Here are 5 steps to help you start investing. The earlier you start, the more time your money has to grow.

STEP 1

Set your goals

Have goals that are specific, measurable and realistic. You are more likely to stay focused and achieve them.

Writing your goals down can increase your success rate.

STEP 2

Work out your risk appetite

Some asset classes fluctuate more than others but may offer higher returns.

Having a variety of assets helps smooth your investing journey.

You may also take on more or less risk, depending on how your financial circumstances change. For instance, a large pay rise or windfall may increase your risk tolerance. A job loss or new baby potentially reduces.

STEP 3

Choose your investments

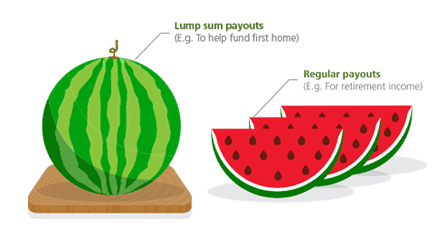

Different types of investments serve different purposes.

Bond or equity mutual funds can give you lump sum payouts in the form of capital gains and investment income.

If you need regular payouts, annuities can provide a fixed stream of payments.

STEP 4

Keep an eye on your portfolio

But don’t over-do it! Over-monitoring may cause you to sell at the wrong time, especially when markets fall.

Stay the course if your initial reasons for investing have not changed.

Avoid panic and emotional decisions. Remember why you are investing and stick to the plan.

STEP 5

Fine tune

Fine tune your portfolio at least once a year.

This is useful as your financial circumstances may have changed due to unexpected expenses, a windfall, job loss, new goals, etc.

You can also speak to your financial adviser on the new opportunities and risks in the market.