Executive Summary

The new US tariffs today have raised the US effective tariff rate from 2.2% at the end of 2024 to close to 20% in less than four months. Within Asia, Trump’s tariff shock is likely to weigh on growth in Vietnam, Korea, Japan, and China most, roughly in that order. While more time and clarity are needed to assess the secondary and tertiary effects on economies and sectors, the ensuing market volatility should present opportunities for active investors.

According to our Chief Economist, Ray Farris, US President Donald Trump’s announcements of new tariffs today have raised the US effective tariff rate from 2.2% at the end of 2024 to close to 20% in less than four months. If items currently under Section 232 investigation end up incurring tariffs, which seems likely, the US effective tariff rate is likely to rise to 25% - 27%, above those that followed the Smoot-Hawley tariff in 1930 act that exacerbated the Great Depression.

Auto tariffs take effect on April 5 while the new reciprocal tariffs hit on April 9. Copper, lumber products, semiconductors, pharmaceuticals, and some other products are currently excluded from the reciprocal tariffs but are at risk of future tariffs due to ongoing Section 232 investigation.

We are not optimistic that many countries will reach agreements with the US before the April 9 deadline, and we expect the EU, Canada, and China to announce retaliatory measures.

Markets have reacted negatively to the tariff announcements with S&P 500 futures down over 2.8%, Nasdaq 100 futures off 3.3%, the US 10-year Treasury yield down almost 8bps to 4.06%, and markets pricing 83bps of Fed cuts by year end.1

We judge these tariffs, if sustained, as likely to push US GDP growth down from 2.5% to about 0.6% - 0.8% this year. Tariffs are a tax on consumption and investment that history shows also generate broader welfare losses due to shifts in resources to lower productivity uses.

Remember also that the tariffs come on top of other fiscal tightening measures of about 0.1% - 0.2% of GDP and rapid curtailment of immigration that is likely to cost US GDP 0.3% - 0.5%. Additionally, US exports are likely to weaken in response to likely retaliatory measures from US trading partners, particularly China, the EU, and Canada.

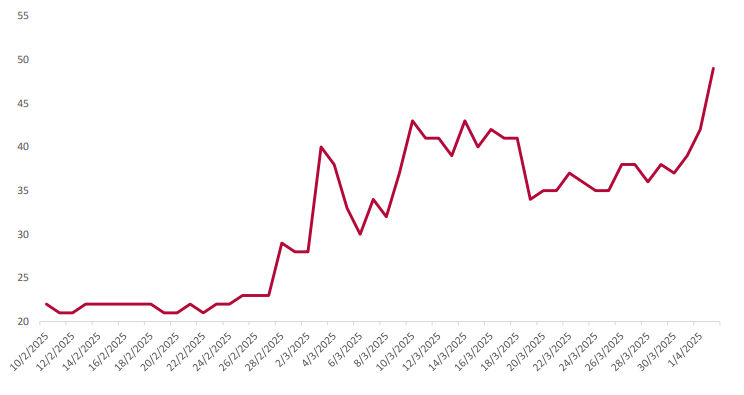

We assess the risk that these shocks culminate into a larger than estimated hit to the economy that turns into a recession as at least as high as the jump in market pricing of recession risk to just under 50%. US recessions are notoriously difficult to predict, but we think the risk of one in the next 12 months is now close to 60%.

Fig 1: Polymarket US recession risk price, %

Source: Bloomberg

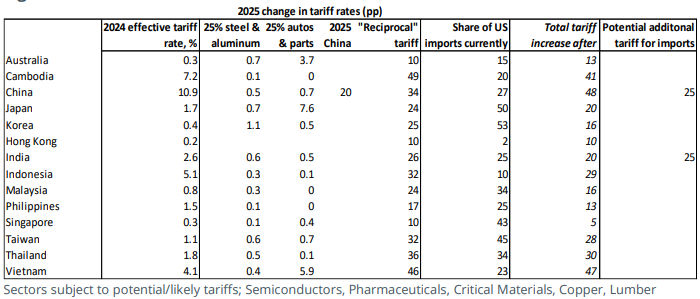

Within Asia, Trump’s tariff shock is likely to weigh on growth in Vietnam, Korea, Japan, and China most, roughly in that order. Effective tariff rates on these countries have increased to 47%, 16%, 20%, and 48% respectively since the start of the year. However, these tariff rate increases need to be scaled by the countries’ exports to the US as a share of their GDP (see Fig 2 below).

Fig 2: Tariff table

Sectors subject to potential/likely tariffs; Semiconductors, Pharmaceuticals, Critical Materials, Copper, Lumber Source: The White House, Goldman Sachs Global Research, Nomura Global Economics. April 2025.

China and India are at risk of seeing their tariff rates rise to 79% and 51% respectively if the US’ 25% tariff on imports from countries that import oil from Venezuela is layered on top of the tariffs announced today.

More generally, all Asian economies are likely to face significant downward pressure on growth this year for three key reasons:

- The sharp increase in US tariff rates on virtually all Asian economies shown in the table will reduce US demand for Asian exports directly.

- The damage to the US, European, and other major economies from Trump’s tariff war will further depress their demand for Asian exports.

- Trump’s decision not to impose punitive reciprocal tariff rates on Latin American or African economies creates incentives for companies to try to relocate production from Asia to these regions. The new effective US tariff rates on most Latin American and African countries are only 10% or lower.

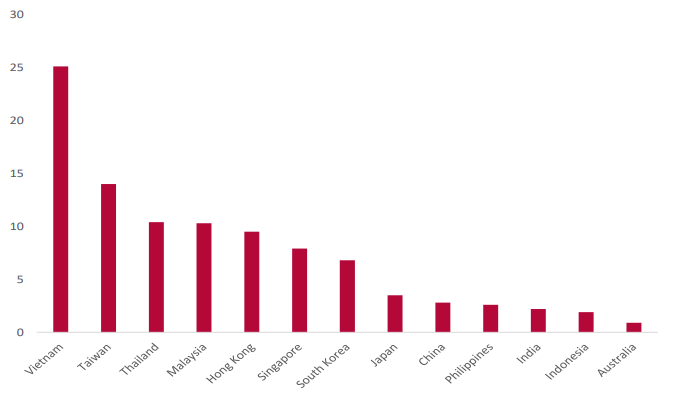

Fig 3: Exports to the US as a % of GDP, 2024

Source: LSEG Datastream. April 2025.

Against this background, it will be crucial to focus on economies where policy can work to offset these negative shocks. We think China and India stand out:

China: China's government has already announced fiscal stimulus worth about 2% of GDP for this year. That is insufficient to offset the tariff shock Trump announced yesterday, but China’s government has also suggested that it has measures in reserve it can use to support growth. We think it will adopt a “whatever it takes” approach this year to try to keep growth above 4.5%. This implies a very heavy focus on domestic consumption and investment spending.

India: The collapse in inflation to 3.6% year-on-year in February vs. the Reserve Bank of India’s ceiling of 6% gives it large room to cut its policy rate from the current 6.25% and ease restrictions on household credit growth. Additionally, India’s government has signaled a willingness to cut its tariff regime aggressively to do a deal with the US. Importantly, Indian exports to the US are small at 2.2% of GDP.

Returning to the risk of US recession and potential Fed rate cuts, we reiterate several points from our recent CIO Weekly updates:

- The impact of tariffs on hard US data such as retail sales, employment, and inflation is likely to come with lags of several months. We don’t expect meaningful effects to begin emerging until the May data that are released in June.

- In the interim, markets are likely to focus on the extent to which consumer confidence surveys and the ISM surveys fall. Initial jobless claims are likely to be the market’s bellwether for impact on the labour market.

- The Fed is likely to express concern about inflation, but we think the Fed will begin cutting if the US unemployment rate rises to 4.5% or above over consecutive months with initial jobless claims breaking above 350k regardless of inflation

Finally, if Treasury yields continue to fall, they could work to offset some of the negative effect of tariffs by pulling down mortgage rates and stimulating housing. We think the 30- year fixed rate needs to drop to close to 6% for this effect to be large. We also see a risk that if Trump imposes tariffs on lumber products and other building materials, the resulting increase in home building costs could offset much of the benefit of falling mortgage rates on affordability.

Investment Implications for Asia

According to Arthur Chai, Portfolio Manager, Asia Growth Equities team, the tariffs announced were worse than expected and, in some cases, larger than the worst-case scenarios assessed by investors in the preceding weeks.

On the flip side, there were modest positive outcomes for certain product categories, notably semiconductors and pharmaceuticals, which will be positive for certain large sectors of the Asian equity market, namely Taiwan and Korea semiconductor manufacturers, and Indian pharmaceutical manufacturers. The exclusion of semiconductors was unexpected, given previous US tariff threats to boost US domestic manufacturing. If semiconductors in finished products from Asia are also excluded, it reduces the value added by Asian tech hardware production and modestly lowers the blended tariffs on tech exports to the US. The reason for this exemption remains unclear.

On the whole, there are expectations the impact of tariffs will decrease as countries negotiate bilateral trade agreements with the US for tariff modifications in exchange for trade and economic concessions. That said, Christina Woon, Head of Asia Equity Income, adds that many Asian companies are more insulated from tariffs due to their domestic focus. A relatively higher proportion of Asian companies have net cash balance sheets. The higher free cash flow yield within Asia relative to rest of the world suggests there is a buffer from a yield perspective in a declining earnings environment. Additionally, the push for better shareholder returns is leading to rising dividend payouts, meaning tariff pressures may not linearly translate into pressure on dividends.

Meanwhile, Michael Sun, Client Portfolio Manager of Quantitative Strategies team, observes that as tariff policy uncertainties have increased market volatility, a significant rotation has taken place: at a market level from Developed to Emerging, at a sector level from cyclical to defensive, and at a style level from high risk to low risk and from growth to value. As such, diversification across regions, sectors, and investment styles is crucial to mitigate risks and seize opportunities in this dynamic market environment.

India

India has been hit by a relatively high tariff rate of 26%, which also appears to be at the high end of expectations. However, India is widely expected to be able to accomplish a meaningful reduction with a bilateral trade deal which is already being negotiated with the US. The impact on listed companies is better than expected due to the exemption of pharmaceuticals, which are a major part of the Indian market. Most of the tariff increases will affect sectors dominated by unlisted, small to medium-sized companies.

ASEAN

The tariffs for the ASEAN-6 countries vary significantly but on average, the ASEAN-6 tariff is 34%, which is higher than the global average reciprocal tariff of around 24%. Bryan Yeong, Portfolio Manager, Equities stresses that the impact of these tariffs will depend on each country's exposure to the US market and the specific sectors. Vietnam's goods exports to the US are the highest at 25% of GDP, followed by Thailand (10.4%), Malaysia (10.3%), and Singapore (8%). Indonesia and the Philippines have smaller figures, around 2% of GDP each. On a sector basis, these ASEAN-6 tariffs have an outsized impact on companies that are involved in outsourced manufacturing for apparel and sportswear as their export costs come under significant pressure with the major centres of outsourced production all located in ASEAN (and China).

With the imposition of tariffs, he believes that the benefits of reshoring to ASEAN may be reduced. This could have a negative impact on foreign direct investment inflows into the region where Vietnam, Thailand and Malaysia have benefitted from in the past. There is potential for negotiation, as US officials have indicated that the current tariffs represent the "high end of the number," provided the countries do not retaliate.

China

Jocelyn Wu, Portfolio Manager, Greater China Equities, considers the heavy-handed level of tariffs could reduce China’s economic growth by a meaningful amount. As such China is likely to initiate new policies to mitigate part of the tariff impact. This will create more uncertainty in the market. Complicating this backdrop is the upcoming deadline of April 5 that the US government has set to find a US buyer for Tik Tok. Therefore, the tariff situation remains fluid.

That said, the Hong Kong / China equity markets have been exposed to many uncertainties, including tariff uncertainty. The team will adopt a bar-bell investment strategy, focusing on domestic sectors insulated from exports and sectors that could benefit from potential new Chinese policies to offset tariff risks. Preferred sectors include domestic consumption with improved supply and demand dynamics and select financial names with attractive dividend yields.

Japan

If the tariffs remain at the announced level, Ivailo Dikov, Head of Japan Equities, believes Japan’s economic growth could be more negatively impacted than expected due to a potential global demand slowdown. More time and clarity are needed to assess the full effects on the global economy and Japanese corporate profits, some of which could be positive.

If the Yen appreciates and commodity prices soften, it could ease domestic cost-push inflation and benefit industries tied to domestic consumption (e.g., domestic retail, railways, utilities) relative to exports and capex (e.g., autos, machinery, US-exposed retail). Reflation and potential real wage growth should support Japan’s domestic economy.

We believe the Bank of Japan will need to assess the impact on corporate earnings, wage negotiations, and inflation before further rate normalisation. During market volatility, the team prefers to wait for the dust to settle rather than anticipate short-term movements.

This approach has historically led to new alpha opportunities. We remain broadly balanced across domestic and exporter exposures, focusing on fundamentals and valuation to navigate the uncertain times ahead.

Asia Fixed Income

Eric Fang, Portfolio Manager, Asian Fixed Income points out that amidst the tariff war uncertainty, the team continues to favour a more defensive position. This includes overweighting Investment Grade credits and Emerging Market (EMs) local currency duration. Within EMs, Latam and commodity exporting bloc appears most spared from direct tariffs and could outperform over the near term.

Sources:

1 As of 3 April 2025.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (531241-U).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).