IT IS A VOLATILE WORLD

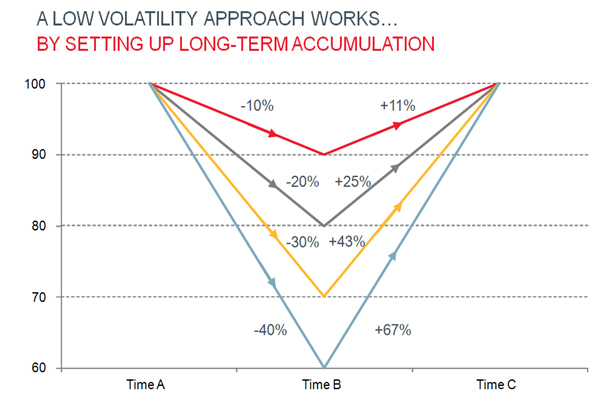

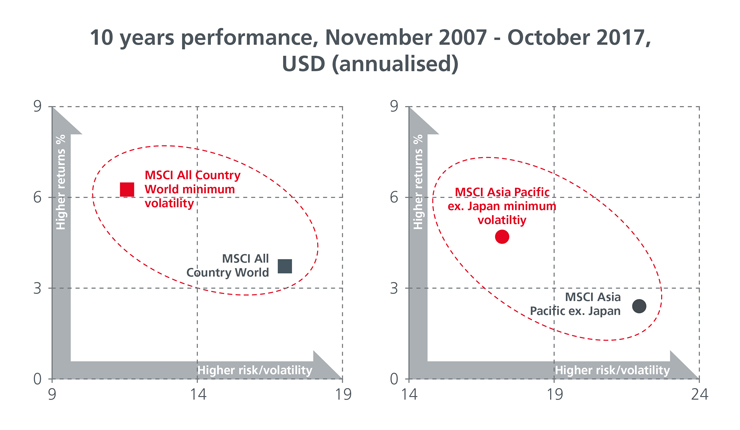

Markets are vulnerable to political instability in the US and the EU, concerns over growth in China, the ongoing situation in the Middle East, fluctuating oil and commodity prices – or another Black Swan event. The past two decades1 have been marked by bouts of volatility triggered by similar crises. Furthermore where previously such crises used to be few and far between, they now occur much more frequently. Given the outlook for volatile conditions, many investors are seeking a core holding in low volatility strategies. These strategies target lower volatility, so prices need to recover less, following a market sell down, to reach the original level. And because these strategies typically lose less in a downturn, they deliver higher risk-adjusted returns across market cycles – outperforming more volatile indices.

LISTEN TO WHAT OUR EXPERT SAYS

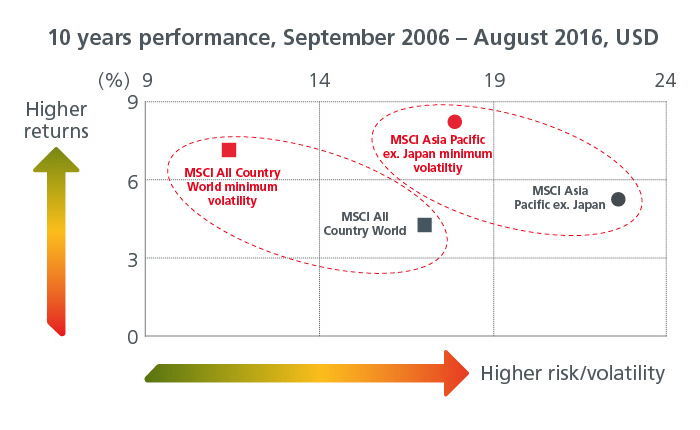

Why low volatility EQUITY investing works?

Low volatility equity investing works as it delivers higher risk-adjusted returns across market cycles. The MSCI Asia Pacific ex Japan Minimum Volatility Index has outperformed the MSCI Asia Pacific ex Japan Index over long term.

Source: Eastspring Investments, Bloomberg, MSCI Indices, data as of 31 December 2001 to 31 July 2016.

low volatility : Busting Common myths

Although low volatility strategies have been in the market for sometime, investors still tend to have preconceived notions about low volatility equity investing. In this section, we address these notions and showcase the facts.

OUR QUANTITATIVE INVESTMENT CAPABILITIES

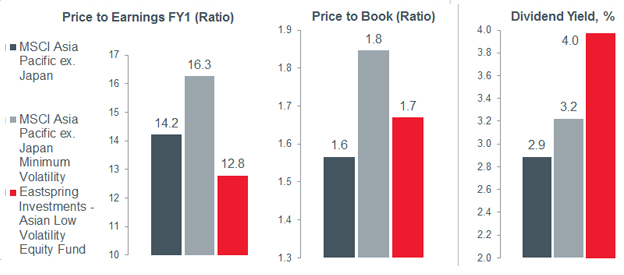

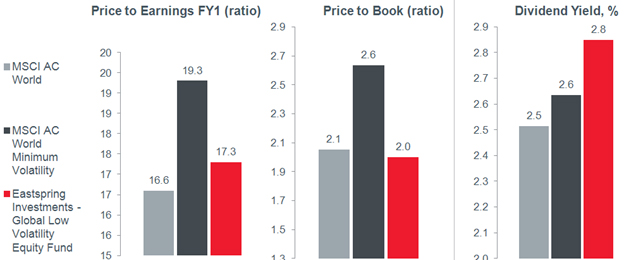

Eastspring has experience in managing more than USD 500 million in Asian Pacific ex Japan equities with a Low Volatility approach since 2013 2. The capability expanded with the commencement of a Eastspring Investments - Global Low Volatility Equity Fund, bringing total funds under management for Quantitative Equity funds to USD 1.2 billion 2.

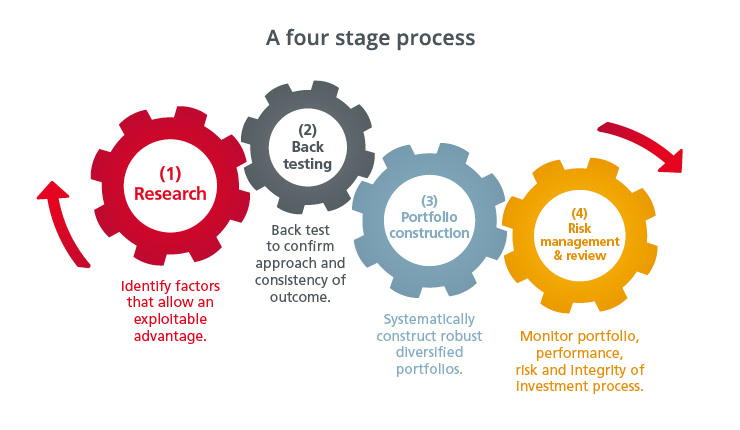

Our Quantitative Solutions Group consolidates all the quantitative functions in Singapore under one umbrella. The highly qualified and experienced team will ensure a consistent and robust approach to the development of our quant models and tools.

Quantitative investment strategies (QIS) team

ABOUT EASTSPRING INVESTMENTS

Eastspring Investments is a leading asset manager in Asia that manages over USD140 billion (as at 30 June 2016) of assets on behalf of institutional and retail clients. Operating in Asia since 1994, Eastspring is the Asian asset management business of Prudential plc, one of the world’s largest financial services companies.

contact us

- 1This is written on 27 September 2016.

- 2As at 30 September 2016