The term ESG was formalised in 2005 following an initiative to incorporate the factors associated with the 3 pillars, Environmental, Social and Governance, in capital market investments. ESG has become increasingly important to the investment community on the premise that integrating these factors will in the long-term lead to sustainable economies.

ESG concepts

Environmental impact from business activities can adversely affect ecosystems and human health. Deforestation and greenhouse emissions have increased the incidence of natural disasters and loss of lives. Paying attention to the environmental aspects will help ensure the future survival of humanity.

Social issues can impact society negatively as a whole. Poor labour standards in companies, for example, can lead to unrest and business disruptions. Organisations that look after their employees and customers stand to benefit from greater stability and loyalty.

Governance refers to processes and controls to monitor how companies operate. Weak governance may encourage corrupt practices and tax evasion which erodes confidence in a company. A robust governance system facilitates growth and creates stability in financial markets.

Examples of ESG factors (list not exhaustive)

| Environmental | Social | Governance |

|---|---|---|

| Climate change & carbon emissions | Customer & employee relations | Bribery & corruption |

| Air & water pollution | Data privacy & protection | Board composition |

| Natural reserve destruction | Gender equality & diversity | Transparency & disclosure |

| Energy & water consumption | Human rights & labour standards | Audit committee structures |

| Waste management | Health & safety | Executive compensation |

The Principles for Responsible Investment (PRI) provides a global standard for responsible investing. The six principles, which are supported by the United Nations are:

- We will incorporate ESG issues into investment analysis and decision-making processes

- We will be active owners and incorporate ESG issues into our ownership practices

- We will seek appropriate disclosure on ESG issues by the entities in which we invest

- We will promote acceptance and implementation of the principles within the investment industry

- We will work together to enhance our effectiveness in implementing the principles

- We will each report on our activities and progress towards implementing the principles

With ESG, investment managers integrate the E, S and G factors into their traditional financial analysis process when evaluating the investment eligibility of an equity or bond to generate positive sustainable returns.

Impact investing often refers to private equity strategies, where the investor has board representation and has a direct impact on the management of the business which in turn effects a positive impact on society. However, not all impact funds today are private equity and not all investors have positions on the board.

The E, S and G factors need not necessarily have equal weightings as not all factors are material to a company. Judgement needs to be applied in assessing which factor is material to a business.

There is no standard set of ESG metrics. Nevertheless, certain industry- and sector-specific ESG performance indicator standards have been developed to provide a framework for investment managers.

There are a number of ESG data providers that help investors gain a better understanding of the risks and opportunities faced by companies by assigning ESG scores. Institutional investors and investment managers may use these scores as one source of information to evaluate a company’s ESG commitment.

Given the lack of standard ESG metrics, always ask about an investment strategy’s exposure to certain factors such as climate risk if environmental issues matter to you.

There are a number of providers offering a very wide array of data, from specialised ones that focus on certain ESG traits, such as carbon score and gender diversity, to others that score companies based on several hundred ESG-related metrics.

Most international and domestic companies are typically evaluated by the well-known data providers such as Bloomberg ESG Data Service, MSCI ESG Research, and Sustainalytics, to name a few.

The differences in approach by these data providers can result in the same company being ranked highly by one provider and poorly by another. Choose a data provider that is consistent with your ESG values or try to understand the differences behind the rankings.

Decide which ESG values matter most to you before shortlisting the relevant ESG funds. Next, read the fund’s investment prospectus for more information on the fund’s objectives. Find out how the fund’s manager screens for companies and check the fund’s holdings to ensure it is aligned with the objectives.

Just as is the case for other fund investments, ensure the ESG fund is sufficiently diversified. More importantly the ESG fund has to be assessed on both its performance standards and ESG metrics.

Do not choose funds based on labels or titles that suggest ESG aspects are incorporated. Check if the funds are genuine in their ESG approach.

There are many ESG benchmark indices which can suit the various objectives of sustainable and responsible investing. Companies that are constituent members of these indices are chosen based on their performance across environmental, social and governance factors.

The vast number of ESG indices allows investors to select customised benchmarks that align with their objectives. These indices also help investment managers to manage and measure the performance of their ESG funds. Some of the leading providers of ESG benchmarks are MSCI Inc., S&P Global Inc. and FTSE Russell.

Investors can refer to relevant indices which the ESG funds are benchmarked against as a guide to invest in the funds.

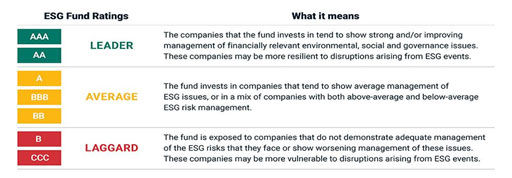

There are a number of independent ESG fund rating providers with each adopting different rating methodologies. Morningstar, a well-known provider of investment research, set up Morningstar Sustainability Rating™ which rates mutual funds and exchange traded funds. MSCI, the world’s largest provider of ESG indices, has established the MSCI ESG Fund Ratings 1 which measures the ESG characteristics of a fund’s holdings on a AAA to CCC ratings scale. See table.

1 https://www.msci.com/esg-fund-ratings

Returns on ESG investments should be analysed on 3 aspects: risk, return and values. ESG investors should seek to balance maximising risk-adjusted returns against values.

Studies have shown that companies that adopt ESG standards tend to have better risk profiles and are more likely to outperform the market in the long run. Research done by MSCI over a 10-year period 2 found that higher-rated ESG companies were more profitable and paid higher dividends than those with lower ESG ratings.

ESG factors generally influence the financial performance of companies in the long-term.

2 January 2007 to May 2017, Foundations of ESG Investing: How ESG Affects Equity Valuation, Risk, and Performance, IPP Journals July 2019

These are some key areas to consider:

- Frequency of staff training on ESG issues

- Availability of ESG research tools

- ESG integration into an investment decision

- The level of transparency in the ESG reports

- Top-down or bottom-up ESG approach

- Extent of senior management involvement