Executive Summary

- Companies in high-polluting industries are often undervalued due to the stigma associated with their environmental impact and/or possible emissions-related financial penalties. This creates a mispricing opportunity for investors who can identify firms that are committed to transitioning towards more sustainable practices.

- By choosing not to ignore “dirty” industries, investors enjoy an expanded investment universe and therefore increased alpha opportunities. This is particularly relevant for investors in Asia and the Emerging Markets (EMs) where brown industries are integral to the economy.

- As these companies reduce their carbon footprint while making their business models more climate-resilient, their market valuations are likely to increase. Tapping into companies at an early stage of their transition journey can potentially result in outsized returns in the future.

Sustainable investing faces greater skepticism and political controversy today than it did a decade ago. Greenwashing concerns, regulatory challenges and political backlash have accompanied an evolution in the way investors approach sustainable investing.

Investing in high-polluting or carbon-intensive industries, often referred to as "dirty" or “brown” industries, may seem at odds with sustainable investing. However, the very industries that are struggling to reduce their carbon emissions can offer investors very attractive opportunities.

The potential for market beating returns

Companies in high-polluting industries are often undervalued due to the stigma associated with their environmental impact and/or possible emissions-related financial penalties. This creates a mispricing opportunity for investors who can identify firms that are committed to transitioning towards more sustainable practices. As these companies implement changes to reduce their carbon footprint while realising opportunities to monetise climate adaptation and/or mitigation solutions, their market valuations are likely to increase, potentially delivering attractive returns to early investors. These companies may also be less researched, hence providing alpha opportunities.

These two directions are potentially value accretive in the following ways:

- Emission reductions: In the case of a Paris-aligned scenario, this will reduce the risk of the company having to pay increased emissions-related costs from carbon taxes or emission trading schemes.

- Realisation of climate transition opportunities: In a climate-changed world, Paris-aligned or otherwise, companies featuring climate-adapted or low carbon solutions in their strategy will likely be able to realise commercial opportunities.

Take for instance a Chinese company which we had identified in the Oil and Gas Drilling industry, a potentially taboo industry for some sustainable investors. While the company has a lower-than-average ESG score1, it has devised a low carbon development action plan overseen by its board, aligning with China’s Nationally Determined Contribution (NDC) targets. The company has also shown significant innovation in its transition efforts and improved energy efficiency.

Similarly, consider an Australian company within the Diversified Metals and Mining industry, another “dirty” industry. The company has an average ESG score2 but has developed a comprehensive climate transition plan and issued Sustainability-Linked Loans (SLL) to support its climate-action initiatives. It has also taken concrete steps to enhance energy efficiency and started increasingly diversifying its business into transition minerals.

These are the kind of opportunities which investors could potentially forego if the focus on ESG ratings leads them to exclude companies in brown industries. The chance to tap into companies at the early stages of their transition journey can result in outsized returns in the future. That said, this approach requires active engagement, robust screening processes and tracking to ensure that investments are directed at companies genuinely working to enhance their environmental, social, and governance (ESG) practices. We will share more of our proprietary framework in upcoming articles.

Do good instead of just feeling good

By choosing not to ignore “dirty” industries, investors enjoy an expanded investment universe and therefore increased alpha opportunities. This is particularly relevant for those investing in Asia and the Emerging Markets (EM) where brown industries form a significant part of the economy.

Although EMs (excluding China, India and Brazil) accounts for c.48% of global population and 33% of global GDP, they only account for only 10% of the investment in clean energy and transition solutions. See Fig. 1. With significant investments needed to support the process of converting inefficient, carbon-emitting assets into sustainable and energy-efficient assets (brown-to-green transition), this should potentially present more opportunities for investors.

Fig. 1. Proportion of energy transition related investments vs population and GDP (2023)

Source: International Energy Renewable Agency. 2024. A just and inclusive energy transition in emerging markets and developing economies. Energy planning, financing, sustainable fuels and social dimensions. Based on: (BNEF, 2024a; IMF, n.d.; World Bank, 2024). Notes: GDP = gross domestic product; EMDEs = emerging markets and developing economies; Data based on latest year available. Annual investment figures are from 2023, while GDP and population data are from 2022. Country classification is based on IMF’s World Economic Outlook.

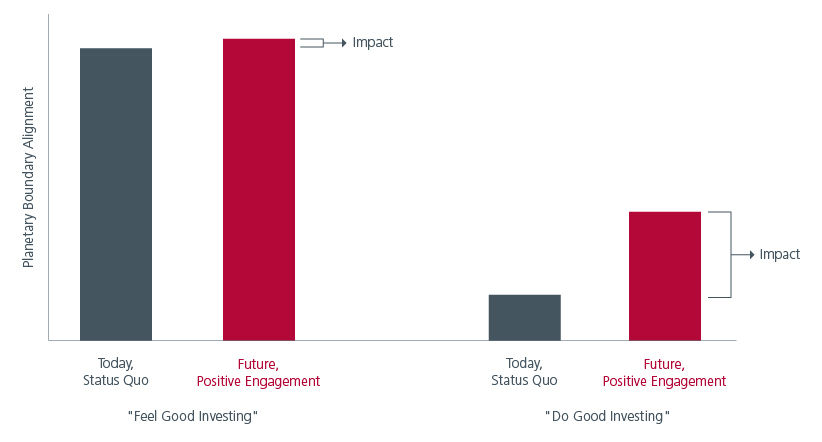

Facilitating companies’ transition from “bad” or “dirty” to “average” or “clean” (Do Good Investing) creates more real-life impact than buying companies that are already “clean” (Feel Good Investing). See Fig 2. With many countries in Asia Pacific and the EMs heavily dependent on high-polluting industries for their GDP, an abrupt divestment from these industries could lead to significant economic disruption and social inequality. By investing in and supporting the transition of these industries, investors can help balance the need for environmental sustainability with economic stability and social equity.

Fig. 2. True impact can’t be achieved by ignoring the difficult

Source: Eastspring Investments (Singapore) Limited. The information provided herein are subject to change at the discretion of the investment manager without prior notice. Any projection or forecast is not necessarily indicative of the future or likely performance. Planetary boundary alignment is the process of aligning actions with the limits of Earth's capacity to support human development. January 2025.

Maximising returns: A win-win proposition

Investing in "dirty" or high-polluting industries presents a unique opportunity for investors to not only enjoy attractive returns but also play a pivotal role in the transition towards sustainability. By tapping into mispriced opportunities and benefitting from a broader investment universe, early adopters of this strategy can also enjoy positive return tailwinds as more institutional investors shift their focus towards transition opportunities.

For those investing in Asia and the EMs, where high-polluting industries are integral to the economy, this approach offers a win-win proposition. By actively supporting the transformation of high-polluting industries, investors can maximise returns while contributing to a more sustainable and balanced future.

Sources:

1 Ratings from Sustainalytics and S&P Global.

2 Ratings from Sustainalytics and S&P Global.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K) and has not been reviewed by Securities Commission of Malaysia.

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).