Summary

Japan equities are seeing the highest inflows in 20 years. Improving economic fundamentals aside, the positive sentiment is being fuelled by cyclical tailwinds and structural reforms that are still in play. Despite the strong rally to date, our Japan equity team believes that there is more room for upside.

Foreign investors have been buying Japanese stocks and pushing the market to 33-year highs. Year to date, the MSCI Japan index has returned 11.6% in USD terms.1 Investors, late to the game, are wondering if much of the rally is over. After the strong market run, Japan’s equity valuations are now at the 10-year historical average of 14x earnings and as such no longer optically cheap versus its own history.

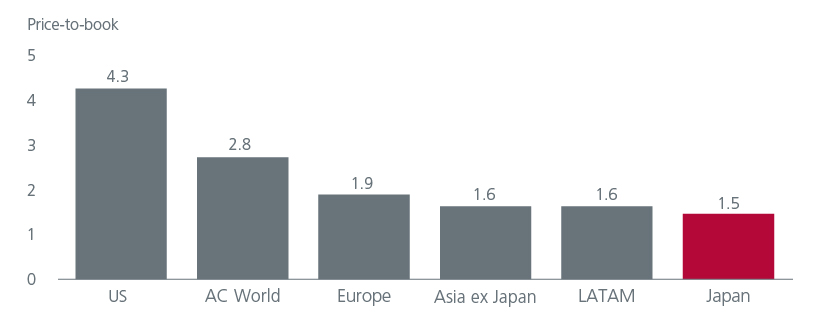

However, the cyclically adjusted (CAPE) multiple for the market is still below its average and at 1.5x price to book, Japan remains cheaper than both Europe at 1.9x and the US at 4.3x. Fig 1. We prefer to characterise Japanese valuations now as being attractive rather than super cheap. The long-term investment case remains very solid, supporting the case for more market upside.

Fig 1: Japan is attractively valued

Source: Eastspring Investments, IBES MSCI Indices, Refinitiv Datastream, as at 30 June 2023.

Tailwinds powering growth

That said, the current investment buzz on Japan is being powered by several other factors. For a start, it is worth noting that Japan, an open economy, has benefitted from the benign global backdrop; expectations of an imminent recession have not panned out thus far. The global economy remains relatively resilient.

Meanwhile Japan’s economy grew at a faster than expected pace in the 1Q23 and current account surplus more than doubled year-on-year in May on a smaller trade deficit and higher investment income. To add, Japan’s post COVID re-opening only started from this year, accelerating towards the second quarter, and boosting the domestic economy. There is plenty of room for more growth.

Rising inbound tourism will be another major growth driver; per capita spending by tourists hit a new high in the 1Q23. Imagine the boost to spending should Chinese tourists return in full force; currently it is negligible. Pre pandemic they used to be the biggest spenders and account for 30% of arrivals.

Corporates unlocking value

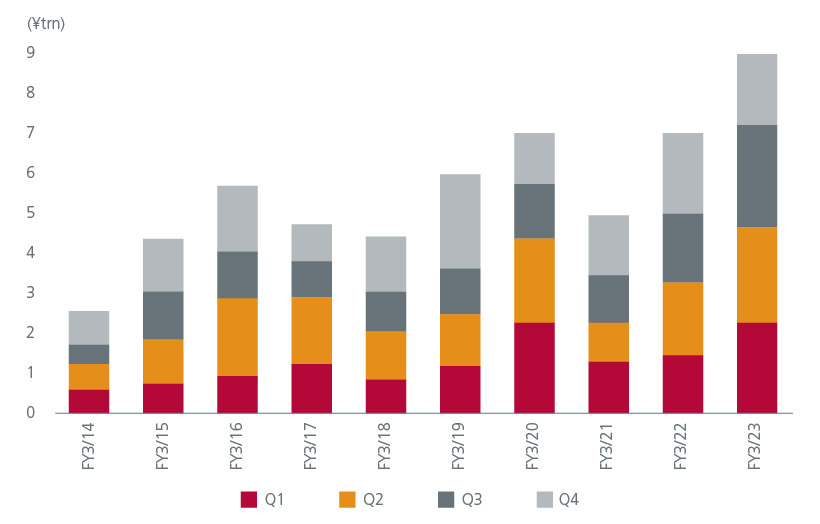

In January, the Tokyo Stock Exchange (TSE) ramped up pressure on Japanese corporates by recommending that companies with persistently low price-to-book ratios disclose plans to improve balance sheets. That resulted in several huge buybacks. Fig 2. We expect this trend to continue and are encouraged to see more companies announcing cost cutting and restructuring. With a consensus culture in Japan, most management teams will be motivated to fall in line with the TSE objectives and be much more shareholder focussed in future.

Fig 2: Buybacks rose in FY23

Source: CLSA, Bloomberg

Apart from the regulatory push, Japanese corporates are also under pressure from increasing shareholder activist activity. Shareholder engagement should further catalyse management teams to improve. Currently 50% of Japanese corporates are still trading below book value while the percentage of non-financial companies sitting with net cash over 20% of equity is approximately 40%.2 This suggests there is plenty of low hanging fruit for investors to capitalise on as the share buybacks gather momentum.

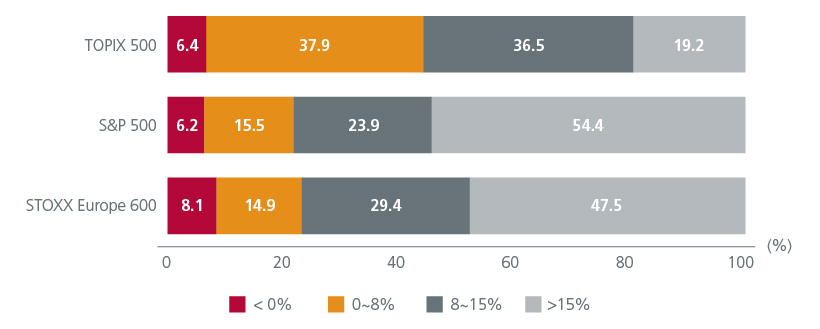

Getting on par with peers

Low returns on equity (ROE) have been a major deterrent for investing in Japan. Fig 3. According to Citibank research, if Japan can half its cross-shareholdings and get to the level of net cash/market cap like Europe, it can improve its ROE from current 8%-9% to 11%-12%.3 Price to book valuations could then adjust and become comparable to European levels too.

Fig 3. Japan’s low return on equity has been a challenge

Source: Bloomberg,Citi Research Trailling 12 month basis. Note: Compiled using stocks for which data items are available.

Operating margins are another area requiring attention. Japanese corporates tend to have poor margins due to the deflationary environment, lack of focus in capital allocation and business portfolio as well as a lack of consolidation in the industry. Mergers and acquisitions (M&A) are necessary to restructure unprofitable companies, but this is often rebuffed by companies, especially the smaller players to preserve management. Nonetheless the trade ministry is looking into ways to boost M&A.

Meanwhile the earnings outlook has improved on lower odds of an imminent US recession. In fact, on an earnings per share basis adjusted for inflation, the Topix has delivered 9.9% per year for the past decade against 4.8% per year for S&P.4

Positive outlook for inflation

Inflation appears to be broadening out and looking more sticky. This is allowing corporates which were negatively impacted by imported inflation last year to increase their pricing, benefiting margins. The capex environment is also improving, with the long-term drivers being the green transformation and ‘friendshoring’. This is especially true for the chemical, industrial and manufacturing companies, and is another positive for the inflation outlook.

Equally the labour market remains very tight as Japan’s working age population is declining, exerting upward pressure on wages. Employment conditions index is pointing to a shortage of workers in every industry. This is key for a sustained move out of the deflationary era, and we still think this is the best chance Japan has had in a generation to do so.

Moreover, with inflation rising to 40-year high, Japanese retail investors are realising the need to protect their asset value. The new tax breaks to encourage retail equity buying will take effect in January 2024 and should encourage more retail investors back into the equity market. After all, cash accounts for more than 50% of household assets in Japan against 14% in the US.5

Impact of policy normalisation

In late July, the Bank of Japan (BoJ) announced that they will further tweak the yield curve control, whereby the prior 0.5% yield ceiling on 10-year government bonds will now be a reference point rather than a hard limit. This allows for more flexible policy going forward and will mean rates could now move towards 1%. Following years of abnormal monetary policy with negative interest rates, this indicates that Kazuo Ueda, the BoJ’s governor, is keen to steer a path towards normalisation, albeit in a cautious and incremental manner.

Higher rates would clearly be beneficial for financials after operating in a negative interest rate environment for so long and we note that even if the Yen strengthens back towards 130 against the USD it is still a comfortable level for most exporters. If inflation and growth are starting to prove more sustainable in the BoJ’s eyes, this should be viewed as a positive for both consumer and investor sentiment. We do not see a normalisation of monetary policy undermining the long-term investment case for Japanese equities, which looks solid given the numerous longer term structural tailwinds.

An attractive proposition awaits

The valuation divergence between growth and value stocks is still elevated versus history. We are seeing plenty of opportunities in the value and mid cap space and will assess companies based on the through business cycles and sustainable earnings.

Japan is also well positioned to handle any fallout from any rising US-China tensions. Both China and the US are Japan’s key trading partners, with the latter supplying both countries with much needed technologies i.e., electrical components, materials, machinery etc.

Overall, the long-term investment case remains solid, and we would characterise the current Japanese valuations as attractive rather than super cheap. Many foreign investors are still looking to build more permanent Japan equity positions in their portfolios. The ongoing share buybacks are also pushing up yield to 2.5%+ which should encourage retail investors back into the equity market.

Japanese equities are set to remain in demand in the second half of the year. Any pullback in the market is likely to be used as a buying opportunity by investors. Perhaps the time has come for Japan to trade at a premium to long-term depressed valuation levels.

Sources:

1 Bloomberg, as at 21 July 2023

2 CLSA: Japan’s on a roll, May 2023

3Nikkei Quick, Bloomberg, Citi Research

4 CLSA: Japan’s on a roll, May 2023

5 CLSA: Japan’s on a roll, May 2023

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).