widely used tools1. For example, a screen might be used to exclude the highest emitters of greenhouse gases from a portfolio (negative screening) or to target only the lowest emitters (positive screening).

The process of screening can be traced to faith-based approaches to avoiding, or divesting from, companies which were involved in activities seen as incompatible with a set of beliefs or values.

Fig 1: Comparison between ESG and Shariah investing

Malaysia’s growing ESG landscape

Demand to invest in funds which focus on ESG factors accelerated in 2020, driving assets under management up 29% in the fourth quarter of 2020 to nearly USD1.7 trillion according to industry tracker Morningstar. Inflows into sustainable funds also hit a record high during the fourth quarter, up 88% to USD152.3 billion, with Europe-domiciled funds accounting for almost 80% of the total inflows.

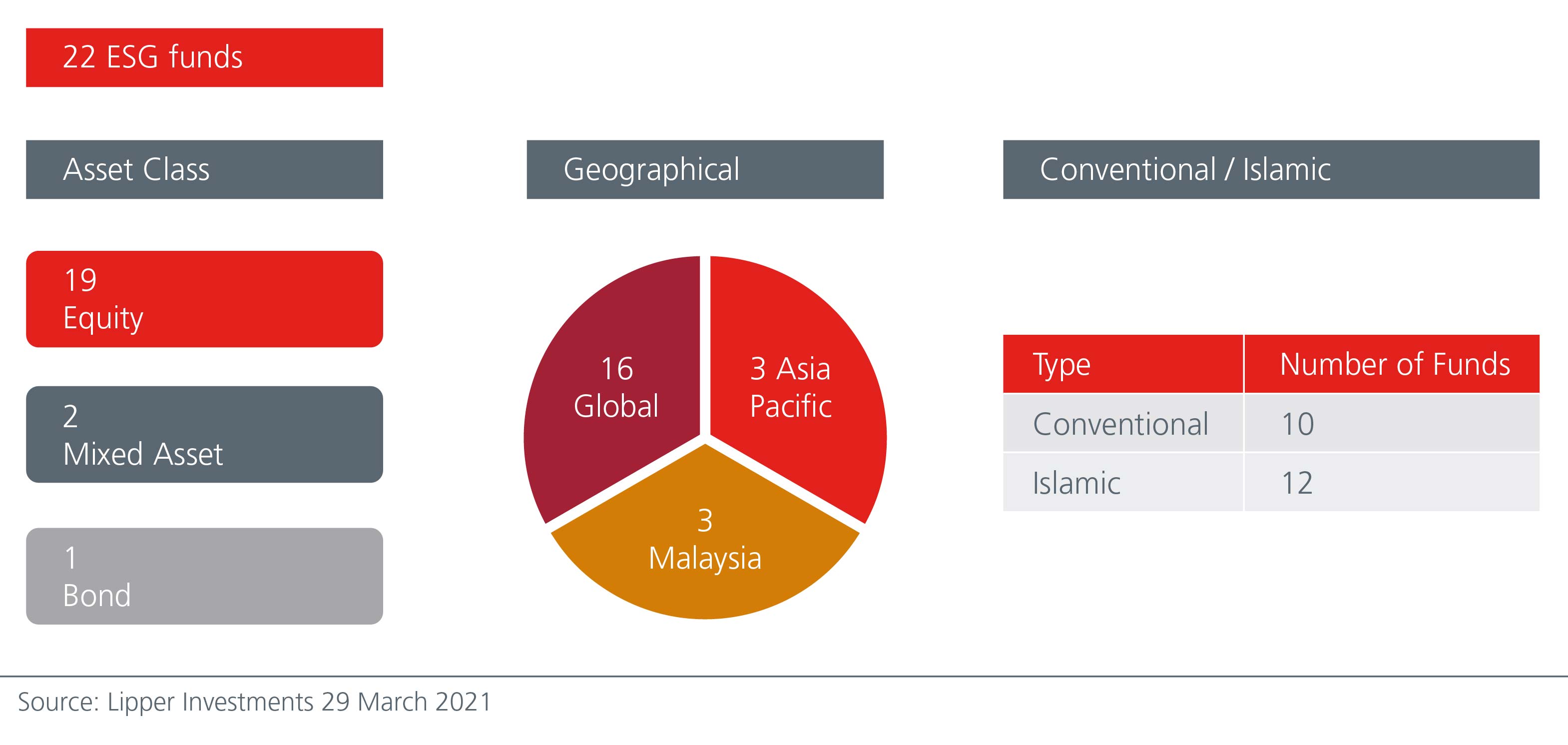

In Malaysia, there are currently a total 22 ESG funds with 12 Islamic funds focused on ESG.2 As at Dec 2020, Islamic ESG funds make up about RM2.1 billion or 1% of the total Shariah assets under management of RM216.8 billion in Malaysia.3 Going forward, the demand for Islamic ESG funds is expected to increase from both retail and institutional investors. Institutional investors such as the Employee Provident Fund have announced their commitment towards ESG best practices. The pension fund became a United Nations Principles for Responsible Investment (“UN PRI”) signatory in 2019.4

Fig 2: ESG funds in Malaysia

Should investors adopt a Shariah or ESG viewpoint?

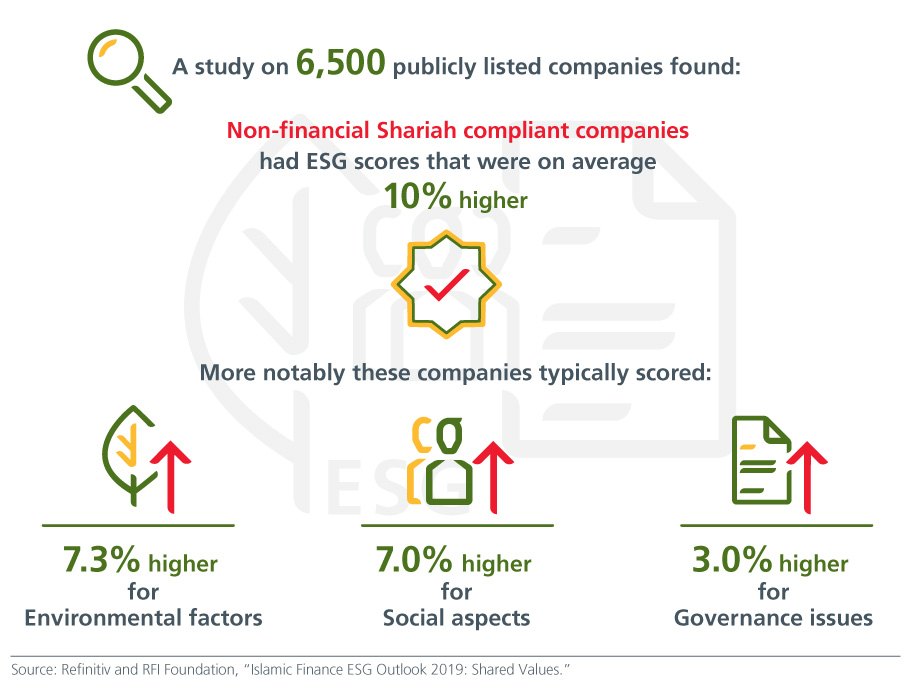

A study on ESG and Shariah investing covering 6,500 publicly listed companies found a direct correlation between Shariah compliance and higher ESG scores. Shariah-compliant companies had ESG scores that were on average 6% higher than those excluded by the Shariah screening process. For non-financial companies, the difference rose to 10%.5 Nevertheless, the often-asked question is whether an ESG or Shariah investing approach would compromise outcomes given a smaller investable universe which could result in more risk taking and lower returns.

Fig 3: Shariah-compliant companies had higher ESG scores

Another study that constructed portfolios based on the global equities’ universe of 2,500 stocks with both ESG and Shariah screens found that by applying the ESG screen, the ESG compliant universe decreased to 850 stocks, of which 50 -70 stocks were chosen to be in the ESG portfolio. Meanwhile the Shariah plus ESG screen portfolio had 30-50 stocks filtered from a smaller universe of 350 stocks. The outcome from this study found that both portfolios had broadly correlated performance over a 5-year period.6

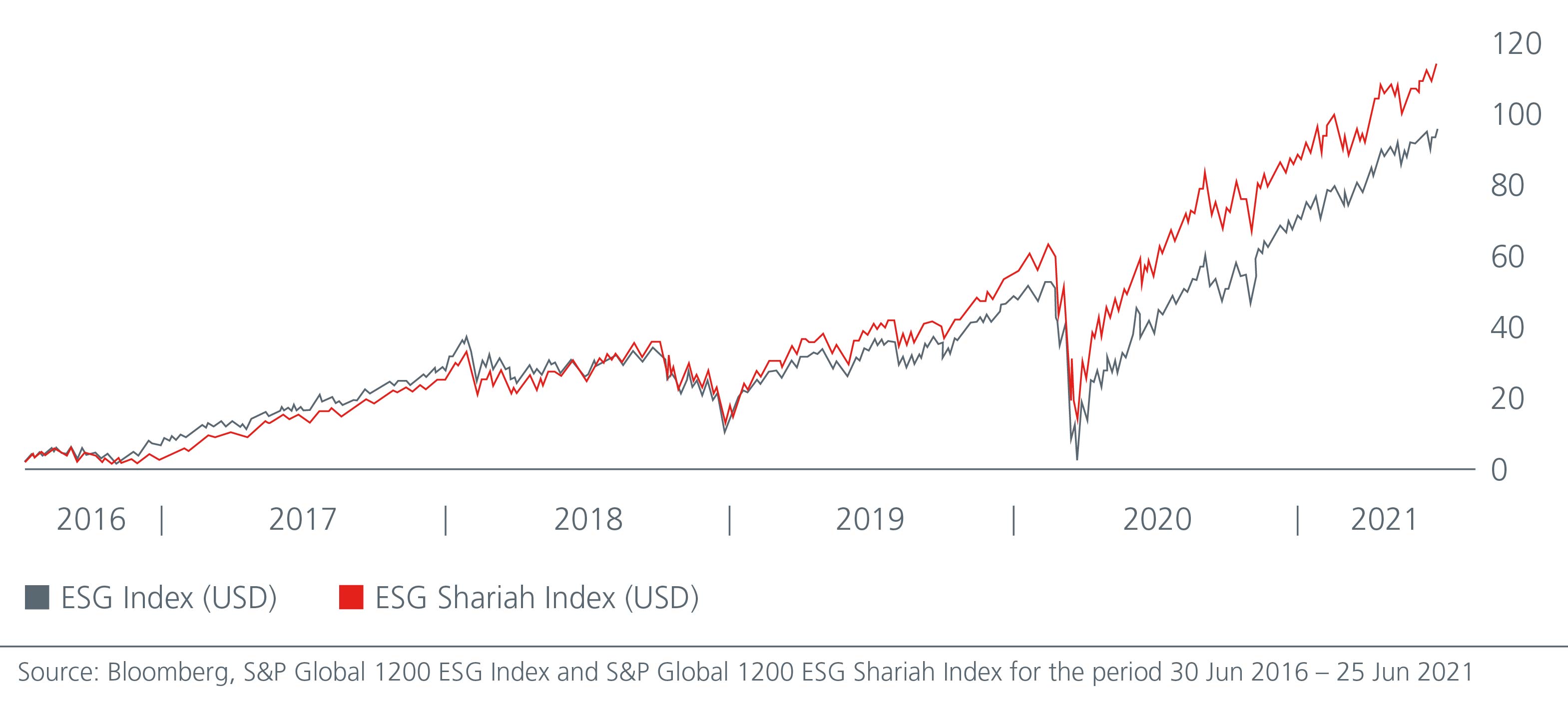

Meanwhile ESG Shariah indices have outperformed the conventional ESG indices due to the better financial management and the lower leverage nature of the companies. See Fig 4. This is evident in the post Covid-19 equity market recovery from March 2020 whereby the Shariah-compliant equity index (S&P Global 1200 ESG Shariah Index) experienced identical volatility-induced declines to conventional stock index (S&P Global 1200 ESG Index), but the ESG Shariah index staged a better recovery.

Fig 4: ESG Shariah index staged a better recovery than ESG index

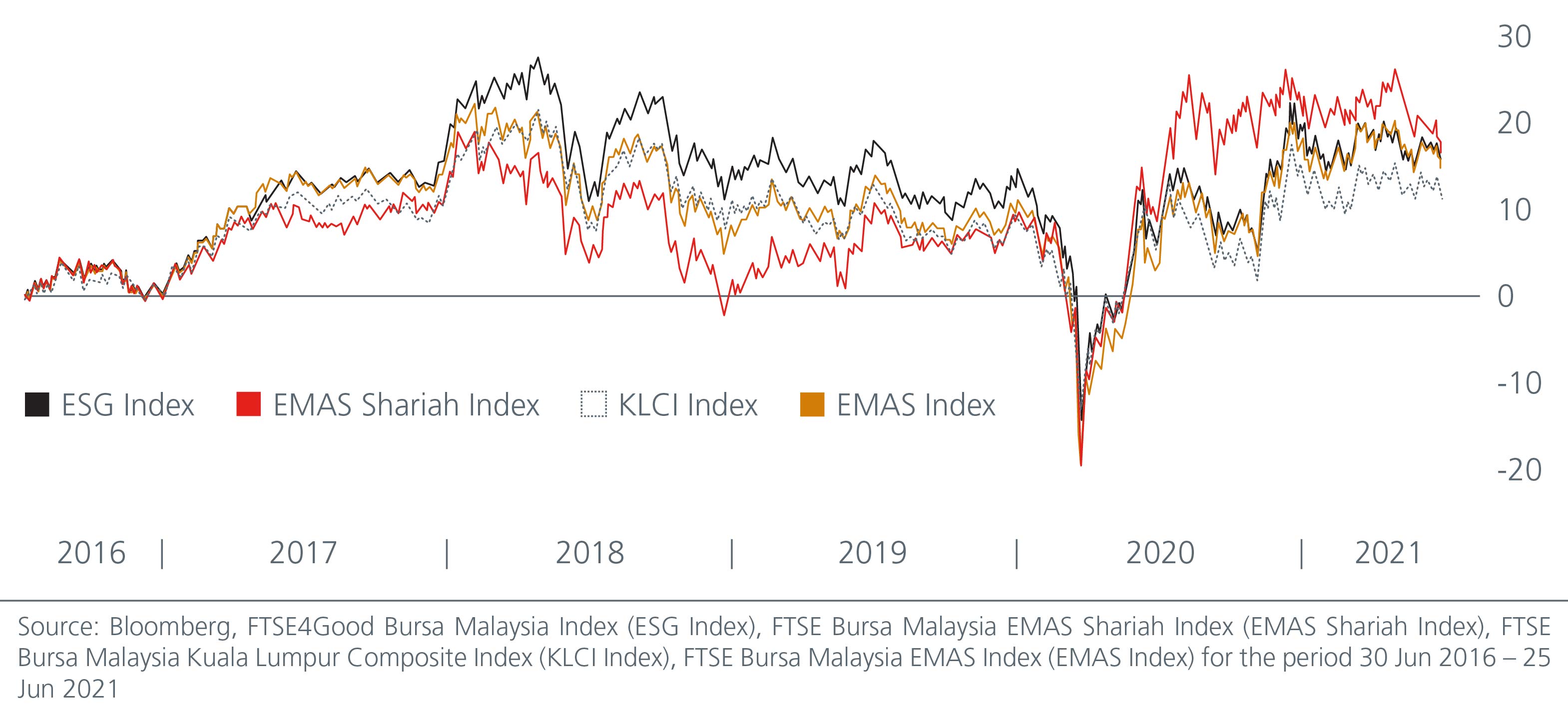

Separately, Malaysia’s first ESG index also known as FTSE4Good Bursa Malaysia index7 has outperformed both the FTSE Bursa Malaysia EMAS index and FTSE Bursa Malaysia KLCI index but came in second to the FTSE Bursa Malaysia EMAS Shariah index. See Fig 5. This suggests that the combination of both ESG screening plus a Shariah overlay can offer attractive sustainable returns over time.

Fig 5: The Shariah and ESG indices outperformed the broader indices

A combined approach offers more benefits

The Malaysian government, as part of its overall initiative to develop an Islamic banking and finance industry in the country, established a Shariah Advisory Council (SAC) in 1996. SAC’s primary task is to advise the Securities Commission on all matters related to the development of the Islamic capital market and function as a reference body for issues related to the Shariah.

Given the growing importance of Islamic and ESG policy, further cooperation and education between regulators and investment professionals is to be expected, leading to policies and initiatives such as promoting transparency and disclosure from investors, fund managers and companies on integrating ESG issues. Fiscal incentives to improve the practice plus adoption of sustainable standards for corporations and integrating Islamic principles into ESG policies would facilitate greater adoption.

Both Shariah and ESG investing are becoming popular. Both Muslim and non-Muslim investors are placing increasing emphasis on the impact of climate change on their portfolios and allocating their portfolios accordingly. Potential investors should consider the fact that Islamic principles combined with ESG investing offers competitive risk-adjusted returns across multiple time periods. This supports the belief that it is possible to do well while doing good.

Sources:

1

https://www.unpri.org/an-introduction-to-responsible-investment/an-introduction-to-responsible-investment-screening/5834.article

2 ESG Fund Landscape in Malaysia, data collected from Lipper 29 March 2021

3 https://www.sc.com.my/api/documentms/download.ashx?id=edb8a38a-0a75-4c74-89c8-37768611f2c1

4 https://www.kwsp.gov.my/-/epf-adopts-un-supported-principles-for-responsible-investment

5 Refinitiv and RFI Foundation, “Islamic Finance ESG Outlook 2019: Shared Values.” http://www.refinitiv.com/content/dam/marketing/en_us/ documents/reports/islamic-finance-esg-outlook-2019-report.pdf

6 Thomson Reuters RFI Responsible Finance Report 2016, The Emerging Convergence of SRI, ESG and Islamic Finance. https://ceif.iba.edu.pk/pdf/ThomsonReuters-ResponsibleFinanceReport2015TheEmergingConvergenceofSRIESGandIslamicFinance.pdf

7 https://research.ftserussell.com/Analytics/FactSheets/temp/2e261d2f-f66e-48fe-bab3-2e05bd64cdfe.pdf

Singapore and Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws.

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author on this page, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this posting is at the sole discretion of the reader. Please consult your own professional adviser before investing. Investment involves risk. Past performance and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments (excluding JV companies) companies are ultimately wholly-owned/indirect subsidiaries/associate of Prudential plc of the United Kingdom. Eastspring Investments companies (including JV’s) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America.