To recap, recession talks emerged in late 2018 which subsequently faded early 2019 only to resurface in the third quarter when yields on short-term US bonds rose higher than those of long-term bonds. This phenomenon known as

the inverted yield curve is typically taken as a sign of a contracting economy and historically has preceded every recession in the past 50 years.

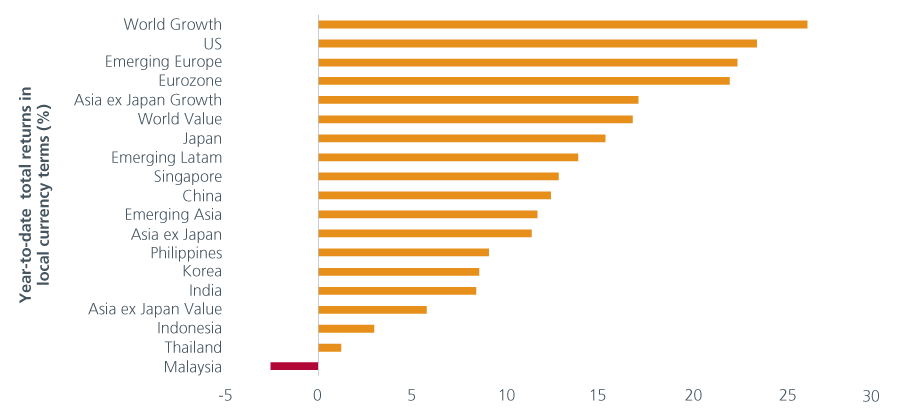

Stock markets have rallied and sold off (both times sharply) as these fears ebbed and flowed. Investors who have avoided equities over concerns of an impending recession would have lost out on some spectacular returns. The

S&P 500, for example, set another record high at the start of November 2019 on better-than-expected US jobs data. Over in Asia, stock markets have also recorded robust returns year-to-date as evidenced by the chart.

Our investment teams are of the view that the while global growth is expected to remain lacklustre, a global recession is still not their base case scenario taking in the view the likely policy support and varied strands of domestic

resilience (refer to the interview with our Head of Investment Solutions, Kelvin Blacklock). US economic data while

moderating is still decent, and the strong labour market continues to support consumer spending. The US economy should also continue to enjoy support from easy financial conditions and buoyant asset markets.

With expectations on the low end, upside surprises in growth data could again trigger a rally as will the resolution of the US-China trade tensions. Staying on the side lines could prove costly but not without due diligence.

Best to go back to basics – rely on fundamentals and be selective when choosing equity investments (refer to the interview with our CIO of Equities, Kevin Gibson).

Equities have chalked up attractive returns in 20191

Source:

1MSCI Ac Asia Ex Jp, MSCI EM Europe, MSCI EM Asia, MSCI India, MSCI USA, MSCI Japan, MSCI EMU, MSCI China, MSCI EM Latin America, MSCI World Value, MSCI World Growth, MSCI AC Asia Ex Jp Growth, MSCI

AC Asia Ex Jp Value, MSCI Thailand, MSCI Philippines, MSCI Singapore, MSCI Malaysia, MSCI Korea, MSCI Indonesia as at 31 Oct 2019 from Refinitiv Datastream. Please refer to www.eastspring.com/reference-index-list for more details on the indices.