Executive Summary

- Idiosyncratic factors helped China and India outperform most Asian markets during the correction in August. We believe that these factors will continue to position these markets favourably during future periods of volatility.

- The resilience of the Indian equity market can be attributed to its strong domestic investor base, low revenue exposure and low market beta to the US. China’s stability is supported by its cheap valuations, low institutional ownership and improving fundamentals in key sectors such as the internet.

- A combined China-India portfolio is not only resilient against global volatility but also offers significant diversification benefits given the declining correlation between the two markets.

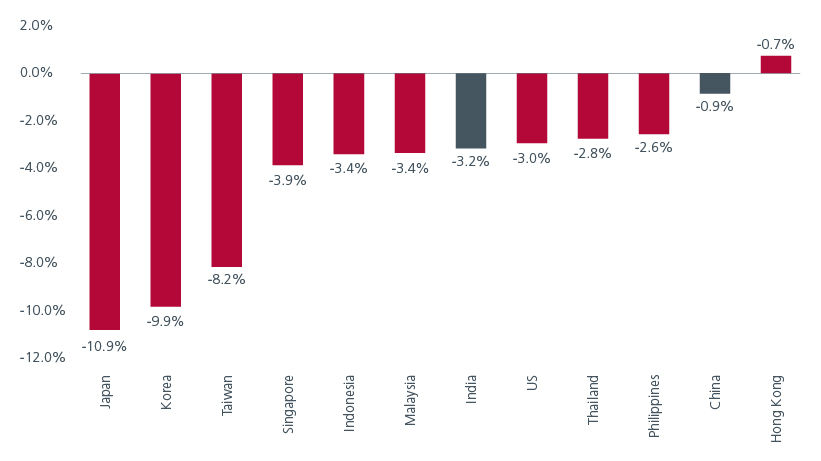

Risk assets sold off sharply in early August on the back of a mix of factors, including concerns over the sustainability of AI spending and monetisation, fears of a US recession and the unwinding of the yen carry trade. Fig. 1. China and India were among the few Asian markets that performed better than the rest, underpinned by idiosyncratic factors. We believe that these factors will continue to position these markets favourably during future periods of volatility.

Fig. 1. Performance of selected equity markets on 5th August

Source: Bloomberg. MSCI Indices in USD terms.

India – domestic flows hold sway

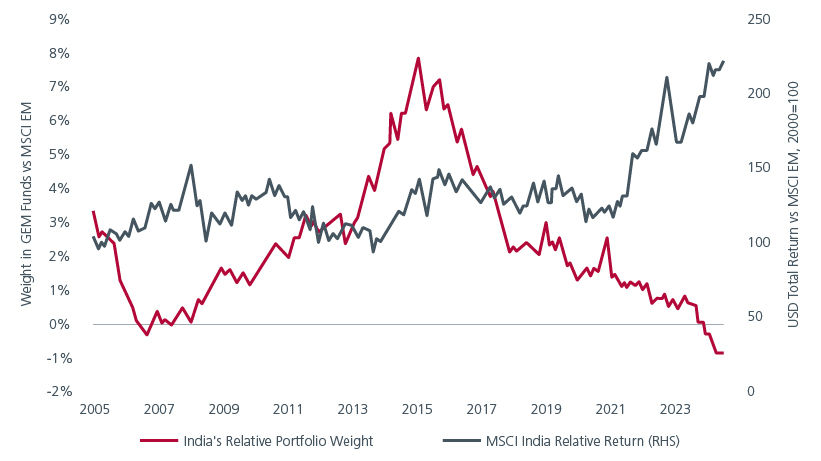

India’s relative outperformance during the recent sell-off may come as a surprise given concerns over its expensive valuations. However, unlike other Asian markets which are more dependent on foreign inflows, the Indian equity market is more reliant on domestic flows, which tends to be “stickier”. Although India is often viewed as a popular market among foreign investors, India’s relative portfolio weight in Global Emerging Market (EM) funds is at its lowest since 2005, despite the market’s outperformance. Fig. 2.

Fig. 2. MSCI India’s portfolio weight and total return relative to MSCI EM

Source: EPFR country allocation, FactSet, Morgan Stanley Research. Data as of July 31, 2024. *Fund weight as of June 2024.

MSCI India also has a low beta to the MSCI USA Index, as shown in Fig. 3. India’s lower revenue exposure to North America potentially reduces its vulnerability to US recession risk. India’s Information Technology (IT) services sector, which has the highest exposure to the US, has already experienced slower growth over the last one and half years, driven by vendor consolidation.

Fig. 3. Index beta to MSCI USA vs revenue exposure to North America

Source: Bloomberg, Morgan Stanley Research; Data as of July 26, 2024; Note: Betas are calculated based on MSCI indices unless specified otherwise; weekly returns, rolling 52 weeks.

With the Federal Reserve (Fed) poised to cut rates in the coming months, the strength of the US dollar may moderate as interest rate differentials narrow between the US and the rest of the world. Historically, Emerging Markets tend to outperform when the dollar index weakens. At the same time, Fed rate cuts potentially give the Reserve Bank of India room to bring rates lower (if needed) without stoking volatility in the Indian rupee.

China – marching to its own beat

Like India, we believe that the Chinese equity market will be relatively resilient in the face of global volatility given its trough valuations, low exposures among institutional investors and improving fundamentals in selected key sectors.

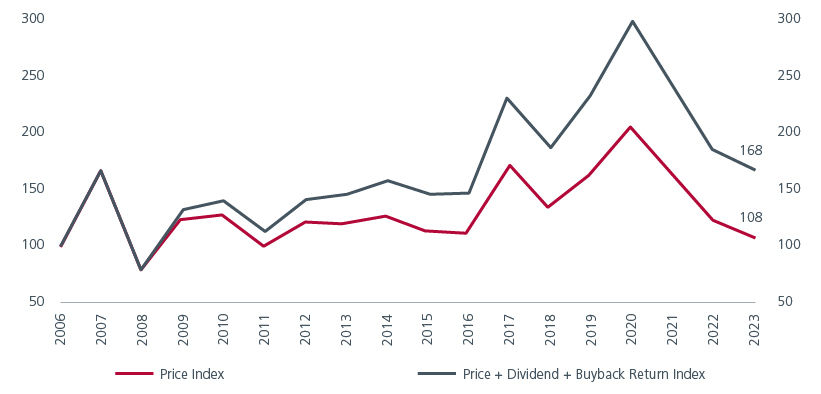

At a 12-month forward price-to-earnings ratio of 9x, MSCI China is trading at a trough relative to its own history and the region. The challenges facing the Chinese economy are well known – a weak property market, low consumer confidence and a lack of effective stimulus from the government. A sizeable stimulus package will be needed to lift investor sentiment. Till then, with the government encouraging companies to return more cash to shareholders, dividends and share buybacks should help to stabilise the market. Fig. 4.

Fig. 4. Dividends and buybacks have been an important component of returns for MSCI China

Source: MSCI, FactSet, Goldman Sachs Global Investment Research (as of 24 June 2024).

China is currently one of the most unloved equity markets amongst investors - global investor positioning in Chinese equities is at its lowest in 12 years. This suggests that the market has less room to fall further if overall investor risk aversion rises. Fig. 2. had earlier shown that like MSCI India, MSCI China’s revenue exposure to North America is low compared to the other EMs, which should also make it less vulnerable to US recession risk. On the macro front, the US’ share of China’s total exports has fallen from a high of 20% in 2001 to 14% in the first quarter of 2024. In contrast, ASEAN’s share of China exports has more than doubled from 7% to 17% over the same period.

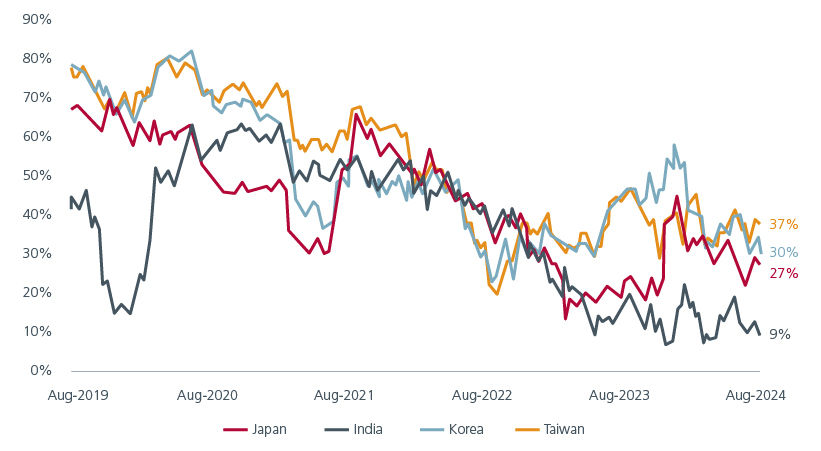

Importantly, MSCI China’s correlation with other markets such as Japan, Taiwan and Korea has been trending down. Fig. 5. Its correlation with MSCI India is even lower. As such, combining both markets in a portfolio can provide investors with significant diversification benefits.

Fig. 5. Rolling correlation with MSCI China

Source: FactSet, MSCI, Goldman Sachs Global Investment Research (15 Aug 2024).

Exhibiting resilience

Besides the market sell-off in August, we note that the Indian stock market has remained resilient to two unexpected domestic “shocks” this year - Prime Minister Modi’s smaller than expected majority in the June election and the capital gains tax increase in the July India budget.

Given the strength of its domestic inflows, it is unlikely that a US recession would derate the Indian equity market. During periods of market volatility, our value focus should allow us to participate in the India structural growth story while providing investors with some buffer i.e. potentially falling less when the market falls.

With periods of volatility expected in the coming months, MSCI China’s trough valuations, low expectations among investors and low correlations with other equity markets should make the market relatively resilient. Although the performance of the Chinese equity market has been disappointing over the last few years, it is in such conditions that value investors are able to uncover attractive bargains. Notably, the internet sector, which accounts for 39% of the MSCI China Index, has been enjoying positive earnings momentum, as e-commerce competition declines and share buybacks accelerate.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).