2016 GLOBAL ASSET ALLOCATION OUTLOOKCHALLENGING CYCLICAL PROFIT OUTLOOK AND THE IMPLICATIONS FOR INVESTORS

Insights

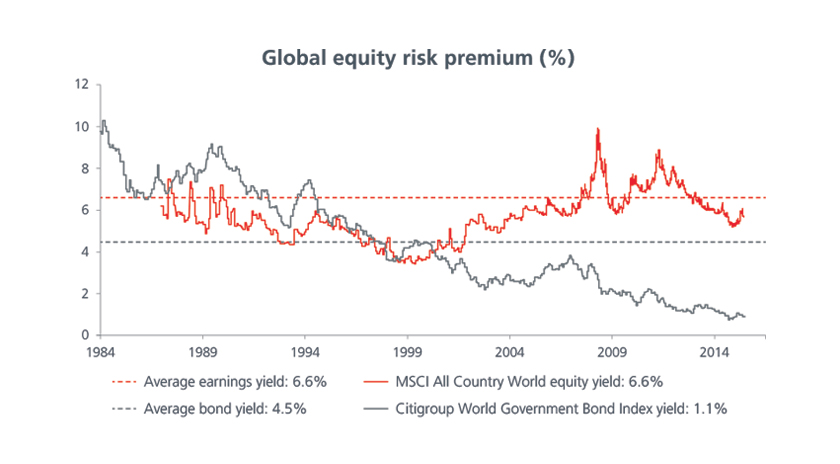

We enter 2016 with a modest overweight to equities relative to fixed income. Global equities offer only modest outright valuation support relative to history. On the positive side, the gap between the earnings yield on equities and the yield on sovereign bonds suggests that equities should outperform sovereign bonds over the medium term. Hence for multi asset funds we have a modest overview to equities from bonds.

Here are some key take away on the market

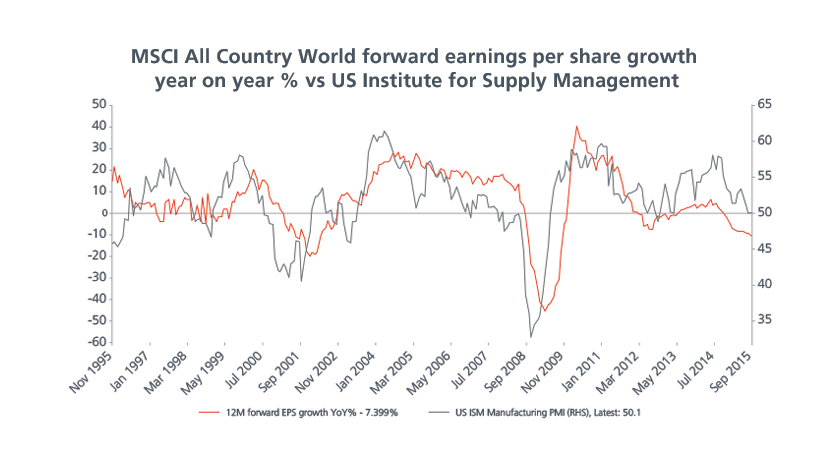

Equity valuation is always conditional on earnings or profits. Our fear is that the correction in global equities reflects a genuine deterioration in the profit cycle. While the weakness at a global aggregate level probably reflects the cyclical deterioration in manufacturing and trade, it is possible that there are also structural conditions weighing on profits in select markets.

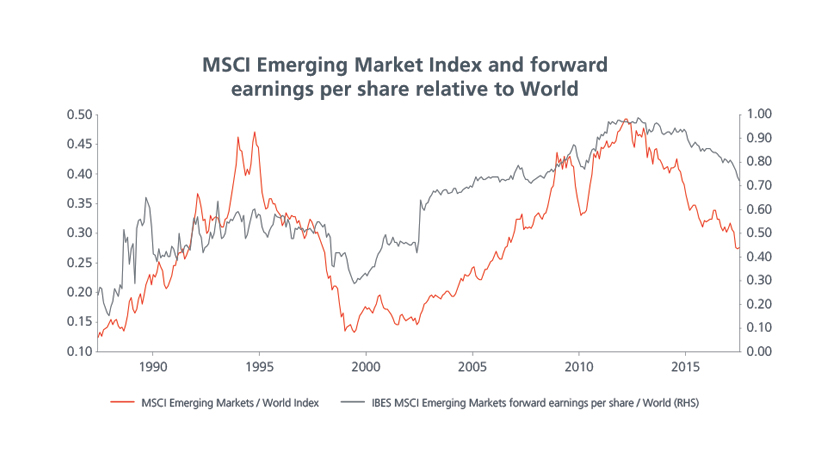

Source: Thomson Routers Datastream, as at 3 October 2015The ongoing weakness in global manufacturing, trade, Asian exports, and commodity and producer prices is evidence of the trend of underperformance in emerging market. While this condition is well appreciated, our fear is that it is legitimate and not fully played out nor priced into all related assets.

Source: Thomson Routers Datastream, as at 1 October 2015The good news is that growth in the domestic US economy and Europe remains firm. The US unemployment rate is near full employment (5.1%) and housing activity is contributing to growth. In Europe, loan growth is expanding for the first time in ten years.

While high yield spreads offer above average levels of spread (or risk) compensation, a genuine profit recession would be challenging for the sector’s fundamentals. A rise in default rates is also plausible next year.

Private sector credit has increased since the last crisis and might contribute to a challenging phase for emerging markets next year if US dollar strength and/or commodity price weakness persists.

BIOGRAPHY

Chief Investment Officer, Global Asset Allocation

Kelvin joined Eastspring Investments as Chief Investment Officer, Global Asset Allocation in 2001.

He is responsible for the Global Asset Allocation team. Kelvin also plays a key role in the strategic asset allocation advisory and liability management of The Group’s life insurance assets in the region. Over his 14 year tenure at Eastspring Investments, Kelvin has also had responsibility for the fixed income team, derivatives and structured products as well as alternative assets.

Kelvin has in total of 25 years investment experience across a wide range of asset classes and markets. Prior to joining Eastspring Investments, Kelvin worked for 11 years at Schroder Investment Management, in various roles within the global fixed income team based in London, Hong Kong and Singapore.

Kelvin holds a Bachelor of Science (First Class Hons) in Mathematical Sciences from University of Strathclyde, Glasgow, Scotland (1989). He has also earned a CFA (UK) charterholder.