It is the quality of an investment that matters most, not the size.

Myth 1

Big is beautiful

Fact

Size is not everything

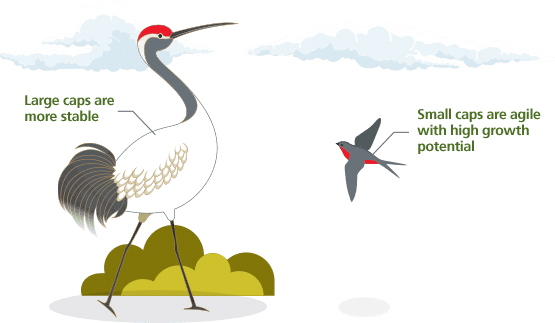

Large capitalisation (cap) companies are typically more stable and have more publicly available information. Many small cap companies, however, are attractive given their innovation and agility.

By investing only in large companies, you may also be missing out on the early stages of growth of high quality but small companies.

Myth 2

Small caps are risky

Fact

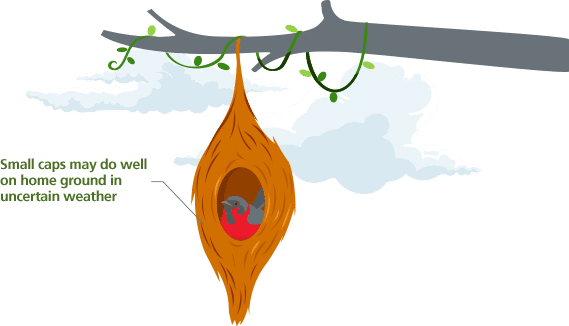

They can be more resilient than large caps

Small caps are historically more volatile than large caps. However, as domestic factors are more important for small caps, they can be more resilient than large caps, especially when global uncertainties (e.g. trade, exports) are high.

Myth 3

Small caps outperform large caps

Fact

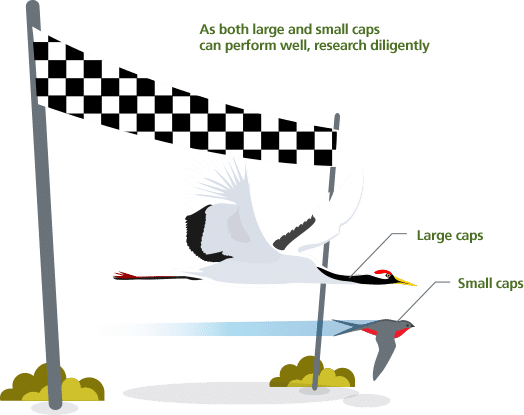

It’s hard to say

With so many factors at play, you need a 360º look at each company. Research is not conclusive that small caps outperform large caps all the time. Hence, investors may not achieve higher returns simply by favouring small caps over large.

As there is publicly less information available on small caps, the sector is more prone to mispricing, allowing active managers to add value.

Having a mix of both big and small companies can help you stay diversified and enjoy the best of both worlds.