Real Estate Investment Trusts (REITs)

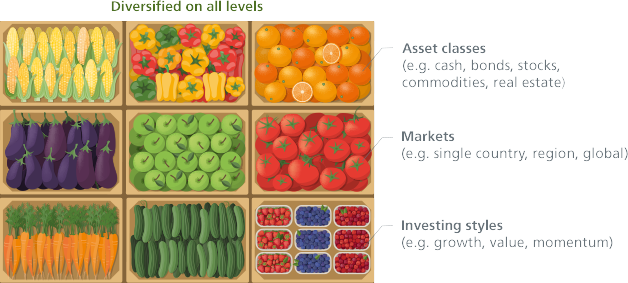

A multi asset strategy offers a one-stop portfolio of different asset classes. Discover its merits.

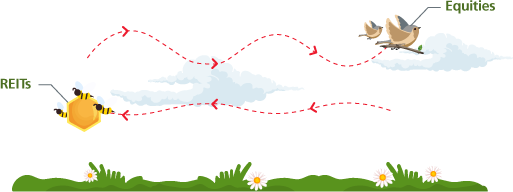

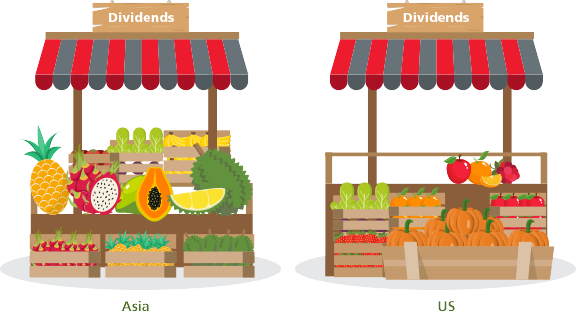

Equities are perhaps the largest investment asset class from an investor's perspective. When you invest in equities, you get income from dividends (and capital gains if you sell your equities at a profit). Dividends are an important source of returns and can help make your portfolio more defensive. Learn more about their attractive features, in particular Asian dividends.

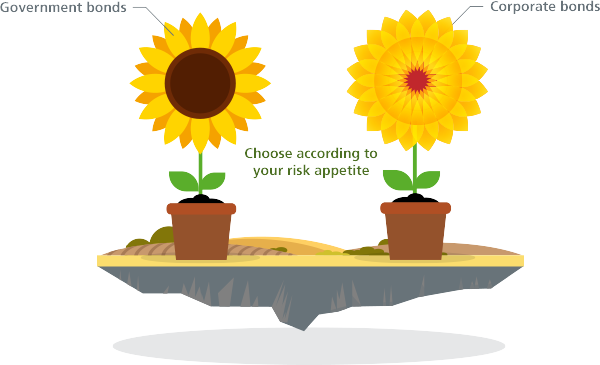

Bonds, like equities, are another important investment asset class. Bonds are basically an IOU between you (the lender) and corporations or governments (the borrower). Bonds are also known as fixed income. The interest you earn is paid in regular intervals. This interest is called coupon because in the old days, bonds were issued as bearer certificates and had detachable coupons printed on them for each scheduled interest payment. Find out if bonds fit your investment profile.

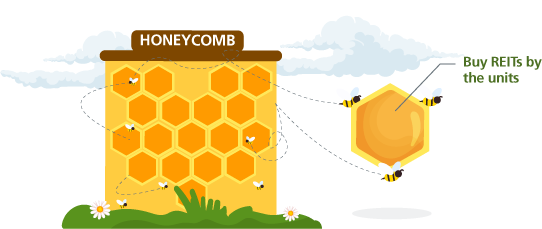

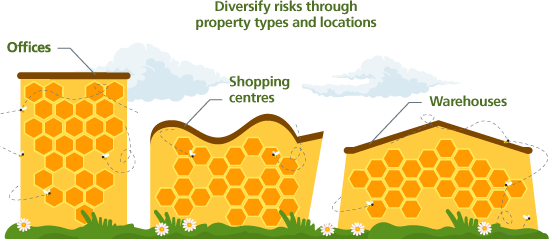

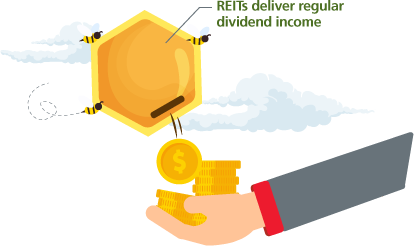

If you are keen on real estate, you needn’t just own physical property. You can also buy the shares of a Real Estate Investment Trust (REIT). A REIT is a company that owns and manages income-generating real estate assets. REITs offer five key advantages: