Summary

Tariff delays and exemptions helped the US economy outperform expectations in the first half of the year, but rising tariff collections and upcoming trade deals—with significantly higher reciprocal rates—could pressure US consumption, a key growth driver. Asian growth too faces headwinds in H2 as US import frontloading fades, but China and India are relatively resilient. The Fed may cut rates by year-end, while most Asian central banks are set to ease amid low inflation. The USD is expected to weaken as US growth slows and rate cuts loom, supporting modest appreciation in most Asian currencies. Meanwhile lingering tariff uncertainty and easing trade tensions create space for tactical risk-taking.

This is an extract of our Q3 2025 Market Outlook. Click here to download the full report which includes a special feature “The tariff landscape is rapidly becoming messy”.

Macro: Tariff-related strains expected to manifest in H2, heightening global growth risks

US growth outperformed in H1 due to tariff delays but is expected to slow to 1.6% year-on-year by year-end and remain sub-trend in 2026. Rising tariffs and trade deal uncertainty may pressure US consumption and global growth, though extreme downside risks are easing. Asia’s export boost from US frontloading is fading, but China and India are relatively resilient. China’s Q3 growth may moderate, with stimulus supporting a Q4 rebound; India’s growth is gradually improving, aided by rate cuts and low inflation.

US inflation is rebounding as tariffs begin to impact prices, prompting companies to pass on costs. In contrast, Asia ex-Japan faces disinflationary pressures from weak growth, low oil prices, and strong harvests, though easing policies may reduce this by year-end. China’s policy shift on manufacturing adds uncertainty but is unlikely to offset property-driven disinflation.

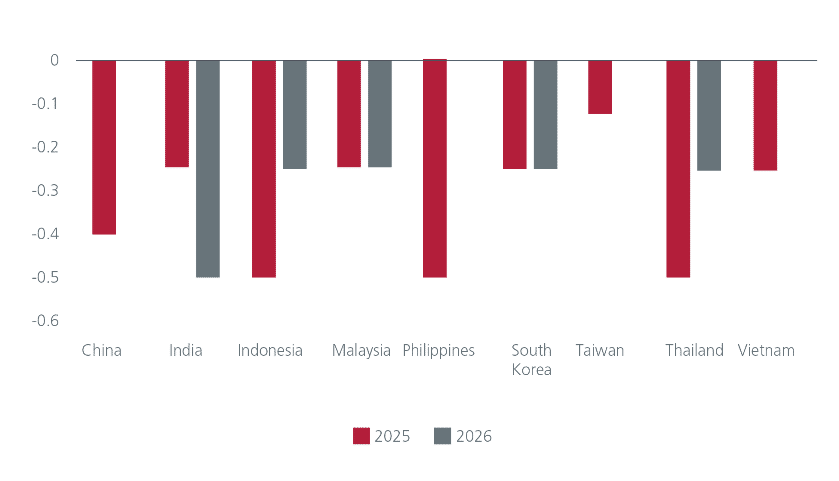

The Fed may cut rates by 25–50bps by year-end if unemployment rises, though timing depends on inflation data. Most Asian central banks are expected to ease. The USD is likely to weaken 3–5% over the next 6–9 months, supporting modest appreciation in most Asian currencies, though gains may be tempered by regional rate cuts.

Asia forecast policy rate change, %

Source: Eastspring, 24 July 2025

Asset Allocation: Tariff uncertainty persists, but de-escalating trade tensions afford runway for tactical risk positioning

Following President Trump’s “Liberation Day” announcement on April 2—which initially triggered sharp declines in equities and widening credit spreads—market sentiment has since recovered, supported by factors such as the 90-day tariff truce and a general easing in trade tensions.

Eastspring’s Multi-Asset Portfolio Solutions (MAPS) team now views the economic impact of tariffs as less severe than previously assessed. As a result, the team has reduced cash allocations and adopted a more constructive tactical stance across risk assets, particularly in equities and credit. Key indicators such as global PMIs and corporate earnings revisions continue to support a near-term positive outlook.

Given ongoing trade policy uncertainty beyond the extended August 1 deadline, the team is implementing barbell strategies using equity options to balance upside participation with downside protection.

Over the 3-month tactical horizon, the team favours Emerging Markets and Asia equities over US, citing more attractive valuations and macro conditions. In credit, US high yield remains compelling with a 7% yield, while EM bonds offer potential upside from USD depreciation. US Treasuries are also held constructively, serving both as a yield opportunity and a hedge against a potential US growth slowdown.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).