Managing Emerging Market bonds since 2011, we seek to add value over the medium term through active management of allocation across the Emerging Market debt universe.

Our edge

- As one of the largest fixed income managers in Asia, our scale allows us to establish a strong presence in the market that helps facilitate good primary deal allocation.

- Our highly experienced team has navigated through different market cycles and major market events, including the European sovereign debt crisis in late 2011, taper tantrum in 2013, as well as the oil market sell-off in 2015-2016.

- Significant experience customizing institutional mandates for liability-linked investments

Team

- The highly experienced team has been managing Eastspring’s Emerging Market bond strategy since April 2011 and is part of a well-resourced and stable Fixed Income team, consisting of 20 investment professionals and 1 quantitative analyst*.

- The Emerging Market Bond team leverages on the research efforts of the broader team where different members focus on analysing global macro, commodities, Asian interest rates and currencies, credits as well as industry trends.

Investment Philosophy

- We invest with a medium-term view.

- We believe that investing on the back of fundamental, valuation and technical analysis can generate superior long-term returns.

- Cyclical extremities in interest rates and credit spreads give rise to opportunities.

- Shifts in investor risk perception can also create opportunities as assets get mispriced, relative to their fundamentals.

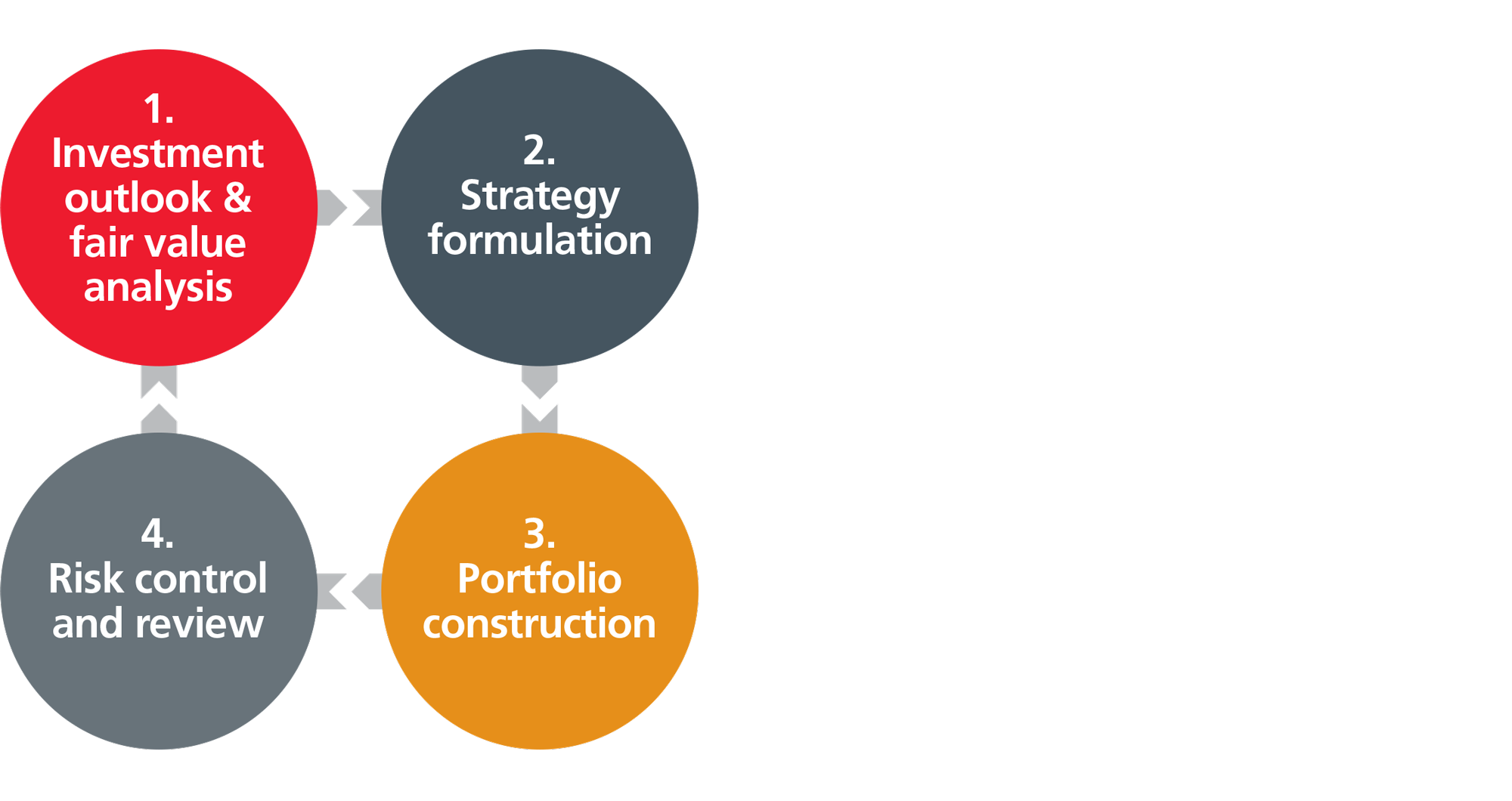

Investment Process

- We conduct macroeconomic and market research to determine the investment outlook and establish the fair value of the broad interest rate, credit and currency markets.

- We combine fundamental, valuation and technical analyses of relevant markets to determine the portfolios’ country/ sector allocation, duration and yield curve strategy, as well as currency positioning.

- Combining both top-down and bottom-up analysis, we construct portfolios that reflect the team’s duration/yield curve, sector, credit and currency risk preferences within the permitted risk parameters.

- We review portfolio risk exposures on an ongoing basis, with portfolio actions discussed with the broader investment team on a regular basis.

ESG

We incorporate ESG issues into our fundamental analysis of companies and assess their impact on an issuer’s financial performance, default risk and bond valuations. The process involves assessing the quality of the company’s corporate governance by taking into account its level of corporate transparency, track record of business integrity, and audit practices. We also consider the severity of allegations and reputational risks. A company’s preparedness in dealing with ESG issues is also key. Our credit analysts determine the materiality of these issues and the appropriate risk premium to be priced. We make use of both information gathered from public sources as well as directly through our interactions with the companies in our assessment and monitoring.

Related articles

EMERGING MARKETS

Investing in Vietnam’s middle-income boom

Middle income households are expected to make up almost 30% of ...

- Nov 23

- |

- Ngo The Trieu

EMERGING MARKETS

The alpha from Asia’s growing equity offerings

Initial public offerings and share placements continue to appeal ...

- Oct 23

- |

- John Tsai

EMERGING MARKETS

Maximising the opportunity set across Global Emerging Markets

The beauty of the emerging markets is that there is no uniform ...

- Sep 23

- |

- Samuel Bentley

*Quantitative analyst is a shared resource with the quantitative strategies team