Summary

Eastspring’s Multi Asset Portfolio Solutions (MAPS) team believes that the odds of a US recession, albeit a shallow one, is rising. A well-diversified portfolio can help investors ride through the market volatility during an economic downturn. Active managers can also implement recession hedges to buffer portfolio returns.

The US economy has shown remarkable resilience to date despite the US Fed being on its fastest tightening cycle in recent history1. The US unemployment rate remains at historical lows and consumer spending rose 3.7% in the first quarter of 2023 compared to the same period last year, up from 1% in the fourth quarter of 2022. That said, several of the indicators which the Eastspring’s Multi Asset Portfolio Solutions (MAPS) team monitors are warning of a deterioration ahead. The recent banking stresses in the US have further tightened credit conditions, thereby increasing the risks of a US recession.

Deterioration ahead

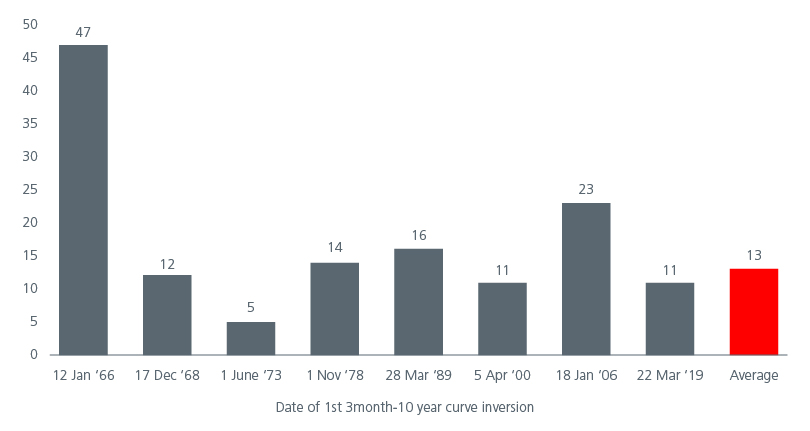

The 3m-10y yield curve has been the most accurate predictor of a US recession historically, with a 100% track record for the last 8 recessions since 1966. On average, there is a 13-month lag between yield curve inversion and a recession, although the period ranges from 5 to 47 months. Fig. 1. while the most recent inversion of the 3m-10y curve took place in November 2022, we believe that we are in a “late” market cycle where economic activity will likely reach its peak (i.e., growth slows down, but remains positive), before heading into a recession over the next 6-12 months.

Fig. 1. Lag between yield curve inversion and NBER recession (months)

Source: Eastspring Investments. May 2023.

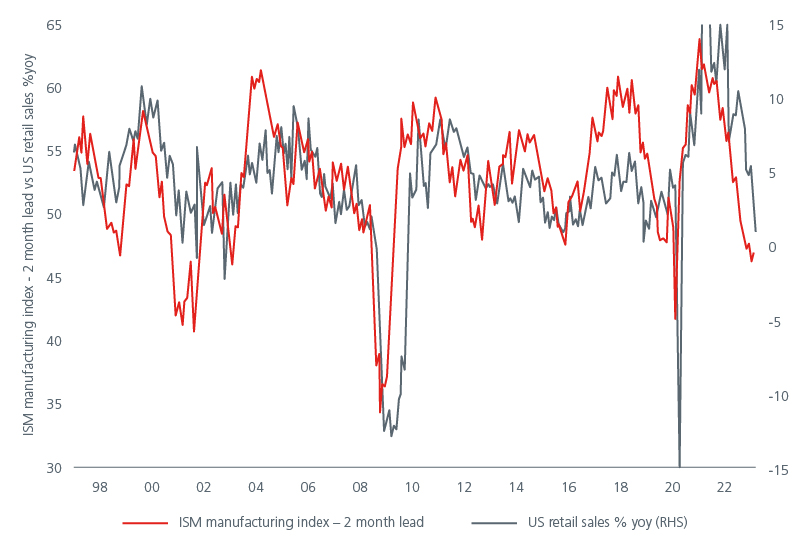

Other indicators that the team monitors are also pointing to an impending slowdown in the US economy. Historically, the ISM Index has led US retail sales. With the index on a downward trend (Fig. 2), the year-on-year change in retail sales should turn negative in the next couple of months. The strong first quarter consumer spending data belies the deterioration which we are already seeing in the monthly retail sales data. US retail sales grew 1.6% on a year-on-year basis in April, down from 2.9% in March. This is significant as consumer spending accounts for 70% of the US economy.

Fig. 2. ISM manufacturing index suggests that US retail sales will fall

Source: Refinitiv Datastream. May 2023.

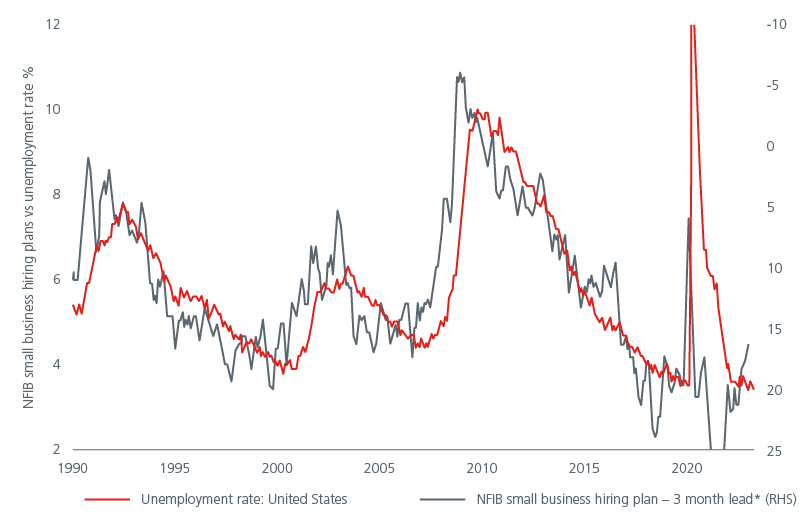

US small businesses are another important barometer on the health of the US economy. Small businesses2 form a vital part of the economy, accounting for 46% of America’s private sector workforce and 43.5% of US GDP3. The hiring plans of US small businesses have historically been a leading indicator for the US unemployment rate. To date, the US unemployment rate remains at a historically low level of 3.7% in May, supported by strong jobs growth. However, with US businesses appearing to be dialling back their hiring plans (Fig. 3), we expect the unemployment rate to rise in the coming months.

Fig. 3. NFIB Small business hiring plans point to rising unemployment

Source: Refinitiv Datastream. May 2023. *Net % change.

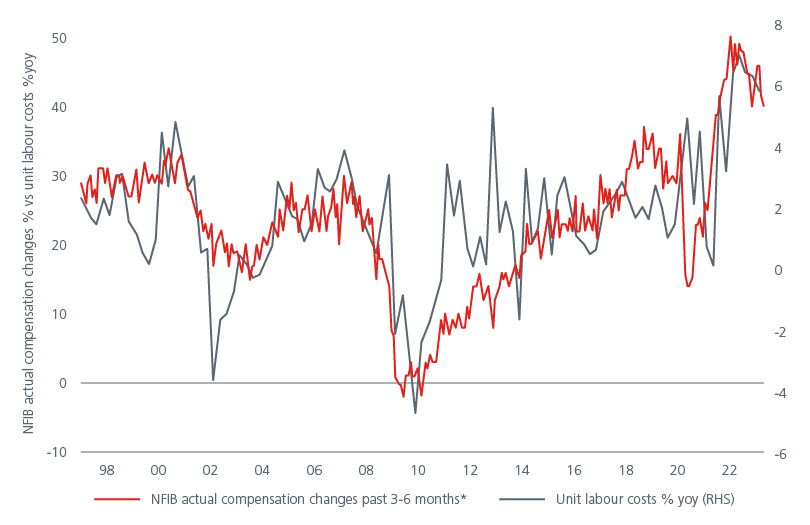

As the US economy weakens and the unemployment rate rises, inflation should also fall as strong wage growth has been one of the key factors holding up US inflation. Small businesses' compensation plans, which have historically led actual changes in compensation, suggest that wages will fall. Fig. 4.

Fig. 4. Small business compensation changes suggest wages would fall

Source: Refinitiv Datastream. May 2023. *Net percentage change in the last three to six months.

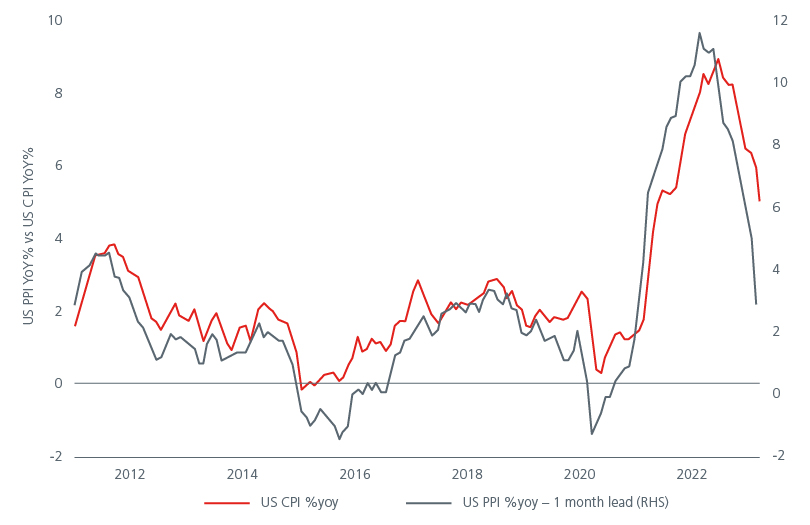

This softer outlook for inflation concurs with what the US Producer Price Index (PPI) is signalling. Producer prices gained 2.3% in April from the previous year, below consensus expectations. Following the historical relationship between producer and consumer prices (Fig 5), consumer prices should be nearer to 3% over the next few months. Core PCE index — the Federal Reserve’s favoured inflation measure — was higher than forecast at 4.4% year on year in April.

Fig. 5. US producer prices point to lower consumer prices

Source: Refinitiv Datastream. May 2023.

The yield curve steepener

Active managers, like ourselves, can implement recession hedges to buffer portfolio returns during economic downturns. The steepener trade has historically outperformed during recessions. The trade combines a long position in a short-dated bond with a short position in a long-dated bond. The trade becomes profitable as the spread between the short and long-term yields widens.

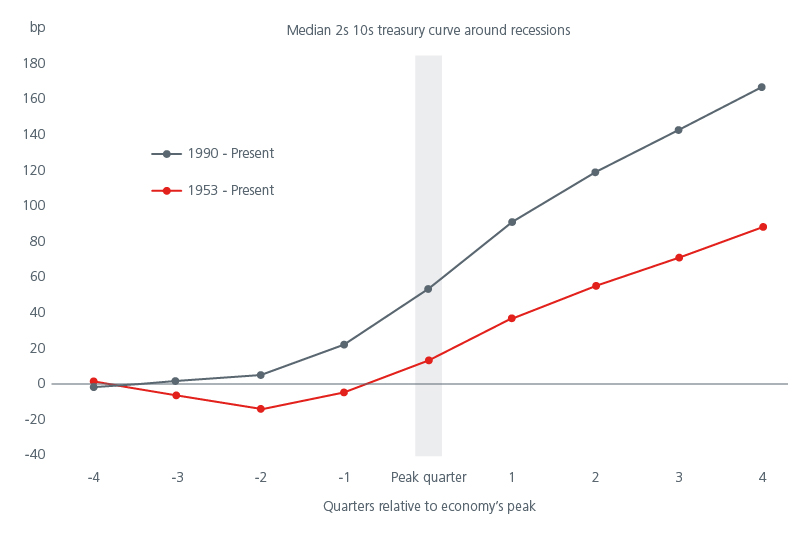

The US 2-10y yield curve tends to steepen during recessionary periods as weaker economic growth drives rate expectations lower, thereby pushing down the short end of the yield curve. Fig. 6.

Fig. 6. The steepener outperforms during recession

Source: Goldman Sachs, November 2022.

While the rationale for the steepener trade may appear intuitive, timing is key. Historically, the best entry point for such a trade has been between the Fed’s last rate hike and first rate cut. Entering the steepener trade before the end of the Fed’s rate hike cycle has historically not produced additional upside.

The recent collapse of the Silicon Valley Bank and the ensuing market volatility in March made the timing of this trade trickier. Bond yields rallied sharply in early March, potentially bringing forward the entry point for the trade. The extent of the rally in the 2-year Treasury yields which historically may have taken three to six months in similar periods of market volatility, took only one week. Our experience told us that the price action in the bond market was overdone. Instead, we relied on our proprietary indicators to guide us on the entry point. With the markets pricing in the possibility of a pause and subsequent rate cuts following the Fed’s 25bp hike in May, we continue to rely on our proprietary indicators to time the further increases in exposure to this trade.

Recession hedges

The leading variables that we monitor point to a US recession potentially in the next six to twelve months, as the US economy absorbs the full impact of the Fed’s tightening. That said, any recession is likely to be shallow as household and non-financial corporations’ balance sheets remain relatively healthy. Despite the recent troubles for the smaller banks in the US, we believe that this does not pose any systemic risk to the US banking system. That said, the volatility in the US banking system will have a downstream impact on the US economy. Even though bank lending standards were tightening before the Silicon Valley Bank debacle, recent events will only exacerbate the credit tightening trend, and in our view increase the risk of a US recession.

During recessions, good quality bonds and the more defensive equity sectors such as utilities and consumer staples tend to fare better. Historically, gold has also largely maintained its value during economic slowdowns. A well-diversified portfolio can help investors ride the market volatility as corporate profits decline. Active managers are also able to implement recession hedges such as yield curve steepeners to buffer portfolio returns during economic downturns.

Sources:

1 https://www.weforum.org/agenda/2022/10/comparing-the-speed-of-u-s-interest-rate-hikes-1988-2022/

2Defined as independent businesses that have less than 500 employees.

3US Small Business Association (SBA). April 2023.

Singapore by Eastspring Investments (Singapore) Limited (UEN: 199407631H)

Australia (for wholesale clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore, is exempt from the requirement to hold an Australian financial services licence and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Australian laws

Hong Kong by Eastspring Investments (Hong Kong) Limited and has not been reviewed by the Securities and Futures Commission of Hong Kong.

Indonesia by PT Eastspring Investments Indonesia, an investment manager that is licensed, registered and supervised by the Indonesia Financial Services Authority (OJK).

Malaysia by Eastspring Investments Berhad (200001028634/ 531241-U) and Eastspring Al-Wara’ Investments Berhad (200901017585 / 860682-K).

Thailand by Eastspring Asset Management (Thailand) Co., Ltd.

United States of America (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is registered with the U.S Securities and Exchange Commission as a registered investment adviser.

European Economic Area (for professional clients only) and Switzerland (for qualified investors only) by Eastspring Investments (Luxembourg) S.A., 26, Boulevard Royal, 2449 Luxembourg, Grand-Duchy of Luxembourg, registered with the Registre de Commerce et des Sociétés (Luxembourg), Register No B 173737.

United Kingdom (for professional clients only) by Eastspring Investments (Luxembourg) S.A. - UK Branch, 10 Lower Thames Street, London EC3R 6AF.

Chile (for institutional clients only) by Eastspring Investments (Singapore) Limited (UEN: 199407631H), which is incorporated in Singapore and is licensed and regulated by the Monetary Authority of Singapore under Singapore laws which differ from Chilean laws.

The afore-mentioned entities are hereinafter collectively referred to as Eastspring Investments.

The views and opinions contained herein are those of the author, and may not necessarily represent views expressed or reflected in other Eastspring Investments’ communications. This document is solely for information purposes and does not have any regard to the specific investment objective, financial situation and/or particular needs of any specific persons who may receive this document. This document is not intended as an offer, a solicitation of offer or a recommendation, to deal in shares of securities or any financial instruments. It may not be published, circulated, reproduced or distributed without the prior written consent of Eastspring Investments. Reliance upon information in this document is at the sole discretion of the reader. Please carefully study the related information and/or consult your own professional adviser before investing.

Investment involves risks. Past performance of and the predictions, projections, or forecasts on the economy, securities markets or the economic trends of the markets are not necessarily indicative of the future or likely performance of Eastspring Investments or any of the funds managed by Eastspring Investments.

Information herein is believed to be reliable at time of publication. Data from third party sources may have been used in the preparation of this material and Eastspring Investments has not independently verified, validated or audited such data. Where lawfully permitted, Eastspring Investments does not warrant its completeness or accuracy and is not responsible for error of facts or opinion nor shall be liable for damages arising out of any person’s reliance upon this information. Any opinion or estimate contained in this document may subject to change without notice.

Eastspring Investments companies (excluding joint venture companies) are ultimately wholly owned/indirect subsidiaries of Prudential plc of the United Kingdom. Eastspring Investments companies (including joint venture companies) and Prudential plc are not affiliated in any manner with Prudential Financial, Inc., a company whose principal place of business is in the United States of America or with the Prudential Assurance Company Limited, a subsidiary of M&G plc (a company incorporated in the United Kingdom).