BOC Main Work Guidelines

The Board of Commissioners is charged with the duty to supervise the management of the Company by the Board of Directors, to perform such other functions as the RUPS may from time to time decide, and to do any other matters provided for in these Articles of Association.

BOC must ensure that the Board of Directors follows up on the findings and recommendations of:

a. Risk management, compliance and internal audit functions;

b. External audit findings;

c. Results of supervision by the Board of Commissioners; and/or

d. Results of supervision by the Financial Services Authority.

e. Results of supervision of the Sharia Supervisory Board.

A Board of Commissioners meeting shall be established in quarterly basis, which being documented in minutes of BOC meeting.

BOD Main Work Guidelines

The Board of Directors shall be fully responsible to perform its duties in the interest of the Company in attaining the Company's objectives and purposes.

Each member of the Board of Directors shall in good faith and with full responsibility perform his/her duties with due regard to the prevailing laws and regulations having the force of law in the Republic of Indonesia. The Board of Directors shall give all pertinent information about the Company as required by the Board of Commissioners to exercise their duties.

A Board of Directors meeting shall be established in monthly basis, which being documented in minutes of BOD meeting.

Code of Ethics of PT Eastspring Investments Indonesia

#1 Our Customer is Our Compass

- We immerse ourselves in understanding our customers.

- We commit to our customers’ needs and address their pain points with speed and empathy.

#2 We Pursue Our Entrepreneurial Spirit

- We push boundaries and explore new possibilities.

- We are resilient, bouncing back from our failures and moving forward with new insight and energy.

#3 We Succeed Together

- We win by collaborating as one team.

- We actively break down silos and work across all levels of the organisation.

#4 We Respect and Care for One Another

- We are empathetic and treat each other the way we would like to be treated.

- We respect differences and create an environment that is safe where everyone can be themselves.

#5 We Deliver on Our Commitments

- We make responsible decisions and are accountable for our actions to all stakeholders.

- We are responsive and execute with excellence and integrity.

Description of Compliance, Risk Management and Audit

PT Eastspring Investments Indonesia

The Company follows a risk management strategy that adopts the concept of "Three Lines of Defense" or 3 lines of defense concept where the business function is in the first line of defense, while the Compliance and Risk Management functions are in the second line of defense. Then, the third line of defense is Audit Committee.

The purpose of the Risk Management function is to provide businesses with good corporate risk framework which to operate, provide challenges and oversight to enable senior management effectively managed the necessary risks, and to support positive risk culture throughout the organization.

Corporate risk management includes exposure to operational risks that may be faced by the Company as well as investment risks derived from the portfolio managed by the Company, which include Liquidity Risk, Credit Risk, Operational Risk, Compliance Risk, AML CFT Risk, Legal Risk, which is coordinated with the Compliance Team and Risk Management.

The Company identifies risks, the possible magnitude and probability of risk occurring, as well as the steps taken in mitigating risks.

The Company's compliance function includes the Company's compliance with applicable rules and regulations, especially those relating to the investment management sector.

The Internal Audit function, one of which is responsible for ensuring that the findings of Internal Audit are reported directly to management and the Company's Audit Committee.

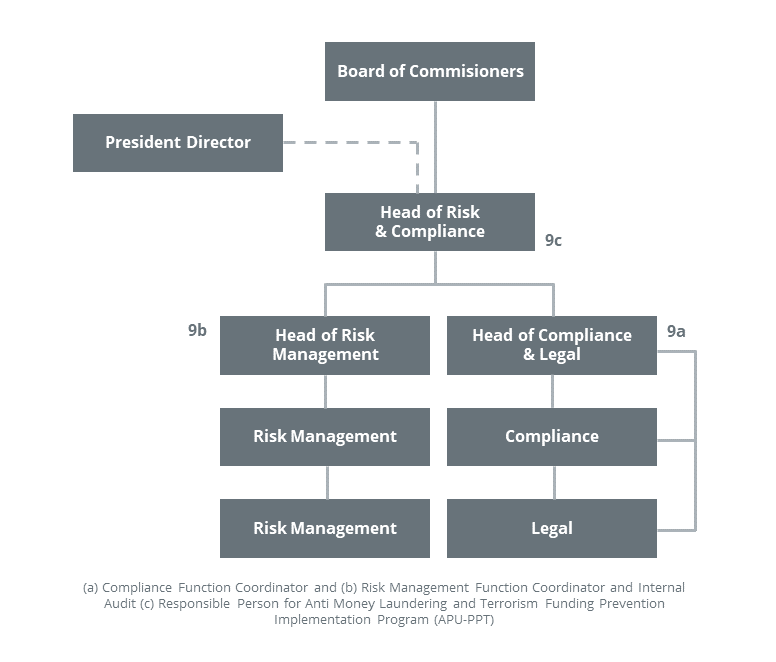

The Risk Management & Internal Audit function and Compliance Function have a separate coordinator under the supervision of the Chief Compliance & Risk Officer who is responsible to the Board of Commissioners and the President Director. The Chief Compliance & Risk Officer also serves as the person in charge of the Anti-Money Laundering and Terrorism Funding Program (APU-PPT).

In general, these functions are responsible for ensuring the application of a risk management and compliance framework, including monitoring of changes in applicable laws and regulations - including assisting to interpret changes in laws and regulations, if any, participating in relevant meetings and ensuring that the existing reports are carried out effectively, on time, and in accordance with applicable regulations.