Summary

Emerging Markets (EMs) are well placed to benefit from the green transition theme. Their dominant share of the world’s reserves in commodities required for green infrastructure and their position as global manufacturing bases will be in demand as green capex spending rises. It is a good time to capture this opportunity since both EMs, and value stocks within EMs are cheap.

A growing number of countries, businesses and institutions are pledging to achieve net-zero emissions by 2050. Today, nearly 100 countries, contributing over 75 percent of greenhouse global emissions (GHG), alongside roughly 7,500 companies and 1,100 cities, have announced a target to reach net-zero emissions.1 Yet the current pledges and spending are still far short of what is required; given the limited window of opportunity to keep to the global warming limit to 1.50C and avoid climate related losses and damages across the globe, the momentum continues to build for a bigger response.

Over 95% of the recent increases in GHG came from emerging and developing countries. This number is set to rise as these countries will account for 98% of the global population growth in this decade, which in turn drives energy demand.2 The key challenge for these countries is to reach a net-zero target without sacrificing growth. Equally, transitioning to net-zero by 2050 will require significant transition capital expenditure (“green capex”).

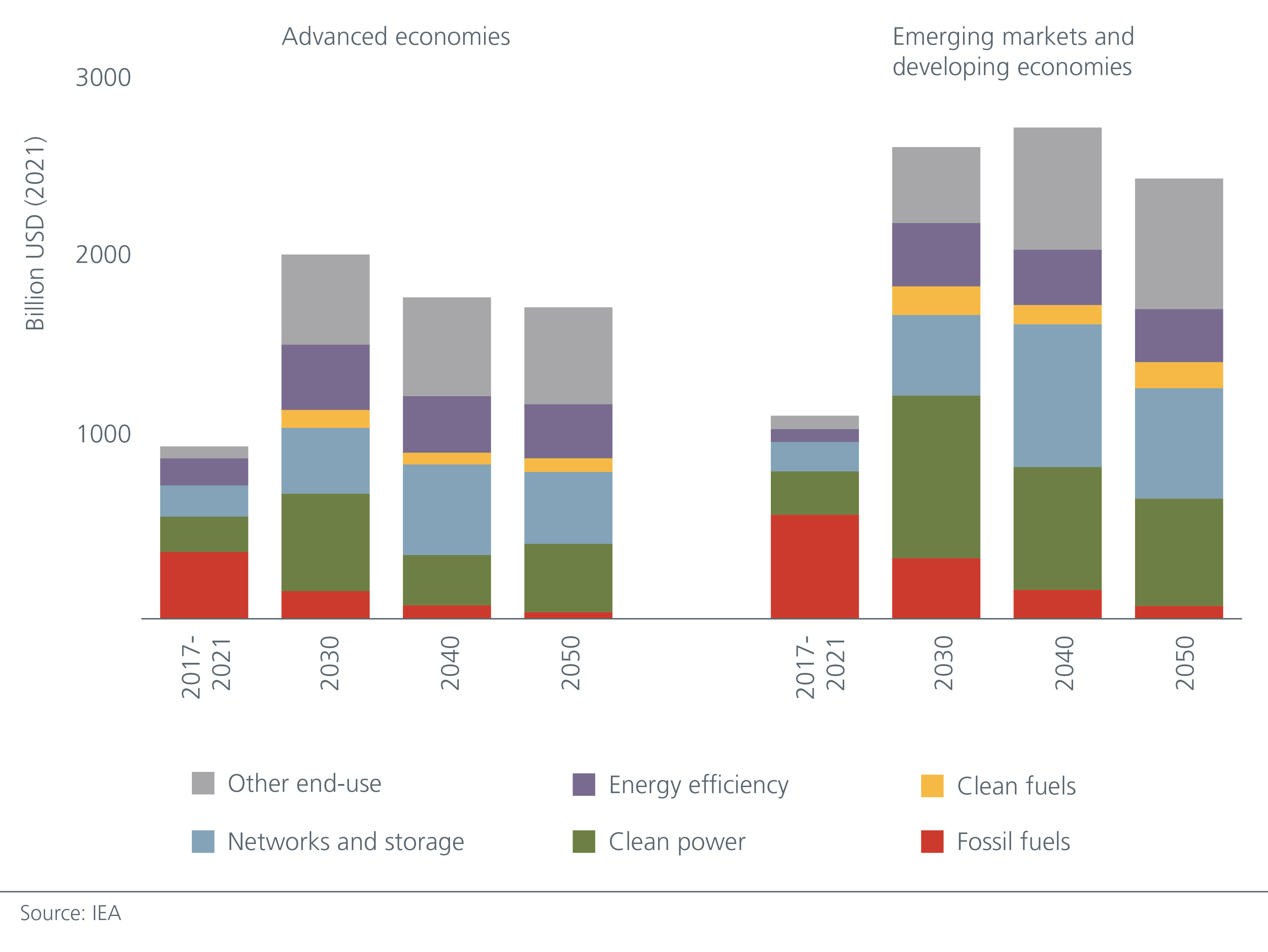

Green capex requirements are huge

Green capex estimates for the energy sector alone, which accounts for around three-quarters of GHG, offer an appreciation of the quantum required. According to the International Energy Association (IEA) total energy capex will rise from around 2.5% of global GDP currently to 4.5% by 2030.

Over the past year, the global energy crisis, precipitated by the Russia-Ukraine war, is accelerating the clean energy transition. Although the high prices and energy shortfalls prompted an increase in fossil fuel consumption, it is a short-term fix. New longer-term plans to invest in clean energy are gaining traction.

In 2021, renewable energy installations posted record growth as renewable energy cost continued to decline, particularly for solar panels. Separately, electric vehicle sales soared in key markets like China, Europe, and the United States. Even during the height of the pandemic in 2020 and 2021, the number of electric vehicles sold globally hit 3 million and 6.6 million respectively.3

Spending in the renewables space is notable especially in the European Union as they seek to reduce dependence on Russian gas. Similarly, Korea and India are increasing their share of renewables in the energy mix. The US, Japan and China have also come up with additional and enhanced clean energy investments plans.

These plans suggest that global annual clean energy investment is set to increase >50% from current levels to > USD 2 trillion by 2030. But this amount is insufficient; to achieve the net-zero by 2050, the level of clean energy investment needs to hit ~ USD 4 trillion per annum, with higher commitments expected from emerging and developing economies.4

Fig 1: Energy investment trends by regions in the net-zero scenario (2017-2050)

Ultimately the point to note is the green capex spending is going to increase as we get closer to the net-zero targets. Moreover, over the last 10 years, companies in both developed and emerging markets have been under-investing in physical assets (property, plant & equipment) and directing the spending to intangibles, particularly in mergers and acquisitions. As the green capex spend requirements increase, this trend will reverse with the new spend going to hard assets. Emerging Markets (EMs) are well placed to benefit given that they are global manufacturing bases.

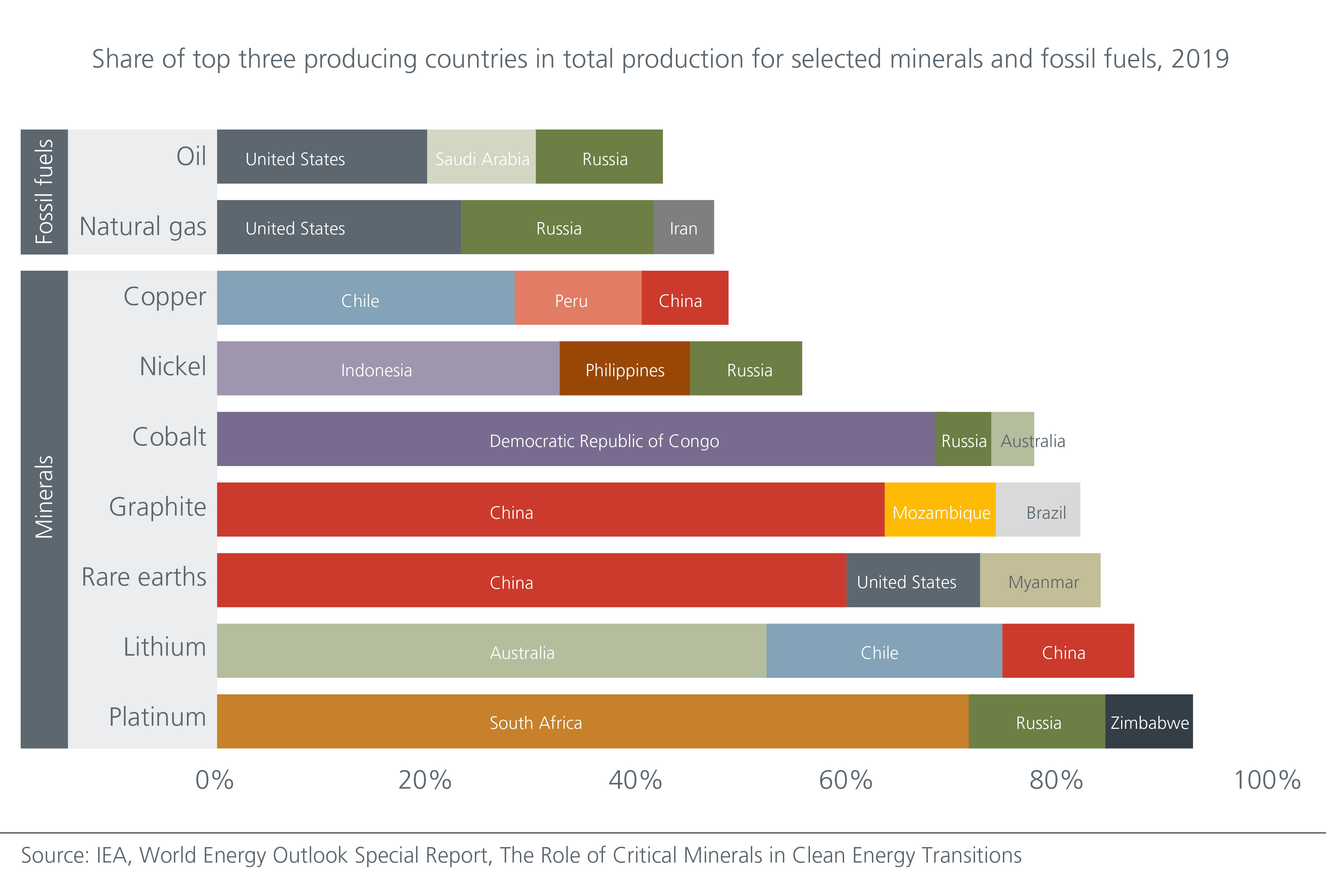

EMs dominate in new and old commodities

Green infrastructure is more commodity intensive. Electric vehicles, for example, use 6 times more minerals than internal combustion engine vehicles. Similarly, wind and solar technology require more materials than coal and gas plants. There will thus be a huge demand for both old and new commodities, many of which can be found in EMs.

Lithium, a new material, is a good case in point. The explosion in lithium prices have resulted in many players buying into lithium projects to offset these high lithium prices. The IEA expects lithium demand to rise by 40 times over the next 10 - 20 years. The potential lies in the underdeveloped lithium reserves. Today Australia is the world’s leading lithium producer. Nevertheless, most the world’s lithium reserves are in Bolivia, Argentina, and Chile. Of these three, only Chile is a serious player today; forecasts show that Argentina could produce 10% of global lithium within the next 10 years.

Fig 2: Current production of energy transition minerals

A turnaround in commodity prices will benefit EMs

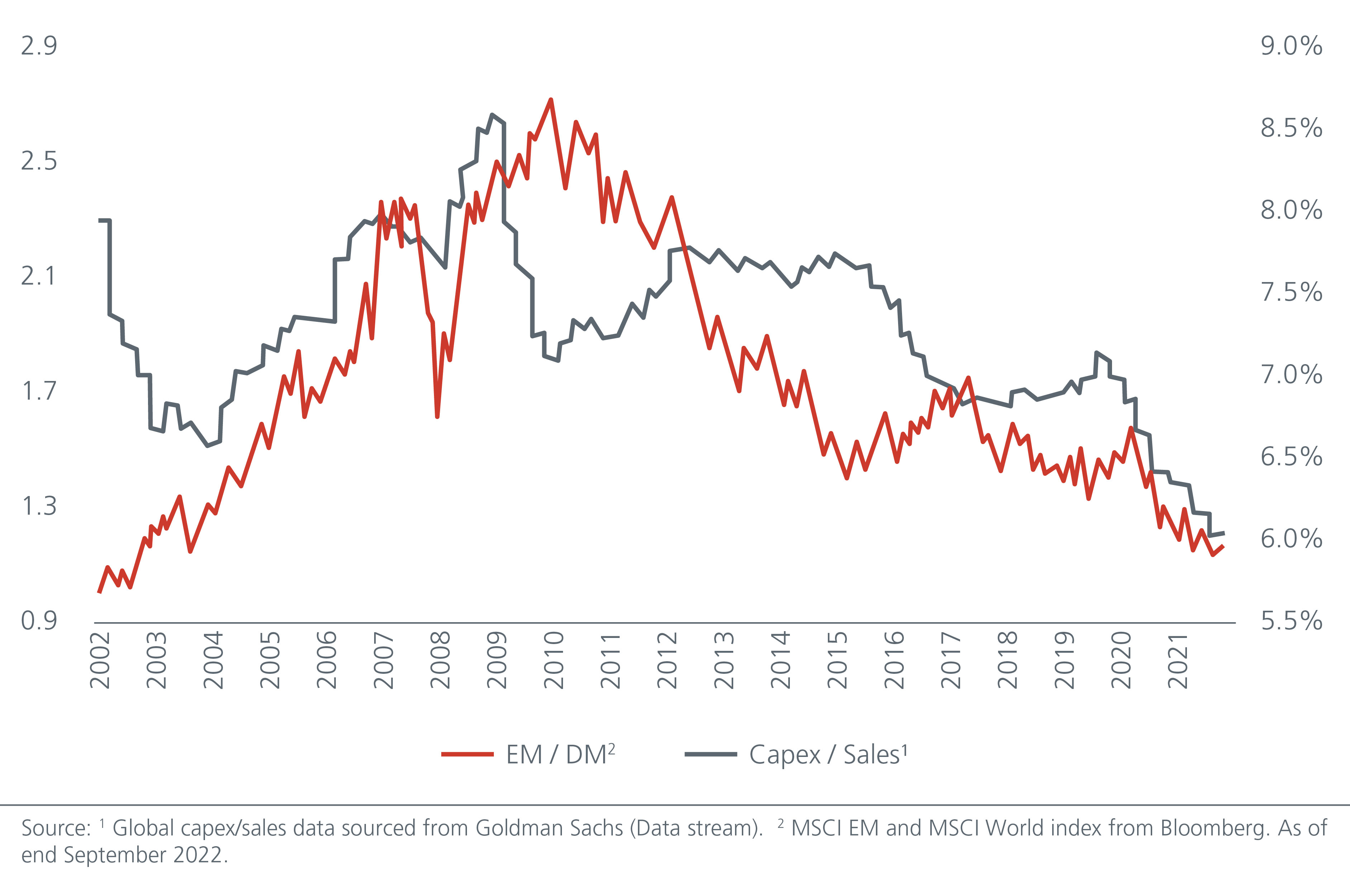

Commodity prices in general have been depressed for some time now. However, looking ahead, investments in clean technology will not only drive the demand for new commodities but also old ones such as steel and cement. As such we think commodity prices should start picking up as green capex spending rises, benefitting EMs.

Meanwhile, past data shows that EMs tend to do better than Developed Markets (DMs) when capex investments are on the rise. See Fig 3. During the commodity boom in the early 2000s, EMs fared better than DMs. However, in the last 10 years since the 2008 Global Financial Crisis, as global capex over sales fell, EMs underperformed DMs.

Fig 3: Green capex should be great for EMs

A similar picture emerges when we consider the performance of MSCI EM Value index to MSCI EM Growth index. The value index outperformed during the commodity capex cycle and underperformed subsequently when investments were being made in asset light companies. Limited capex spending and investments into commodities have been a big headway to EMs – a reversal of this trend augurs well for EMs and value within EMs.

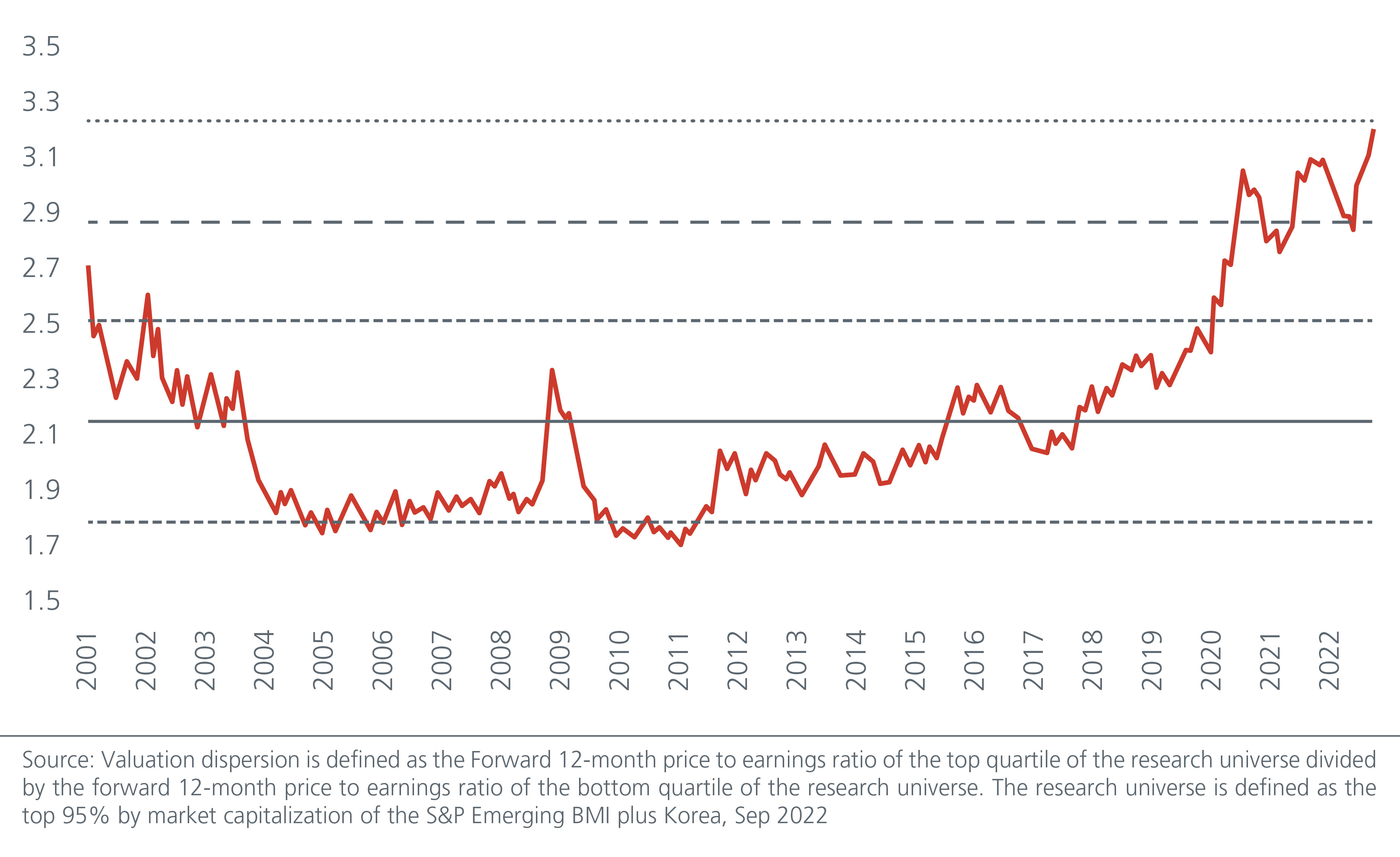

Why value within EMs stand out

On a price-to-book basis, EMs look very cheap compared to DMs. At the same time, within the EM universe, there is still extreme value dispersion; the gap between the most expensive quartile of stocks and the cheapest quartile of stocks is at the widest it has ever been. See Fig 4.

Fig 4: Valuation dispersion between growth and value stocks within EMs

Post the Global Financial Crisis, investors have avoided value names and instead preferred high-quality stocks and those with short-term earnings potential. Although value has made a comeback since late 2020, there is still plenty of room for value stocks to continue their run given the current policy focus on investing in the real economy.

Separately, the green transition theme will also allow investors to capture both the direct and indirect value plays in EMs with a carbon tilt. For example, indirect beneficiaries of green capex include companies exposed to building out renewable energy infrastructure (from steel to smart grid players), EV charging infrastructure, mining capex supply, solar panel installation, etc. A simple focus on only the most obvious “green capex” beneficiaries like EV OEMs and renewable energy utilities, for example, will almost certainly miss great investment opportunities within the far broader commodity and manufacturing expertise within EM.

Our investment proposition

Climate risk is investment risk and financial institutions are increasingly lining up behind net-zero targets. The Glasgow Financial Alliance for Net-Zero for example has over 450 financial firms across 45 countries responsible for over USD 130 trillion in assets under management. These alliances also have specific decarbonisation targets: 25% - 30% carbon reduction by 2025 and 50% by 2030. There are also growing requirements for listed companies to report their climate related information and tighter legislation to prevent green washing efforts.

Thus, the confluence of factors i.e., net-zero targets, asset owners’ pledges, green capex spending, and commodity reserves are firmly in EMs’ favour. The best way to capture this opportunity is to have an exposure to value plays in EMs with a carbon tilt. We believe this is an opportune time to invest in EMs. The global net-zero transition will help shape portfolio outcomes over the coming years, with EMs playing a key role.

Sources:

1 https://climateactiontracker.org/documents/1083/2022-10-26_StateOfClimateAction2022.pdf

2 https://www.weforum.org/agenda/2022/06/3-actions-to-accelerate-emerging-market-climate-transition/

3 https://www.iea.org/commentaries/electric-cars-fend-off-supply-challenges-to-more-than-double-global-sales

4 The Global ESG Research Weekly Observer, Credit Suisse, Oct 2022

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).